Region:Global

Author(s):Shubham

Product Code:KRAB0709

Pages:84

Published On:August 2025

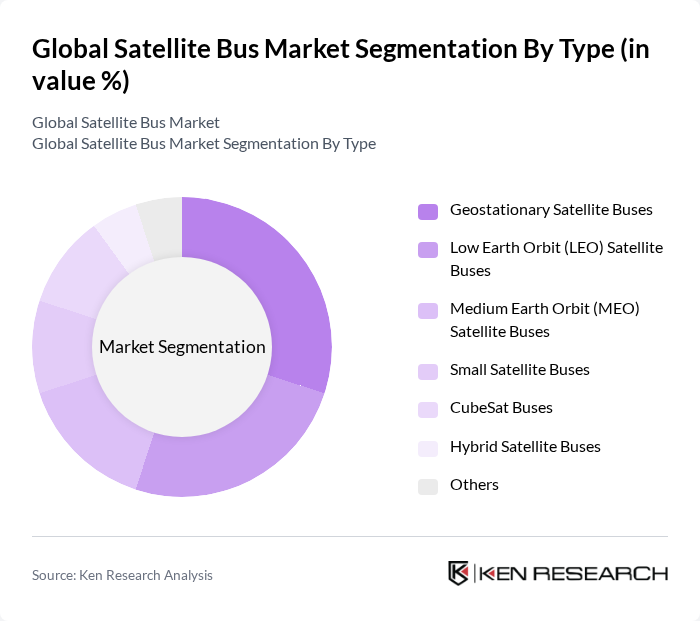

By Type:The satellite bus market is segmented into various types, including Geostationary Satellite Buses, Low Earth Orbit (LEO) Satellite Buses, Medium Earth Orbit (MEO) Satellite Buses, Small Satellite Buses, CubeSat Buses, Hybrid Satellite Buses, and Others. Each type serves different operational needs and applications, with specific designs and capabilities tailored to their respective missions. Geostationary satellite buses are primarily used for telecommunications and broadcasting, LEO satellite buses are favored for Earth observation and communication constellations, MEO satellite buses support navigation and timing services, while small and CubeSat buses are widely adopted for scientific, commercial, and academic missions due to their cost-effectiveness and rapid deployment .

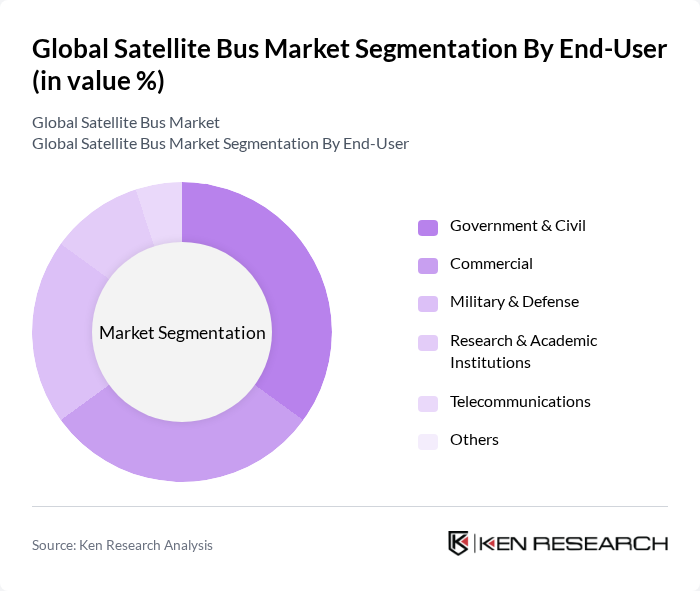

By End-User:The market is also segmented by end-user, which includes Government & Civil, Commercial, Military & Defense, Research & Academic Institutions, Telecommunications, and Others. Each end-user category has distinct requirements and applications for satellite buses, influencing the design and functionality of the satellite systems. Government & Civil and Military & Defense segments are driven by national security, surveillance, and public service missions, while the Commercial segment is expanding rapidly due to increased demand for broadband, Earth observation, and IoT connectivity. Research & Academic Institutions leverage small and CubeSat buses for scientific experiments and technology demonstrations .

The Global Satellite Bus Market is characterized by a dynamic mix of regional and international players. Leading participants such as Airbus Defence and Space, Boeing Defense, Space & Security, Lockheed Martin Corporation, Northrop Grumman Corporation, Thales Alenia Space, Maxar Technologies, SSL (Space Systems Loral), Mitsubishi Electric Corporation, China Aerospace Science and Technology Corporation (CASC), Indian Space Research Organisation (ISRO), Rocket Lab, Planet Labs PBC, Arianespace, Relativity Space, Astroscale Holdings Inc., OHB SE, Israel Aerospace Industries (IAI), Surrey Satellite Technology Ltd (SSTL), Ball Aerospace & Technologies Corp., Blue Canyon Technologies contribute to innovation, geographic expansion, and service delivery in this space .

The future of the satellite bus market is poised for transformative growth, driven by technological advancements and increasing global connectivity needs. As satellite miniaturization continues, the market will likely see a surge in small satellite deployments, enhancing accessibility for various applications. Furthermore, the integration of AI and machine learning in satellite operations is expected to optimize performance and reduce operational costs, paving the way for innovative services and applications in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Geostationary Satellite Buses Low Earth Orbit (LEO) Satellite Buses Medium Earth Orbit (MEO) Satellite Buses Small Satellite Buses CubeSat Buses Hybrid Satellite Buses Others |

| By End-User | Government & Civil Commercial Military & Defense Research & Academic Institutions Telecommunications Others |

| By Application | Communication Earth Observation & Meteorology Scientific Research & Space Exploration Navigation & Positioning Remote Sensing & Surveillance Technology Demonstration Others |

| By Payload Capacity | Light Payload (<500 kg) Medium Payload (500–2,500 kg) Heavy Payload (>2,500 kg) Ultra-Heavy Payload |

| By Subsystem | Power Systems Thermal Control Systems Attitude and Orbit Control Systems Propulsion Systems Structural Systems Telemetry, Tracking, and Command Flight Software |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Satellite Bus Manufacturers | 60 | Product Managers, R&D Engineers |

| Government Space Agencies | 50 | Program Directors, Policy Makers |

| Aerospace and Defense Contractors | 45 | Supply Chain Managers, Procurement Officers |

| Satellite Communication Providers | 55 | Operations Managers, Technical Directors |

| Research Institutions in Space Technology | 40 | Lead Researchers, Academic Professors |

The Global Satellite Bus Market is valued at approximately USD 15.4 billion, reflecting a significant growth trend driven by increasing demand for satellite services and advancements in satellite technology.