Global Seasoning And Spices Market Overview

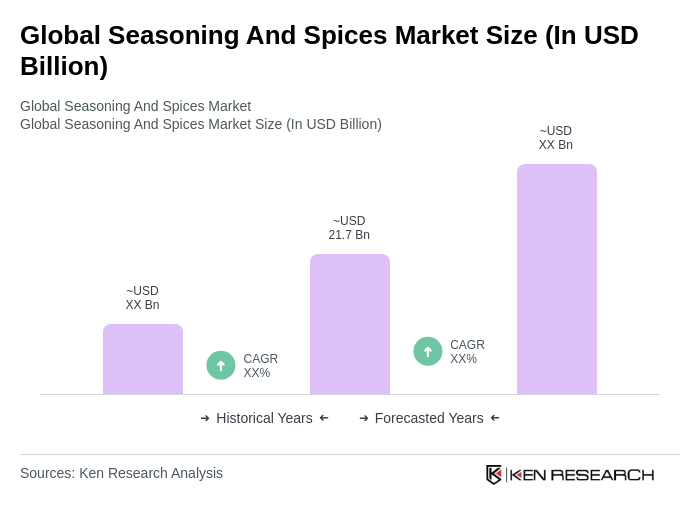

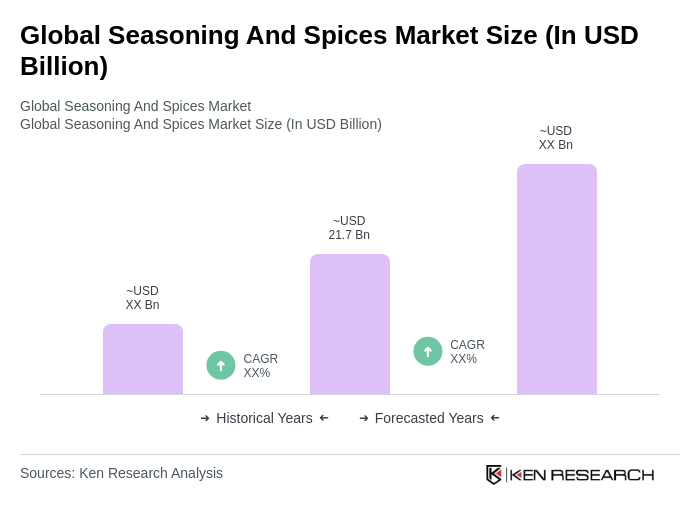

- The Global Seasoning and Spices Market was valued at USD 21.7 billion. This growth is primarily driven by increasing consumer preference for natural and organic products, the rising trend of home cooking and gourmet food preparation, and a surge in demand for ethnic and specialty flavors. The market is also supported by the expansion of the food service industry and retail channels, which enhance product availability and consumer access. Additionally, the growing popularity of ready-to-use spice mixes and premiumization of spice offerings are significant contributors to market growth.

- Countries such as the United States, India, and China dominate the Global Seasoning and Spices Market due to their rich culinary traditions and high consumption rates of spices and seasonings. The U.S. is a major consumer and innovator in spice blends, while India is a leading producer and exporter, leveraging its diverse agricultural base. China, with its vast population and culinary diversity, also plays a significant role in the market. The Asia Pacific region holds the largest market share, driven by a strong demand for ethnic flavors and a rapidly growing food service sector.

- In 2023, the U.S. Food and Drug Administration (FDA) continued to enforce regulations regarding the labeling of spices and seasonings, mandating clear ingredient disclosures and allergen information. These regulations aim to enhance consumer safety and transparency, ensuring that consumers are well-informed about the products they purchase, thereby fostering trust in the seasoning and spices market.

Global Seasoning And Spices Market Segmentation

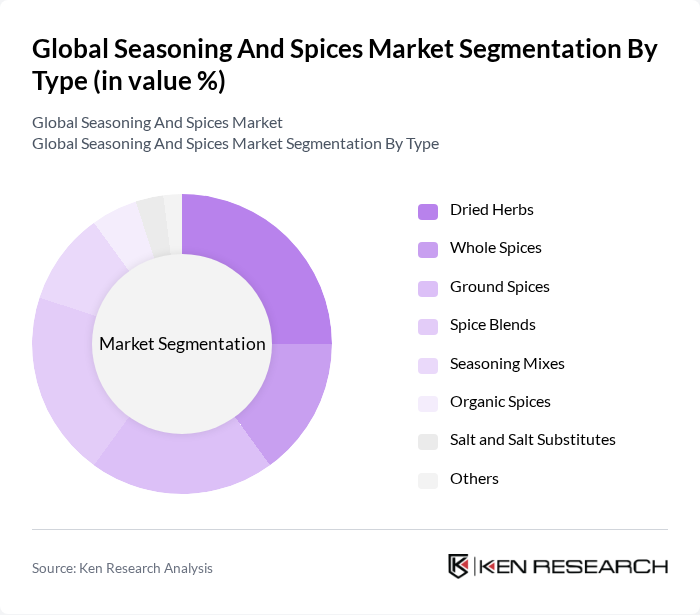

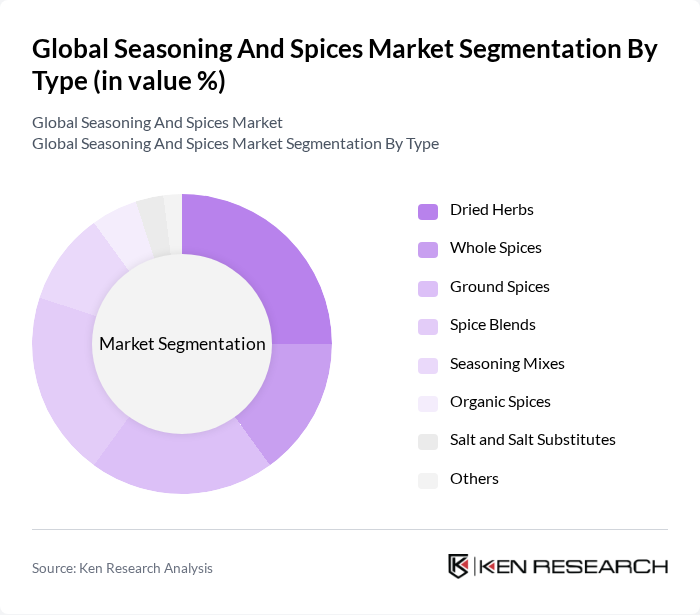

By Type:The seasoning and spices market can be segmented into dried herbs, whole spices, ground spices, spice blends, seasoning mixes, organic spices, salt and salt substitutes, and others. Dried herbs and spice blends are particularly popular due to their versatility and convenience in enhancing flavor in various dishes. The increasing trend towards healthy eating and the use of natural ingredients has also boosted the demand for organic spices. The market is further influenced by the demand for functional spices such as turmeric, ginger, and cinnamon, recognized for their health benefits, including anti-inflammatory and antioxidant properties.

By Application:The seasoning and spices market is segmented by application, including meat and poultry products, snacks and convenience food, soups, sauces and dressings, bakery and confectionery, frozen products, beverages, food processing, retail, food service, home cooking, and others. The meat and poultry segment is a significant contributor, driven by the increasing consumption of processed and ready-to-eat meat products, which often require seasoning for flavor enhancement. Additionally, the growing demand for snacks, convenience foods, and international cuisines is boosting the use of spices and seasonings across multiple food categories.

Global Seasoning And Spices Market Competitive Landscape

The Global Seasoning and Spices Market is characterized by a dynamic mix of regional and international players. Leading participants such as McCormick & Company, Inc., Olam International Limited, Associated British Foods plc, Ajinomoto Co., Inc., Kerry Group plc, Sensient Technologies Corporation, DSM-Firmenich AG, Cargill, Incorporated, The Kraft Heinz Company, B&G Foods, Inc., Everest Spices, DS Group (Dharampal Satyapal Group), Baria Pepper, Moguntia Food Group, and Pacific Spice Company contribute to innovation, geographic expansion, and service delivery in this space.

Global Seasoning And Spices Market Industry Analysis

Growth Drivers

- Increasing Consumer Demand for Natural Flavors:The global shift towards natural ingredients is evident, with the organic food market projected to reach $320 billion in future, according to the Organic Trade Association. This trend is driven by consumers seeking healthier, additive-free options. In future, 60% of consumers reported a preference for natural flavors over synthetic ones, indicating a significant market shift. This demand is expected to bolster the seasoning and spices market, as brands adapt to consumer preferences for authenticity and quality.

- Rising Popularity of Ethnic Cuisines:The increasing interest in diverse culinary experiences is driving the demand for spices and seasonings. The ethnic food market is projected to grow to $100 billion in future, as consumers explore global flavors. This trend is particularly strong in urban areas, where multicultural populations influence food choices. The rise of cooking shows and social media platforms showcasing ethnic recipes further fuels this demand, encouraging consumers to experiment with spices from various cultures.

- Growth of the Food Processing Industry:The food processing sector is a significant driver of spice demand, with the global market expected to reach $4 trillion in future, according to the Food and Agriculture Organization. As processed food products increasingly incorporate spices for flavor enhancement, the need for high-quality seasonings rises. This growth is supported by the convenience trend, as busy consumers opt for ready-to-eat meals that often rely on spices to deliver taste and appeal, thus expanding market opportunities.

Market Challenges

- Fluctuating Raw Material Prices:The seasoning and spices market faces challenges from volatile raw material prices, which can significantly impact profit margins. For instance, the price of black pepper surged by 30% in future due to supply chain disruptions and adverse weather conditions in key producing regions. Such fluctuations create uncertainty for manufacturers, forcing them to adjust pricing strategies and potentially pass costs onto consumers, which can affect demand and market stability.

- Stringent Food Safety Regulations:Compliance with food safety regulations poses a challenge for spice manufacturers. In future, the FDA implemented stricter guidelines for spice imports, requiring enhanced testing for contaminants. This has increased operational costs for companies, as they must invest in quality control measures and documentation processes. Non-compliance can lead to product recalls and reputational damage, making it essential for businesses to navigate these regulations effectively to maintain market presence.

Global Seasoning And Spices Market Future Outlook

The future of the seasoning and spices market appears promising, driven by evolving consumer preferences and innovative product offerings. As health-conscious trends continue to rise, companies are likely to focus on developing natural and organic spice blends. Additionally, the expansion of e-commerce platforms will facilitate greater access to diverse spice products, enhancing consumer choice. The integration of technology in supply chains will also improve efficiency, ensuring that businesses can meet the growing demand for high-quality seasonings in a competitive landscape.

Market Opportunities

- Growth in Health-Conscious Consumer Segment:The increasing awareness of health and wellness is creating opportunities for spice manufacturers to develop products that cater to this demographic. With the health food market projected to reach $1 trillion in future, companies can capitalize on this trend by offering spices that promote health benefits, such as anti-inflammatory properties, thus attracting health-focused consumers.

- Development of Organic and Non-GMO Products:The demand for organic and non-GMO products is on the rise, with the organic spice market expected to grow significantly. As consumers become more discerning about food sourcing, companies that invest in organic certification and transparent sourcing practices will likely gain a competitive edge. This trend presents a lucrative opportunity for brands to differentiate themselves in a crowded market.