Region:Global

Author(s):Dev

Product Code:KRAA2231

Pages:92

Published On:August 2025

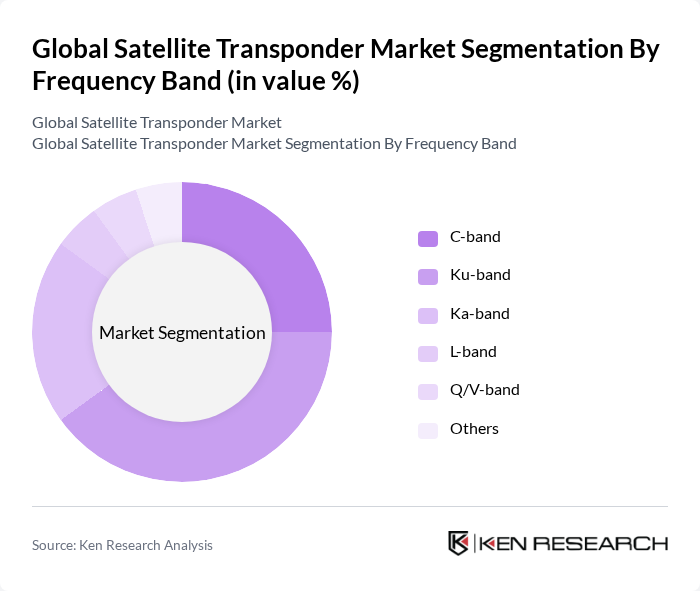

By Frequency Band:The frequency band segmentation includes C-band, Ku-band, Ka-band, L-band, Q/V-band, and others. Among these, the Ku-band is currently dominating the market due to its balance of bandwidth and coverage, making it ideal for various applications such as broadcasting and broadband services. The increasing demand for high-speed internet and video services has further propelled the adoption of Ku-band transponders, while C-band remains popular for its reliability in long-distance communications. The Ka-band is gaining traction for high-capacity data transmission, especially in enterprise and government applications.

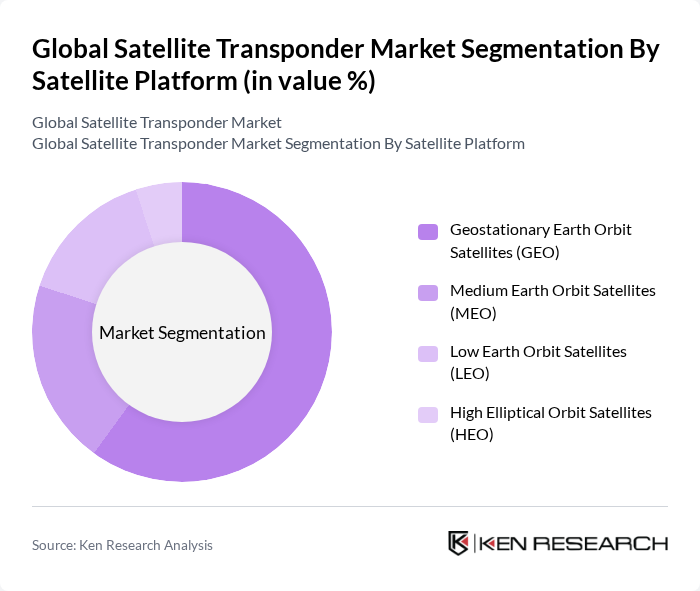

By Satellite Platform:The satellite platform segmentation includes Geostationary Earth Orbit Satellites (GEO), Medium Earth Orbit Satellites (MEO), Low Earth Orbit Satellites (LEO), and High Elliptical Orbit Satellites (HEO). The GEO segment is leading the market due to its ability to provide continuous coverage over a specific area, making it ideal for television broadcasting and telecommunications. The stability and reliability of GEO satellites have made them the preferred choice for many service providers, despite the growing interest in LEO satellites for their low latency and suitability for broadband and IoT applications.

The Global Satellite Transponder Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intelsat S.A., SES S.A., Eutelsat Communications S.A., Telesat Canada, Inmarsat Global Limited, Iridium Communications Inc., Hispasat S.A., Arabsat, Asia Satellite Telecommunications Co. Ltd. (AsiaSat), Hughes Network Systems, LLC, Viasat, Inc., Globalstar, Inc., Speedcast International Limited, Avanti Communications Group plc, OneWeb, Telesat Holdings Inc., Thuraya Telecommunications Company, Yahsat (Al Yah Satellite Communications Company PJSC), SKY Perfect JSAT Corporation, Gilat Satellite Networks Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the satellite transponder market appears promising, driven by technological advancements and increasing demand for connectivity. The integration of high-throughput satellites (HTS) is expected to enhance data transmission capabilities significantly. Furthermore, the growing focus on sustainability will likely lead to the development of eco-friendly satellite technologies. As the market evolves, strategic partnerships among industry players will be crucial for leveraging resources and expertise, ensuring competitive advantages in a rapidly changing landscape.

| Segment | Sub-Segments |

|---|---|

| By Frequency Band | C-band Ku-band Ka-band L-band Q/V-band Others |

| By Satellite Platform | Geostationary Earth Orbit Satellites (GEO) Medium Earth Orbit Satellites (MEO) Low Earth Orbit Satellites (LEO) High Elliptical Orbit Satellites (HEO) |

| By Service Type | Fixed Satellite Services (FSS) Broadcast Satellite Services (BSS) Mobile Satellite Services (MSS) Others |

| By Application | Commercial Communications Government Communications Navigation Remote Sensing Research & Development Others |

| By End-User | Telecommunications Broadcasting Government and Military Maritime Aviation Others |

| By Region | North America Europe Asia Pacific Middle East & Africa Latin America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Broadcasting Services | 100 | Broadcast Engineers, Content Managers |

| Telecommunications Providers | 80 | Network Operations Managers, Technical Directors |

| Government and Defense Applications | 50 | Government Officials, Defense Contractors |

| Maritime and Aviation Services | 60 | Fleet Managers, Aviation Safety Officers |

| Emerging Market Applications | 70 | Market Analysts, Regional Sales Managers |

The Global Satellite Transponder Market is valued at approximately USD 25 billion, driven by the increasing demand for high-throughput satellite services and the need for reliable broadband connectivity in remote areas.