Region:Global

Author(s):Geetanshi

Product Code:KRAC0156

Pages:87

Published On:August 2025

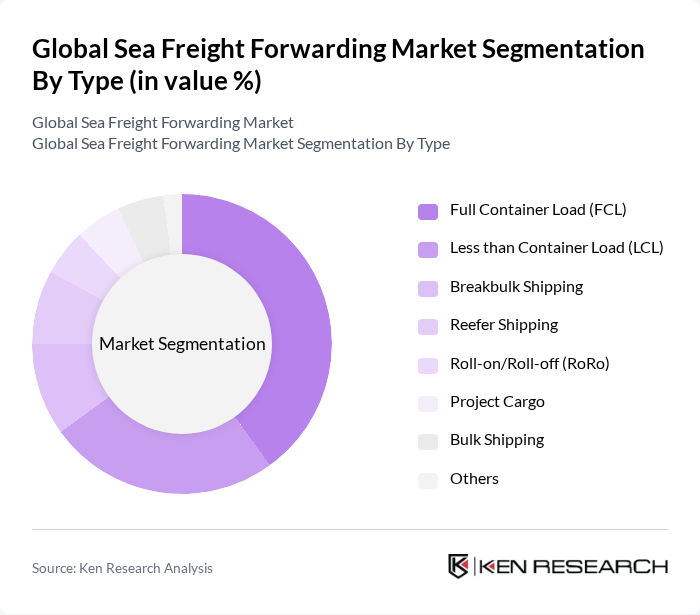

By Type:The market is segmented into Full Container Load (FCL), Less than Container Load (LCL), Breakbulk Shipping, Reefer Shipping, Roll-on/Roll-off (RoRo), Project Cargo, Bulk Shipping, and Others. Among these, Full Container Load (FCL) is the most dominant segment due to its efficiency in transporting large volumes of goods, cost-effectiveness for shippers with high-volume needs, and reduced risk of cargo damage or delays. The adoption of digital booking platforms and real-time tracking has further increased the preference for FCL among large-scale exporters .

By End-User:The end-user segmentation includes Retail, Manufacturing, Automotive, Pharmaceuticals, Consumer Electronics, Chemicals, Food & Beverages, and Others. The Retail segment is leading due to the surge in online shopping, omnichannel distribution strategies, and the need for timely delivery of goods, which has increased the demand for efficient sea freight forwarding services. Manufacturing remains a key segment, driven by globalized supply chains and the need for cost-effective bulk transportation .

The Global Sea Freight Forwarding Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Global Forwarding, Kuehne + Nagel International AG, DB Schenker, Sinotrans Limited, DSV A/S, Expeditors International of Washington, Inc., C.H. Robinson Worldwide, Inc., CEVA Logistics, Bolloré Logistics, Nippon Express Holdings, Inc., Kintetsu World Express, Inc., UPS Supply Chain Solutions, Maersk Logistics & Services, Hapag-Lloyd AG, Yang Ming Marine Transport Corporation, ZIM Integrated Shipping Services Ltd., Evergreen Marine Corporation, CMA CGM Group, OOCL (Orient Overseas Container Line), MSC Mediterranean Shipping Company contribute to innovation, geographic expansion, and service delivery in this space .

The future of the sea freight forwarding market appears promising, driven by increasing global trade and technological innovations. As businesses continue to prioritize cost-effective and efficient shipping solutions, the adoption of digital platforms and automation will likely enhance operational capabilities. Furthermore, the focus on sustainability will push companies to adopt greener practices, aligning with global environmental goals. This evolving landscape presents significant opportunities for growth and adaptation in the logistics sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Full Container Load (FCL) Less than Container Load (LCL) Breakbulk Shipping Reefer Shipping Roll-on/Roll-off (RoRo) Project Cargo Bulk Shipping Others |

| By End-User | Retail Manufacturing Automotive Pharmaceuticals Consumer Electronics Chemicals Food & Beverages Others |

| By Shipping Route | Transpacific Transatlantic Intra-Asia Europe-Asia Europe-North America Others |

| By Service Type | Door-to-Door Port-to-Port Customs Clearance Warehousing Freight Insurance Others |

| By Cargo Type | Dry Cargo Liquid Cargo Hazardous Cargo Perishable Cargo Oversized Cargo Others |

| By Delivery Speed | Standard Delivery Expedited Delivery Time-Definite Delivery Others |

| By Pricing Model | Fixed Pricing Variable Pricing Spot Pricing Contract Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| International Sea Freight Forwarding | 100 | Logistics Directors, Freight Operations Managers |

| Regional Freight Services | 60 | Regional Managers, Supply Chain Analysts |

| Customs Brokerage Services | 50 | Customs Compliance Officers, Trade Specialists |

| Cold Chain Logistics | 40 | Cold Chain Managers, Quality Assurance Leads |

| Emerging Market Freight Solutions | 45 | Market Development Managers, Business Analysts |

The Global Sea Freight Forwarding Market is valued at approximately USD 89 billion, reflecting a significant growth driven by increasing international trade, e-commerce expansion, and the need for efficient logistics solutions.