Region:Global

Author(s):Dev

Product Code:KRAD0422

Pages:86

Published On:August 2025

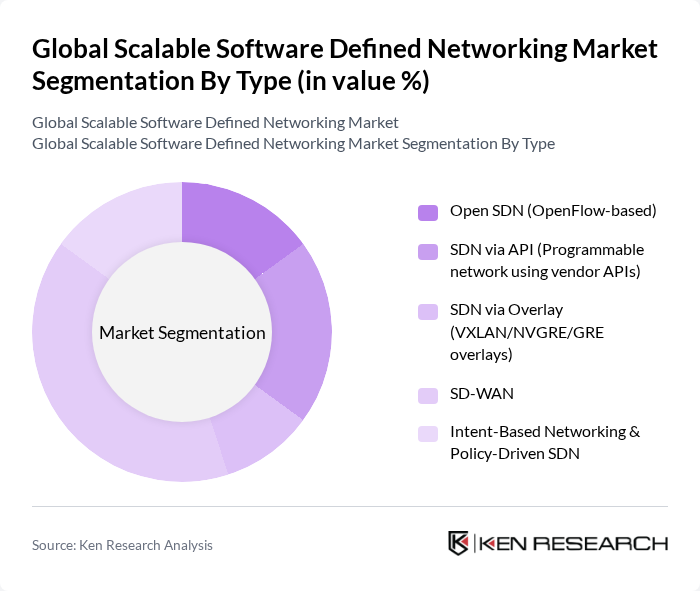

By Type:The market is segmented into various types, including Open SDN (OpenFlow-based), SDN via API (Programmable network using vendor APIs), SDN via Overlay (VXLAN/NVGRE/GRE overlays), SD-WAN, and Intent-Based Networking & Policy-Driven SDN. Among these, SD-WAN is currently the leading sub-segment due to its ability to provide secure and efficient connectivity for enterprises, especially with the rise of remote work and cloud applications. The demand for flexible and scalable networking solutions has driven enterprises to adopt SD-WAN for better performance and cost savings.

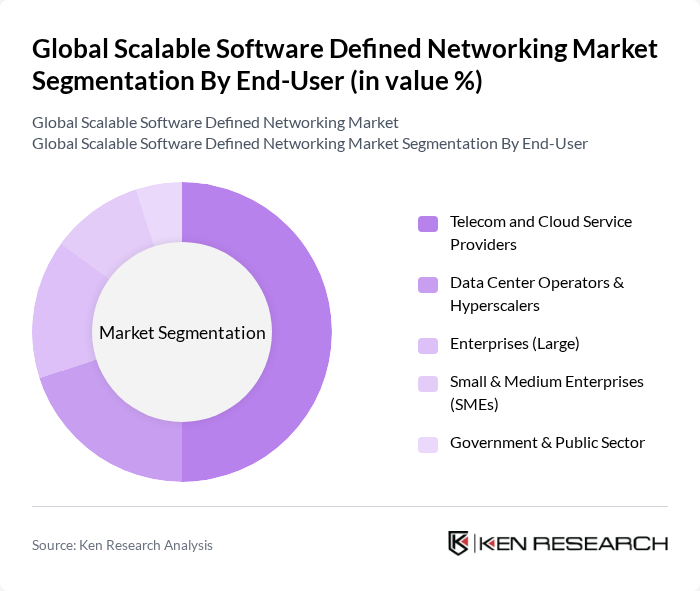

By End-User:The end-user segmentation includes Telecom and Cloud Service Providers, Data Center Operators & Hyperscalers, Enterprises (Large), Small & Medium Enterprises (SMEs), and Government & Public Sector. Telecom and Cloud Service Providers are the dominant segment, driven by the increasing demand for bandwidth and the need for efficient network management solutions. These providers are rapidly adopting SDN technologies to enhance service delivery and improve customer experiences.

The Global Scalable Software Defined Networking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., VMware, Inc. (Broadcom Inc.), Arista Networks, Inc., Juniper Networks, Inc., Hewlett Packard Enterprise (HPE) / Aruba, Nokia Corporation (Nuage Networks), Extreme Networks, Inc., Cumulus Networks (NVIDIA), NVIDIA Corporation (including Mellanox), Huawei Technologies Co., Ltd., International Business Machines Corporation (IBM), NETGEAR, Inc., Dell Technologies Inc. (including Dell Networking), Fortinet, Inc., ZTE Corporation, Palo Alto Networks, Inc., F5, Inc., Check Point Software Technologies Ltd., Versa Networks, Inc., Silver Peak (HPE Aruba) contribute to innovation, geographic expansion, and service delivery in this space.

The future of scalable software-defined networking is poised for significant transformation, driven by technological advancements and evolving business needs. As organizations increasingly prioritize network automation and security, the integration of AI and machine learning into SDN solutions will enhance operational efficiency. Additionally, the expansion of 5G networks will create new opportunities for SDN applications, enabling faster and more reliable connectivity. The focus on sustainability will also shape future developments, as companies seek eco-friendly networking solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Open SDN (OpenFlow-based) SDN via API (Programmable network using vendor APIs) SDN via Overlay (VXLAN/NVGRE/GRE overlays) SD-WAN Intent-Based Networking & Policy-Driven SDN |

| By End-User | Telecom and Cloud Service Providers Data Center Operators & Hyperscalers Enterprises (Large) Small & Medium Enterprises (SMEs) Government & Public Sector |

| By Application | Data Center and Cloud Networking WAN/SD-WAN and Branch Connectivity Network Security & Micro-Segmentation Network Automation & Orchestration Edge & 5G Network Slicing |

| By Deployment Model | On-Premises Cloud-Based (SaaS) Hybrid |

| By Component | SDN Infrastructure (Switches, Routers, NICs) SDN Software/Controllers Services & Support (Consulting, Integration, Managed Services) |

| By Sales Channel | Direct Sales Value-Added Resellers & Distributors Online Sales & Marketplaces |

| By Pricing Model | Subscription-Based Pay-As-You-Go (Consumption-Based) Perpetual/Term License |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Providers | 120 | Network Engineers, Operations Managers |

| Enterprise IT Departments | 90 | IT Directors, Network Administrators |

| Cloud Service Providers | 70 | Cloud Architects, Product Managers |

| SDN Solution Vendors | 60 | Sales Executives, Technical Support Managers |

| Research Institutions | 50 | Research Analysts, Technology Consultants |

The Global Scalable Software Defined Networking Market is valued at approximately USD 30 billion, driven by the increasing demand for network virtualization, cloud computing, and enhanced network management solutions across various sectors, including enterprises and telecom environments.