Region:Global

Author(s):Dev

Product Code:KRAD0411

Pages:95

Published On:August 2025

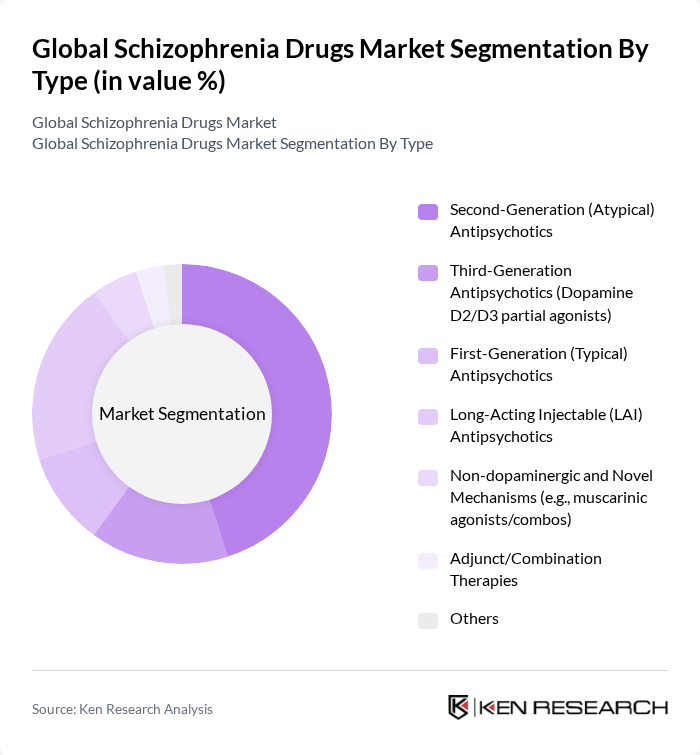

By Type:The market is segmented into various types of antipsychotic medications, including Second-Generation (Atypical) Antipsychotics, Third-Generation Antipsychotics (Dopamine D2/D3 partial agonists), First-Generation (Typical) Antipsychotics, Long-Acting Injectable (LAI) Antipsychotics, Non-dopaminergic and Novel Mechanisms (e.g., muscarinic agonists/combos), Adjunct/Combination Therapies, and Others. Among these, Second-Generation Antipsychotics dominate the market due to their improved efficacy and safety profiles compared to First-Generation options. The preference for these medications is driven by their lower incidence of side effects, making them more appealing to both patients and healthcare providers.

By Administration Route:The administration routes for schizophrenia drugs include Oral (tablets, ODTs), Injectable (short-acting and LAI), and Transdermal and Other Routes. Oral administration remains the most common due to its convenience and patient compliance. However, the Injectable route, particularly Long-Acting Injectables, is gaining traction as it helps improve adherence in patients who struggle with daily medication regimens.

The Global Schizophrenia Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson (Janssen Pharmaceuticals), Otsuka Pharmaceutical Co., Ltd., H. Lundbeck A/S, Eli Lilly and Company, AbbVie Inc., Teva Pharmaceutical Industries Ltd., Alkermes plc, Sunovion Pharmaceuticals Inc. (Sumitomo Pharma), Mitsubishi Tanabe Pharma Corporation, Viatris Inc. (including legacy Mylan), Dr. Reddy’s Laboratories Ltd., Hikma Pharmaceuticals PLC, Zydus Lifesciences Limited, Aurobindo Pharma Limited, Cipla Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the schizophrenia drugs market appears promising, driven by ongoing research and the development of innovative treatment options. As the healthcare landscape evolves, the integration of digital health solutions and personalized medicine is expected to enhance patient outcomes significantly. Furthermore, the increasing focus on mental health initiatives by governments and organizations will likely lead to improved access to care, fostering a more supportive environment for patients. This trend indicates a robust growth trajectory for the market in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Second-Generation (Atypical) Antipsychotics Third-Generation Antipsychotics (Dopamine D2/D3 partial agonists) First-Generation (Typical) Antipsychotics Long-Acting Injectable (LAI) Antipsychotics Non-dopaminergic and Novel Mechanisms (e.g., muscarinic agonists/combos) Adjunct/Combination Therapies Others |

| By Administration Route | Oral (tablets, ODTs) Injectable (short-acting and LAI) Transdermal and Other Routes |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Specialty Pharmacies |

| By Patient Demographics | Adults (18–64 years) Adolescents (13–17 years) Geriatric (65+ years) |

| By Treatment Setting | Inpatient Outpatient/Community Care |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low (generic) Medium High (branded/innovator) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Psychiatric Clinics | 120 | Psychiatrists, Clinical Psychologists |

| Pharmaceutical Distributors | 90 | Sales Representatives, Distribution Managers |

| Patient Advocacy Groups | 60 | Patient Advocates, Caregivers |

| Healthcare Policy Makers | 50 | Health Economists, Policy Analysts |

| Clinical Research Organizations | 70 | Clinical Researchers, Trial Coordinators |

The Global Schizophrenia Drugs Market is valued at approximately USD 8.5 billion, reflecting a significant growth driven by the increasing prevalence of schizophrenia, advancements in drug formulations, and heightened awareness of mental health issues.