Region:Global

Author(s):Geetanshi

Product Code:KRAA1204

Pages:96

Published On:August 2025

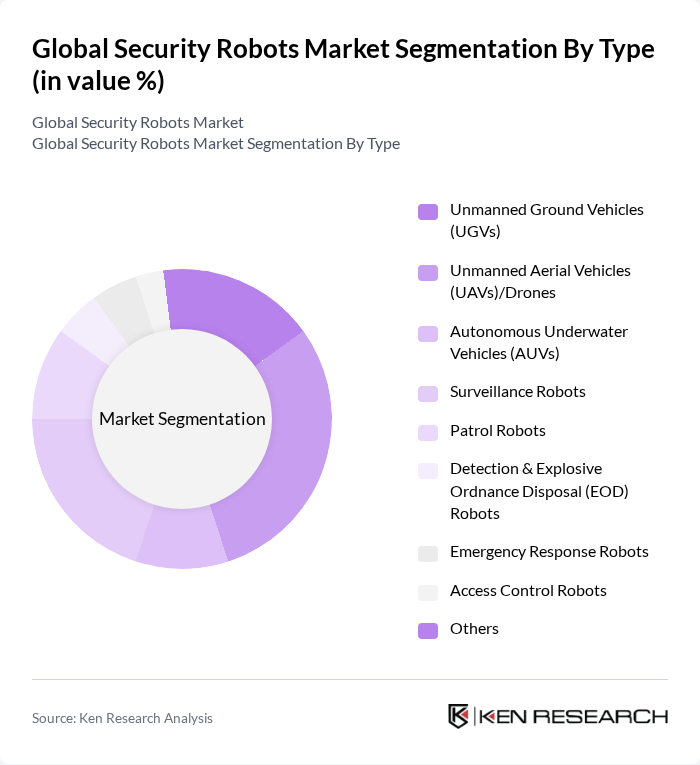

By Type:The market is segmented into various types of security robots, including Unmanned Ground Vehicles (UGVs), Unmanned Aerial Vehicles (UAVs)/Drones, Autonomous Underwater Vehicles (AUVs), Surveillance Robots, Patrol Robots, Detection & Explosive Ordnance Disposal (EOD) Robots, Emergency Response Robots, Access Control Robots, and Others. Among these, Unmanned Aerial Vehicles (UAVs)/Drones are currently dominating the market due to their versatility and effectiveness in surveillance and reconnaissance operations. The increasing adoption of drones for security purposes in both military and civilian applications is driving their market share .

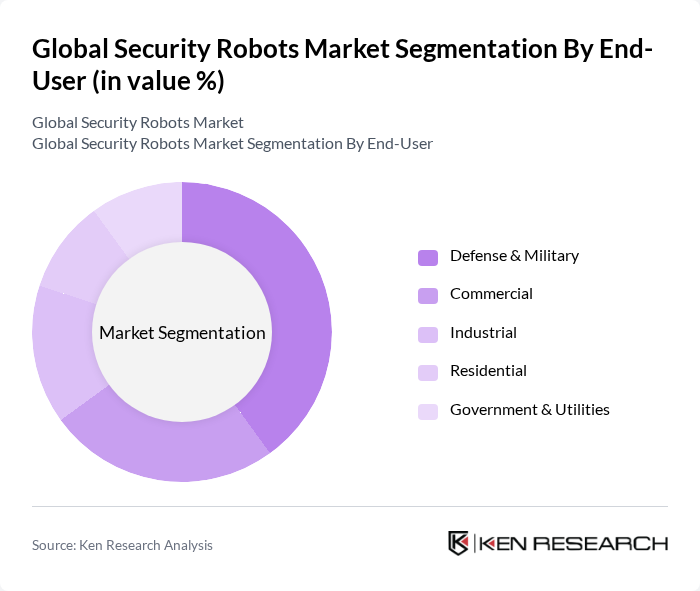

By End-User:The market is segmented by end-user into Defense & Military, Commercial, Industrial, Residential, and Government & Utilities. The Defense & Military sector is the leading end-user of security robots, driven by the need for enhanced surveillance and reconnaissance capabilities in combat and peacekeeping operations. The increasing defense budgets of various countries and the growing emphasis on modernizing military capabilities are propelling the demand for security robots in this sector .

The Global Security Robots Market is characterized by a dynamic mix of regional and international players. Leading participants such as Boston Dynamics, Knightscope, Inc., Savioke, Robotic Assistance Devices, Inc., Avidbots Corp., Cobalt Robotics, SMP Robotics, GuardBot, Inc., DJI Technology Co., Ltd., Clearpath Robotics, G4S plc, Elbit Systems Ltd., L3Harris Technologies, Inc., Northrop Grumman Corporation, QinetiQ Group plc, Leonardo S.p.A., ReconRobotics, Inc., Lockheed Martin Corporation, AeroVironment, Inc., Thales Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the security robots market appears promising, driven by continuous technological advancements and increasing security demands. As urbanization accelerates, cities are likely to adopt more automated security solutions, integrating robots into their infrastructure. Furthermore, the collaboration between robotics firms and AI developers will enhance the functionality of security robots, making them indispensable in various sectors. This evolution will likely lead to more tailored solutions that address specific security challenges, fostering growth in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Unmanned Ground Vehicles (UGVs) Unmanned Aerial Vehicles (UAVs)/Drones Autonomous Underwater Vehicles (AUVs) Surveillance Robots Patrol Robots Detection & Explosive Ordnance Disposal (EOD) Robots Emergency Response Robots Access Control Robots Others |

| By End-User | Defense & Military Commercial Industrial Residential Government & Utilities |

| By Application | Perimeter Security Event Security Infrastructure Security Transportation Security Spying & Intelligence Gathering Explosive Detection & Disposal Rescue Operations |

| By Component | Hardware (Sensors, Cameras, Propulsion, Power Systems, etc.) Software (AI, Navigation, Analytics, etc.) Services (Integration, Maintenance, Training) |

| By Distribution Channel | Direct Sales Online Sales Distributors |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low-End Mid-Range High-End |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Security Applications | 100 | Security Managers, Facility Directors |

| Government and Defense Robotics | 80 | Defense Analysts, Procurement Officers |

| Private Security Firms | 60 | Operations Managers, Technology Officers |

| Healthcare Security Solutions | 50 | Healthcare Administrators, Security Coordinators |

| Retail Security Robotics | 40 | Loss Prevention Managers, Store Operations Heads |

The Global Security Robots Market is valued at approximately USD 12 billion, driven by increasing security concerns, advancements in robotics technology, and a rising demand for automation in security operations.