Region:Global

Author(s):Dev

Product Code:KRAB0391

Pages:96

Published On:August 2025

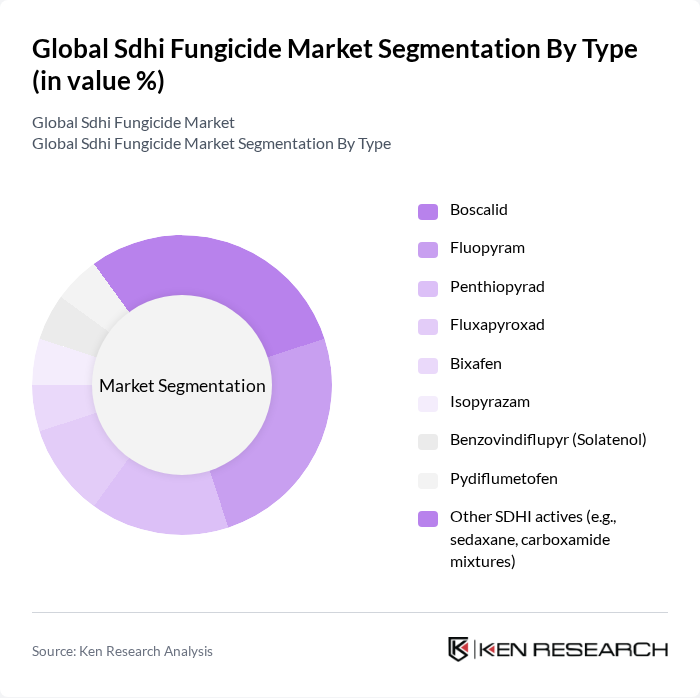

By Type:The market is segmented into various types of SDHI fungicides, including Boscalid, Fluopyram, Penthiopyrad, Fluxapyroxad, Bixafen, Isopyrazam, Benzovindiflupyr (Solatenol), Pydiflumetofen, and other SDHI actives such as sedaxane and carboxamide mixtures. Among these, Fluopyram and Boscalid are leading due to their broad-spectrum efficacy and favorable safety profiles.

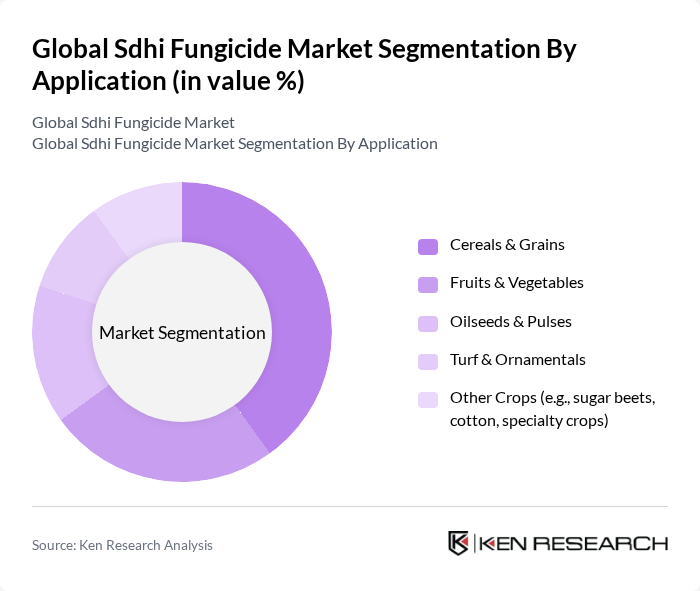

By Application:The applications of SDHI fungicides are diverse, covering cereals & grains, fruits & vegetables, oilseeds & pulses, turf & ornamentals, and other crops such as sugar beets and cotton. The cereals & grains segment is particularly dominant due to the high demand for effective disease management in staple crops.

The Global Sdhi Fungicide Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Syngenta AG, Bayer AG, Corteva, Inc., FMC Corporation, ADAMA Ltd., Nufarm Limited, UPL Limited, Sumitomo Chemical Co., Ltd., Nippon Soda Co., Ltd., Mitsui Chemicals Agro, Inc., Isagro S.p.A. (a Gowan Company), Gowan Company, LLC, Albaugh, LLC, and Zhejiang Heben Pesticide & Chemicals Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the SDHI fungicide market appears promising, driven by the increasing adoption of integrated pest management strategies and the growing preference for organic farming practices. As farmers seek effective solutions to combat rising crop diseases, the demand for innovative fungicides is expected to grow. Additionally, advancements in precision agriculture technologies will likely enhance the application efficiency of SDHIs, further supporting market expansion and sustainability in agricultural practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Boscalid Fluopyram Penthiopyrad Fluxapyroxad Bixafen Isopyrazam Benzovindiflupyr (Solatenol) Pydiflumetofen Other SDHI actives (e.g., sedaxane, carboxamide mixtures) |

| By Application | Cereals & Grains Fruits & Vegetables Oilseeds & Pulses Turf & Ornamentals Other Crops (e.g., sugar beets, cotton, specialty crops) |

| By Formulation | Suspension Concentrate (SC) Emulsifiable Concentrate (EC) Water-Dispersible Granules (WG/WDG) Flowable Concentrate for Seed Treatment (FS) Other Formulations (e.g., SE, OD) |

| By Distribution Channel | Direct Sales to Large Farms & Co-ops Ag-Retailers & Distributors Online/Marketplace Channels Government & Institutional Procurement |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By End-User | Large-Scale Commercial Farms Contract Growers & Producer Organizations Smallholder Farmers Turf Managers & Horticulture Professionals |

| By Price Range | Economy Mid-Range Premium Value Packs & Combos (premixes) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Row Crop Farmers | 120 | Agricultural Producers, Farm Managers |

| Agrochemical Distributors | 90 | Distribution Managers, Sales Representatives |

| Research Institutions | 60 | Research Scientists, Agronomy Experts |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Crop Protection Consultants | 70 | Consultants, Industry Analysts |

The Global SDHI Fungicide Market is valued at approximately USD 2.8 billion, reflecting a significant growth trend driven by the demand for sustainable agricultural practices and effective crop protection solutions.