Region:Europe

Author(s):Dev

Product Code:KRAD0425

Pages:80

Published On:August 2025

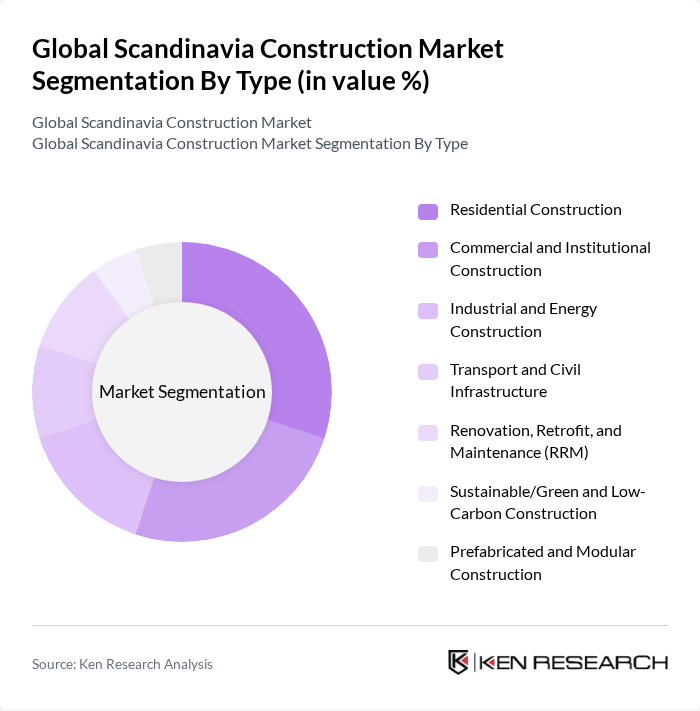

By Type:The construction market can be segmented into various types, including Residential Construction, Commercial and Institutional Construction, Industrial and Energy Construction, Transport and Civil Infrastructure, Renovation, Retrofit, and Maintenance (RRM), Sustainable/Green and Low-Carbon Construction, and Prefabricated and Modular Construction. Each of these segments plays a crucial role in the overall market dynamics, driven by specific consumer needs and industry trends. Infrastructure and energy-transition projects are notable growth areas, while prefabrication and modular methods are expanding due to labor shortages and carbon regulations .

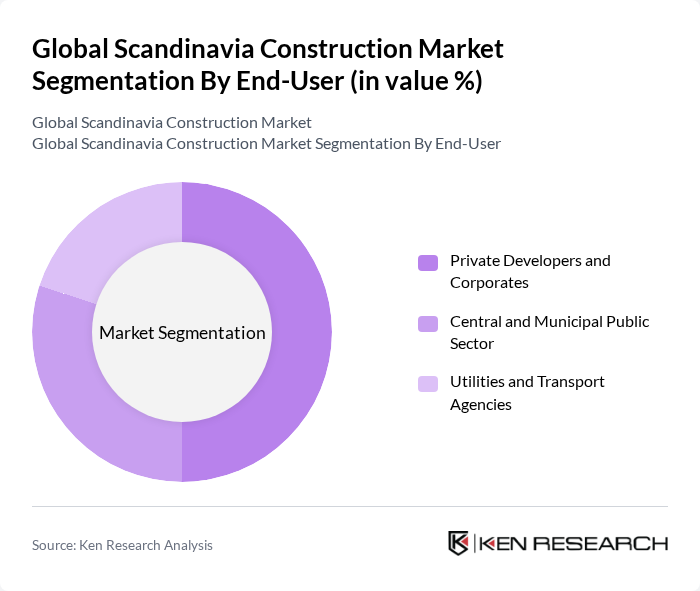

By End-User:The end-user segmentation includes Private Developers and Corporates, Central and Municipal Public Sector, and Utilities and Transport Agencies. Each of these end-users has distinct requirements and influences on the construction market, shaping the demand for various construction types and methodologies. Private capital participation through PPPs and institutional investors has increased in Nordic infrastructure, complementing public sector demand .

The Global Scandinavia Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Skanska AB, NCC AB, Peab AB, Veidekke ASA, AF Gruppen ASA, YIT Corporation, Caverion Corporation, Bonava AB, JM AB, Implenia AG (Nordics), Strabag SE (Nordics), Ramudden Group, Serneke Group AB, Peikko Group, COWI A/S, Ramboll Group A/S, Sweco AB, Boliden – Bergsøe (Construction Metals Supply), NCC Industry (Asphalt & Aggregates), Per Aarsleff Holding A/S contribute to innovation, geographic expansion, and service delivery in this space. Nordic contractors are increasingly leveraging BIM, robotics, and prefabrication to improve productivity and meet low?carbon requirements .

The future of the construction market in Scandinavia appears promising, driven by ongoing urbanization and government investments in infrastructure. As cities expand, the demand for innovative construction solutions will grow, particularly in sustainable building practices. Additionally, the integration of smart technologies will enhance operational efficiency. Companies that adapt to these trends and invest in workforce development will likely thrive, positioning themselves favorably in a competitive landscape characterized by rapid technological advancements and evolving consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Construction Commercial and Institutional Construction Industrial and Energy Construction Transport and Civil Infrastructure Renovation, Retrofit, and Maintenance (RRM) Sustainable/Green and Low-Carbon Construction Prefabricated and Modular Construction |

| By End-User | Private Developers and Corporates Central and Municipal Public Sector Utilities and Transport Agencies |

| By Application | Housing (Single-family, Multi-family) Non-Residential Buildings (Offices, Retail, Hospitality, Healthcare, Education) Civil Works (Roads, Rail, Bridges, Tunnels, Ports, Airports) Energy and Industrial Facilities (Power, Grid, Renewables, Manufacturing) |

| By Investment Source | Domestic Private Capital Foreign Direct Investment (FDI) Public Expenditure Public-Private Partnerships (PPP) |

| By Policy Support | Green Building Codes and Carbon Caps Tax Incentives and Subsidies Procurement and PPP Frameworks Housing and Infrastructure Programs |

| By Construction Method | Traditional On-site Construction Prefabrication/Off-site Modular/Volumetric Design-Build and EPC |

| By Material Type | Concrete and Cement Steel Engineered Timber (CLT/Glulam) Asphalt and Aggregates Other Materials |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 150 | Project Managers, Site Supervisors |

| Commercial Building Developments | 100 | Architects, Construction Executives |

| Infrastructure and Public Works | 80 | Government Officials, Urban Planners |

| Green Building Initiatives | 70 | Sustainability Consultants, Engineers |

| Renovation and Retrofitting Projects | 90 | Contractors, Building Inspectors |

The Global Scandinavia Construction Market is valued at approximately USD 135 billion, reflecting significant growth driven by urbanization, infrastructure investments, and a rise in residential and commercial projects across Denmark, Sweden, and Norway.