Region:Global

Author(s):Shubham

Product Code:KRAA1793

Pages:98

Published On:August 2025

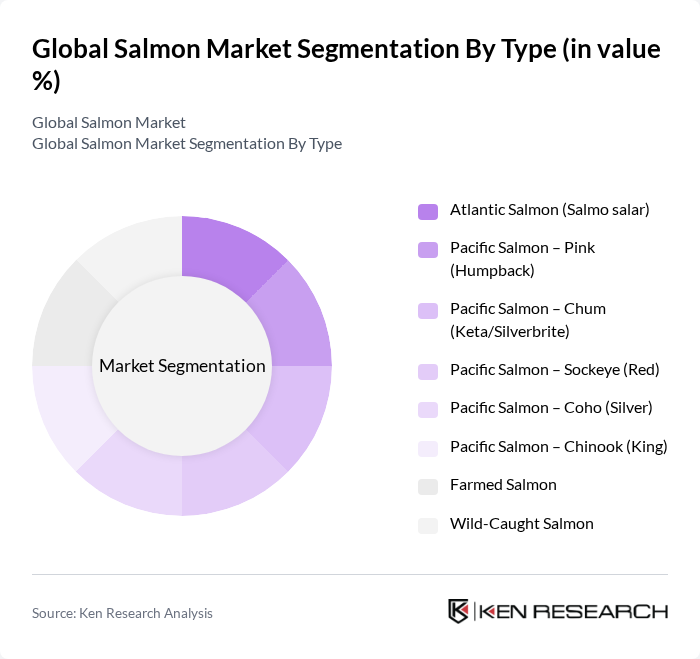

By Type:The Global Salmon Market can be segmented into various types, including Atlantic Salmon, Pacific Salmon varieties, and both farmed and wild-caught salmon. Among these,Atlantic Salmon (Salmo salar)is the most widely produced and consumed type, largely due to its adaptability to farming and consistent quality from aquaculture systems.Farmed salmonaccounts for the large majority of global supply, supported by advances in feed, genetics, and health management; wild-caught supply is comparatively smaller and more volatile due to stock variability and environmental conditions.

Notes: Atlantic salmon is predominantly farmed; Pacific species are largely wild?caught, with smaller farmed volumes (e.g., coho, king) in select regions.

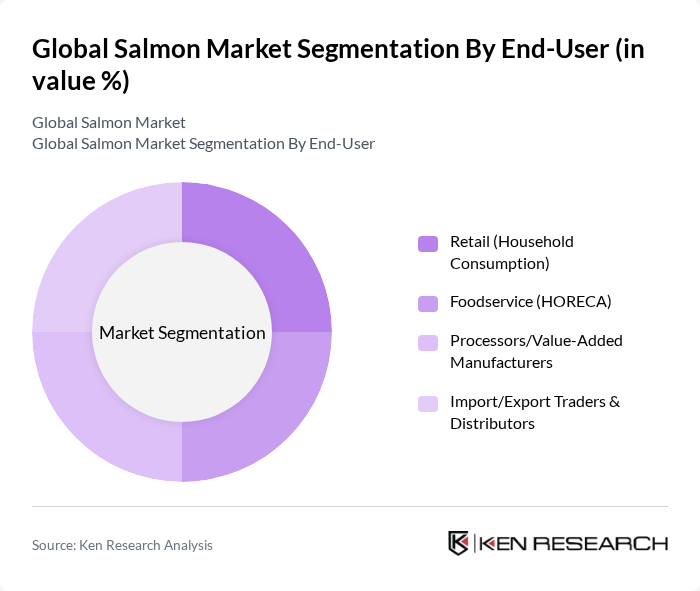

By End-User:The market can also be segmented based on end-users, which include retail (household consumption), foodservice (HORECA), processors/value-added manufacturers, and import/export traders & distributors. Retail consumption has increased with at?home cooking and e?commerce/online retail growth; foodservice demand remains robust as restaurants expand salmon offerings due to versatility and health positioning. Value?added formats (smoked, ready?to?cook, marinated) are growing within retail and processor channels.

The Global Salmon Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mowi ASA, SalMar ASA, Lerøy Seafood Group ASA, Grieg Seafood ASA, Bakkafrost P/F, Cermaq Group AS, Cooke Aquaculture Inc., Tassal Group Limited (JBS Australia), Huon Aquaculture Group Pty Ltd (JBS Australia), New Zealand King Salmon Investments Ltd, Scottish Sea Farms Ltd (SalMar/Lerøy JV), Aquachile S.A., Multiexport Foods S.A. (Multi X), Camanchaca S.A. (Salmones Camanchaca), Nova Sea AS contribute to innovation, geographic expansion, and service delivery in this space.

The future of the salmon market in None appears promising, driven by increasing health awareness and a shift towards sustainable practices. As consumers prioritize quality and sustainability, producers are likely to invest in innovative aquaculture technologies. Additionally, the rise of e-commerce platforms for seafood sales is expected to enhance market accessibility, allowing consumers to purchase fresh salmon conveniently. These trends indicate a dynamic market landscape that will adapt to evolving consumer preferences and regulatory environments.

| Segment | Sub-Segments |

|---|---|

| By Type | Atlantic Salmon (Salmo salar) Pacific Salmon – Pink (Humpback) Pacific Salmon – Chum (Keta/Silverbrite) Pacific Salmon – Sockeye (Red) Pacific Salmon – Coho (Silver) Pacific Salmon – Chinook (King) Farmed Salmon Wild-Caught Salmon |

| By End-User | Retail (Household Consumption) Foodservice (HORECA) Processors/Value-Added Manufacturers Import/Export Traders & Distributors |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Seafood Stores Direct Sales & B2B (Wholesale) |

| By Product Form | Fresh (Whole, H&G, Fillets) Frozen (Portions, Fillets, Whole) Smoked & Cured Canned Value-Added/Ready-to-Eat (RTE/RTC) |

| By Farming/Production Method | Sea-Cage Aquaculture Land-Based RAS (Recirculating Aquaculture Systems) Offshore/Open-Ocean Farming Wild Capture (Commercial Fisheries) |

| By Certification/Claim | ASC-Certified MSC-Certified Organic-Certified Antibiotic-Free/Non-GMO Claims |

| By Price Range | Premium Mid-Range Budget |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Salmon Farming Operations | 100 | Farm Managers, Aquaculture Specialists |

| Seafood Distribution Channels | 80 | Distributors, Supply Chain Managers |

| Retail Market Insights | 75 | Retail Buyers, Category Managers |

| Consumer Preferences and Trends | 120 | End Consumers, Health-conscious Shoppers |

| Regulatory and Compliance Insights | 60 | Regulatory Affairs Managers, Compliance Officers |

The Global Salmon Market is valued at approximately USD 20 billion, driven by increasing consumer demand for healthy protein sources and advancements in aquaculture practices. This valuation is based on a five-year historical analysis of market trends and growth.