Region:Global

Author(s):Shubham

Product Code:KRAC0761

Pages:99

Published On:August 2025

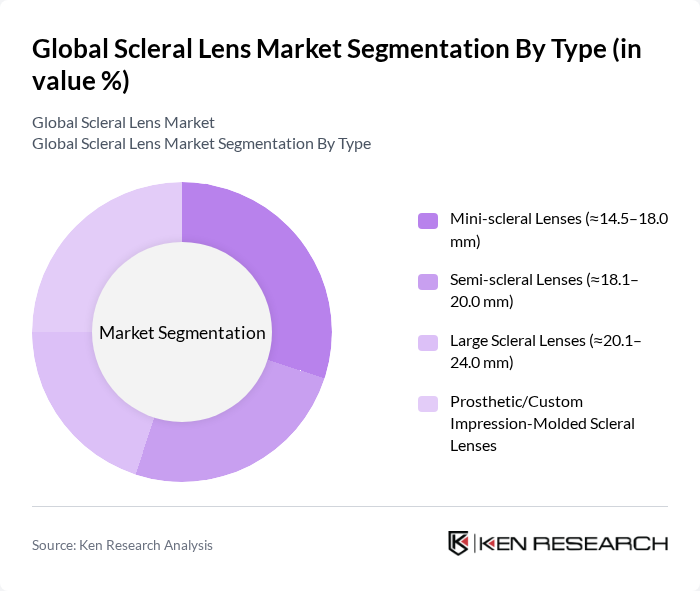

By Type:The scleral lens market is segmented into four main types: Mini-scleral Lenses, Semi-scleral Lenses, Large Scleral Lenses, and Prosthetic/Custom Impression-Molded Scleral Lenses. Mini-scleral lenses, which range from approximately 14.5 to 18.0 mm, are gaining popularity due to their comfort and ease of use. Semi-scleral lenses (18.1 to 20.0 mm) and large scleral lenses (20.1 to 24.0 mm) are preferred for more severe ocular conditions, while prosthetic lenses are tailored for specific patient needs, driving their demand in specialized markets.

By End-User:The end-user segmentation includes Eye Clinics/Optometry Practices, Hospital Ophthalmology Departments, Specialty Contact Lens Laboratories, and Academic/Research Institutes. Eye clinics and optometry practices are the primary consumers of scleral lenses due to their direct interaction with patients. Hospital ophthalmology departments also play a significant role, particularly in managing complex ocular conditions. Specialty laboratories cater to the growing demand for customized lenses, while academic institutions contribute to research and development in this field.

The Global Scleral Lens Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bausch + Lomb (Zenlens, Zen RC), CooperVision Specialty EyeCare (Blanchard Onefit, Onefit MED), Johnson & Johnson Vision (SightGlass/portfolio; specialty initiatives), Alcon Vision LLC (material partnerships; specialty channels), Menicon Co., Ltd. (Menicon Z materials; specialty labs), Art Optical Contact Lens, Inc. (Ampleye), BostonSight (BostonSight SCLERAL; non-profit innovation), Visionary Optics (Europa, Latitude), EyePrint Prosthetics (EyePrintPRO impression-based), SynergEyes, Inc. (SynergEyes VS; hybrid and scleral), Hispace/EssilorLuxottica Specialty Labs (Europa EU distribution partners), AccuLens (Maxim 3D), TruForm Optics (Europa derivative, custom designs), Valley Contax, Inc. (Custom Stable), Paragon Vision Sciences (materials; ortho-k and specialty) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the scleral lens market appears promising, driven by ongoing advancements in technology and increasing consumer awareness. As the demand for personalized eye care solutions rises, manufacturers are likely to focus on developing innovative products tailored to individual needs. Additionally, the expansion of online sales channels will facilitate greater access to scleral lenses, particularly in underserved regions, thereby enhancing market penetration and consumer adoption in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Mini-scleral Lenses (?14.5–18.0 mm) Semi-scleral Lenses (?18.1–20.0 mm) Large Scleral Lenses (?20.1–24.0 mm) Prosthetic/Custom Impression-Molded Scleral Lenses |

| By End-User | Eye Clinics/Optometry Practices Hospital Ophthalmology Departments Specialty Contact Lens Laboratories (B2B fitting/support) Academic/Research Institutes |

| By Material | Fluoro-silicone Acrylate (RGP) High Dk Fluoro-silicone Acrylate (e.g., Boston XO, Hexa100) PMMA (legacy/limited use) Surface-treated/Coated Materials (e.g., Hydra-PEG) |

| By Indication | Corneal Irregularity (e.g., Keratoconus, PMD, post-LASIK/RK) Ocular Surface Disease (e.g., Severe Dry Eye, GVHD, SJS) Aphakia/High Refractive Error and Presbyopia Post-surgical/Trauma Rehabilitation |

| By Distribution Channel | Direct-to-Clinic Sales (manufacturer to ECP) Authorized Distributors/Regional Labs Online Professional Portals (B2B ordering by ECPs) Institutional/Group Purchasing |

| By Price Range (Per Pair, Professional Market) | Entry (basic designs) Mid (customized, high Dk) Premium (impression-based/prosthetic, advanced coatings) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmologists | 140 | Eye Care Specialists, Vision Correction Experts |

| Optometrists | 120 | Optometry Practitioners, Contact Lens Fitters |

| Scleral Lens Manufacturers | 80 | Product Development Managers, Sales Directors |

| Patients using Scleral Lenses | 100 | End-users, Patient Advocacy Group Members |

| Healthcare Policy Makers | 50 | Regulatory Affairs Specialists, Health Economists |

The Global Scleral Lens Market is valued at approximately USD 340 million, reflecting a significant growth trend driven by increasing ocular conditions and advancements in lens technology, enhancing patient comfort and usability.