Region:Global

Author(s):Rebecca

Product Code:KRAC0272

Pages:84

Published On:August 2025

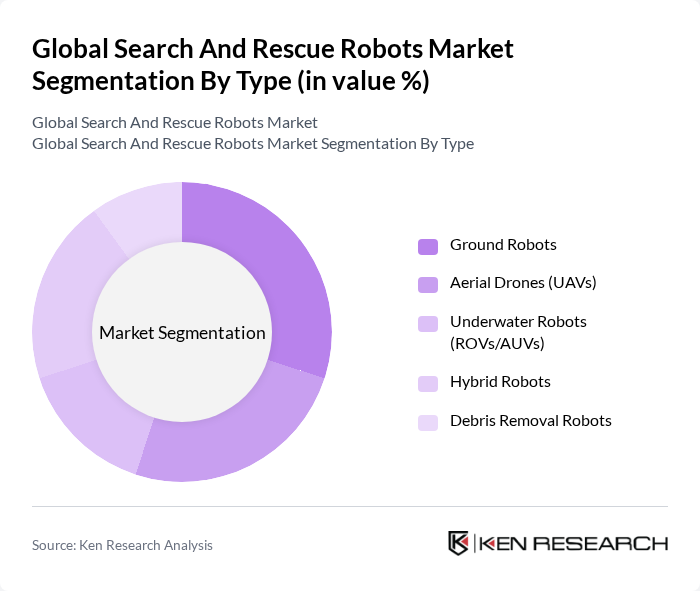

By Type:The market is segmented into various types of robots, including Ground Robots, Aerial Drones (UAVs), Underwater Robots (ROVs/AUVs), Hybrid Robots, and Debris Removal Robots. Each type serves distinct functions in search and rescue operations, catering to different environments and challenges faced during emergencies .

The Ground Robots segment is currently leading the market due to their versatility and effectiveness in various terrains, making them ideal for urban and rural search and rescue operations. These robots are equipped with advanced sensors and communication systems, allowing them to navigate complex environments and provide real-time data to rescue teams. The increasing adoption of ground robots by government agencies and NGOs for disaster response is a significant factor contributing to their dominance .

By End-User:The market is segmented into Government Agencies (e.g., Civil Defense, Fire Departments), Non-Governmental Organizations (NGOs), Military & Defense Forces, and the Private Sector (Industrial, Security Firms). Each end-user category has unique requirements and applications for search and rescue robots .

Government Agencies are the leading end-users of search and rescue robots, primarily due to their critical role in emergency response and disaster management. These agencies are increasingly adopting robotic solutions to enhance their operational efficiency and effectiveness during crises. The growing emphasis on public safety and the need for rapid response capabilities are driving the demand for advanced robotic systems in this sector .

The Global Search And Rescue Robots Market is characterized by a dynamic mix of regional and international players. Leading participants such as Boston Dynamics, iRobot Corporation, DJI Technology Co., Ltd., Clearpath Robotics, Northrop Grumman Corporation, FLIR Systems, Inc., Kongsberg Gruppen ASA, Roboteam Ltd., QinetiQ Group plc, SoftBank Robotics, Thales Group, Aeryon Labs Inc., ECA Group, SRI International, 3D Robotics, Lockheed Martin Corporation, Elbit Systems Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of search and rescue robots is poised for significant transformation, driven by technological advancements and increasing demand for efficient emergency response solutions. As governments and organizations invest more in disaster management, the integration of AI and autonomous systems will enhance operational capabilities. Furthermore, the growing focus on eco-friendly solutions will likely shape the development of new robotic technologies, ensuring they meet both performance and sustainability standards in the years ahead.

| Segment | Sub-Segments |

|---|---|

| By Type | Ground Robots Aerial Drones (UAVs) Underwater Robots (ROVs/AUVs) Hybrid Robots Debris Removal Robots |

| By End-User | Government Agencies (e.g., Civil Defense, Fire Departments) Non-Governmental Organizations (NGOs) Military & Defense Forces Private Sector (Industrial, Security Firms) |

| By Application | Disaster Response (Earthquake, Flood, Fire, etc.) Search Operations (Missing Persons, Urban Rescue) Surveillance & Reconnaissance Recovery Operations (Debris Removal, Medical Delivery) |

| By Component | Sensors (Thermal, LIDAR, Gas, etc.) Cameras (HD, Infrared, Night Vision) Communication Systems (Satellite, Radio, Cellular) Power Supply (Battery, Fuel Cell, Solar) |

| By Distribution Channel | Direct Sales Online Sales Distributors/Resellers |

| By Region | North America (U.S., Canada, Mexico) Europe (UK, Germany, France, Italy, Spain, Russia, Nordics, Benelux) Asia-Pacific (China, Japan, India, South Korea, ASEAN, Oceania) Middle East & Africa (Turkey, Israel, GCC, South Africa, North Africa) Latin America (Brazil, Argentina, Rest of Latin America) |

| By Price Range | Low-End Mid-Range High-End |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Emergency Response Teams | 100 | Rescue Coordinators, Field Operations Managers |

| Robotics Manufacturers | 60 | Product Development Engineers, Sales Directors |

| Government Disaster Management Agencies | 50 | Policy Makers, Emergency Management Officials |

| Research Institutions in Robotics | 40 | Academic Researchers, Robotics Professors |

| Non-Governmental Organizations (NGOs) | 40 | Disaster Relief Coordinators, Program Managers |

The Global Search And Rescue Robots Market is valued at approximately USD 2 billion, driven by advancements in robotics technology and increasing demand for efficient disaster response solutions. This market is expected to grow significantly in the coming years.