Region:Global

Author(s):Dev

Product Code:KRAA2209

Pages:93

Published On:August 2025

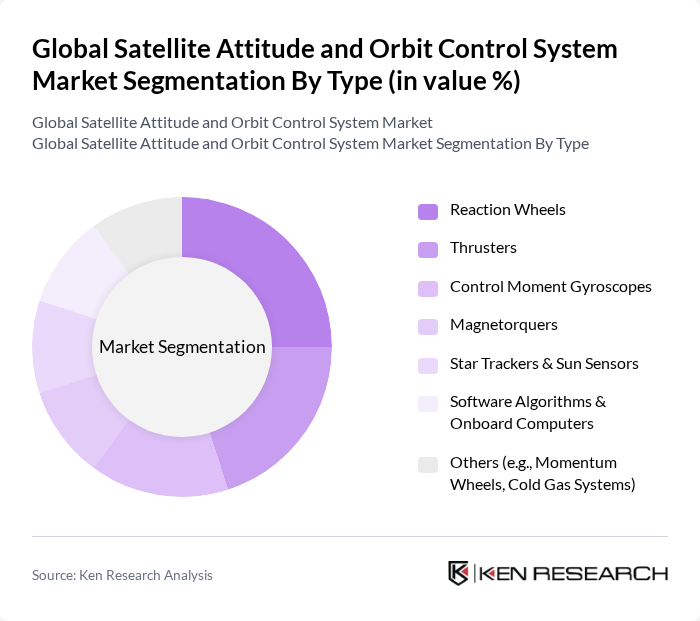

By Type:The market is segmented into various types of attitude and orbit control systems, including Reaction Wheels, Thrusters, Control Moment Gyroscopes, Magnetorquers, Star Trackers & Sun Sensors, Software Algorithms & Onboard Computers, and Others (e.g., Momentum Wheels, Cold Gas Systems). Each of these sub-segments plays a critical role in ensuring the stability and orientation of satellites in space .

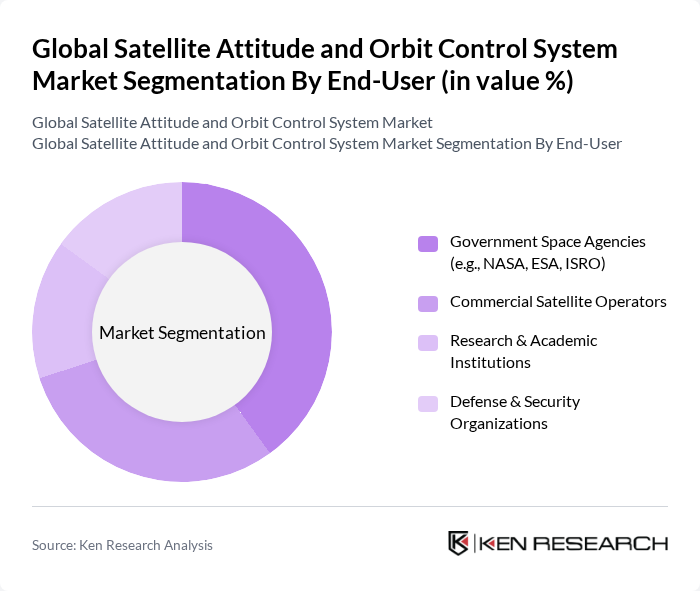

By End-User:The end-user segmentation includes Government Space Agencies (e.g., NASA, ESA, ISRO), Commercial Satellite Operators, Research & Academic Institutions, and Defense & Security Organizations. Each of these segments has unique requirements and applications for attitude and orbit control systems, driving demand in the market .

The Global Satellite Attitude and Orbit Control System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Airbus Defence and Space, Northrop Grumman Corporation, Boeing Defense, Space & Security, Lockheed Martin Corporation, Thales Alenia Space, Honeywell Aerospace, Maxar Technologies, Raytheon Technologies, OHB SE, L3Harris Technologies, Surrey Satellite Technology Ltd. (SSTL), SpaceX, Rocket Lab, Blue Canyon Technologies, Astroscale Holdings Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the satellite attitude and orbit control system market appears promising, driven by technological advancements and increasing demand for satellite services. As the industry shifts towards miniaturization and the integration of AI, operational efficiencies are expected to improve significantly. Furthermore, the rise of mega-constellations will enhance global connectivity, creating new opportunities for satellite applications. Companies that adapt to these trends and invest in innovative AOCS solutions will likely gain a competitive edge in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Reaction Wheels Thrusters Control Moment Gyroscopes Magnetorquers Star Trackers & Sun Sensors Software Algorithms & Onboard Computers Others (e.g., Momentum Wheels, Cold Gas Systems) |

| By End-User | Government Space Agencies (e.g., NASA, ESA, ISRO) Commercial Satellite Operators Research & Academic Institutions Defense & Security Organizations |

| By Application | Earth Observation & Remote Sensing Communication Satellites Navigation & Positioning Scientific & Technology Demonstration Missions |

| By Component | Hardware (Sensors, Actuators, Controllers) Software (Control Algorithms, Simulation Tools) Services (Integration, Testing, Maintenance) |

| By Sales Channel | Direct Sales (OEMs, System Integrators) Distributors & Value-Added Resellers Online Procurement Platforms |

| By Satellite Mass Class | Nanosatellites (<10 kg) Microsatellites (10–100 kg) Minisatellites (100–500 kg) Medium & Large Satellites (>500 kg) |

| By Orbit Type | Low Earth Orbit (LEO) Medium Earth Orbit (MEO) Geostationary Orbit (GEO) Highly Elliptical Orbit (HEO) |

| By Region | North America Europe Asia Pacific Rest of the World |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Satellite Operators | 100 | Operations Managers, Technical Directors |

| Government Space Agencies | 80 | Project Managers, Aerospace Engineers |

| Satellite Component Manufacturers | 60 | Product Development Managers, Supply Chain Analysts |

| Research Institutions in Aerospace | 50 | Lead Researchers, Academic Professors |

| Consulting Firms Specializing in Space Technology | 40 | Industry Analysts, Strategic Advisors |

The Global Satellite Attitude and Orbit Control System Market is valued at approximately USD 3.5 billion, reflecting a five-year historical analysis. This growth is driven by increased satellite miniaturization and the rising demand for small satellite launches, particularly in low Earth orbit.