Region:Global

Author(s):Shubham

Product Code:KRAA1737

Pages:87

Published On:August 2025

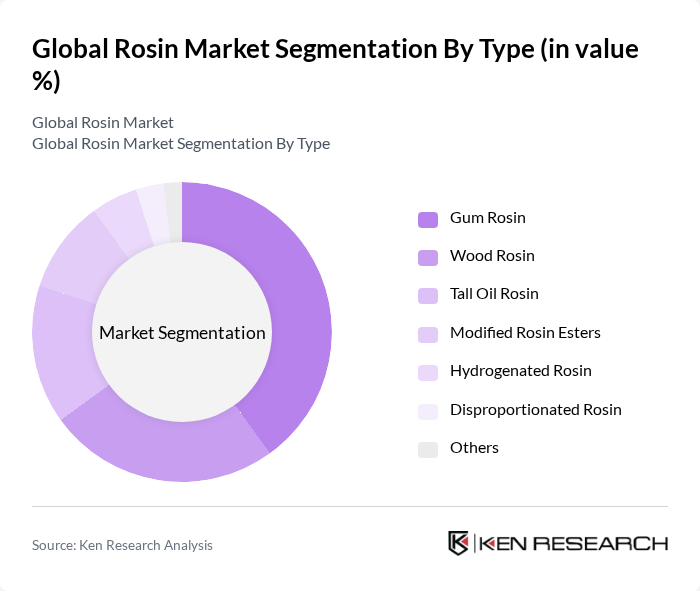

By Type:The rosin market is segmented into various types, including Gum Rosin, Wood Rosin, Tall Oil Rosin, Modified Rosin Esters, Hydrogenated Rosin, Disproportionated Rosin, and Others. Gum Rosin is widely used due to its versatility and cost-effectiveness across adhesives, inks, paper sizing, and rubber compounding; industry sources identify gum rosin as a major submarket by value, supported by extensive use in tackifier systems and printing inks.

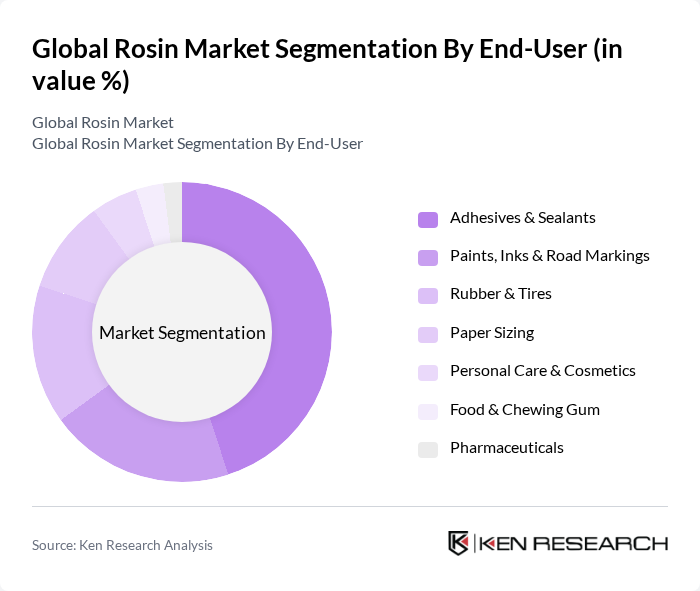

By End-User:The end-user segments of the rosin market include Adhesives & Sealants, Paints, Inks & Road Markings, Rubber & Tires, Paper Sizing, Personal Care & Cosmetics, Food & Chewing Gum, Pharmaceuticals, and Others. The Adhesives & Sealants segment is a leading end-user, driven by construction, packaging, and automotive, where rosin and rosin esters function as tackifiers and performance additives for hot-melt, pressure-sensitive, and water-based systems.

The Global Rosin Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kraton Corporation (A DL Chemical Company), DRT (Dérivés Résiniques et Terpéniques, an International Flavors & Fragrances company), Eastman Chemical Company, Harima Chemicals Group, Inc., Lawter, Inc. (A Harima Company), Guangdong KOMO Co., Ltd., Wuzhou Pine Chemicals Co., Ltd., Guilin Songquan Forest Chemical Co., Ltd., Resinall Corp. (An Eastman Company), Les Dérivés Résiniques (Lesder) Co., Ltd., Forestar Group Co., Ltd. (China), Pinova, Inc. (now part of Kraton), Georgia-Pacific Chemicals LLC, Arakawa Chemical Industries, Ltd., Ingevity Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the rosin market appears promising, driven by increasing consumer demand for sustainable and eco-friendly products. Innovations in bio-based rosin formulations are expected to enhance product offerings, catering to the growing preference for natural ingredients across various industries. Additionally, the expansion of rosin applications in emerging economies, particularly in Asia-Pacific, will likely create new growth avenues, as these regions experience rapid industrialization and urbanization, further boosting market potential.

| Segment | Sub-Segments |

|---|---|

| By Type | Gum Rosin Wood Rosin Tall Oil Rosin Modified Rosin Esters Hydrogenated Rosin Disproportionated Rosin Others |

| By End-User | Adhesives & Sealants Paints, Inks & Road Markings Rubber & Tires Paper Sizing Personal Care & Cosmetics Food & Chewing Gum Pharmaceuticals Others |

| By Application | Tackifiers (Hot-melt and Pressure-sensitive Adhesives) Printing Inks and Varnishes Paints, Coatings & Road Marking Paint Rubber Compounding Paper Sizing Agents Chewing Gum Base Others |

| By Distribution Channel | Direct (Producers to End-users) Distributors/Traders Online B2B Platforms Retail/Small-volume Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Product Form | Solid Rosin (Lumps/Chips) Liquid Rosin/Resin Solutions Powdered/Flaked Rosin Rosin Esters Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Adhesives and Sealants | 120 | Product Managers, R&D Specialists |

| Printing Inks | 85 | Production Managers, Quality Control Analysts |

| Coatings and Paints | 95 | Formulation Chemists, Marketing Directors |

| Food Packaging | 75 | Packaging Engineers, Compliance Officers |

| Personal Care Products | 60 | Product Development Managers, Regulatory Affairs Specialists |

The Global Rosin Market is valued at approximately USD 2.6 billion, reflecting its extensive use in various applications such as adhesives, inks, rubber, and coatings. This valuation is based on a comprehensive five-year analysis of market trends and consumption patterns.