Region:Global

Author(s):Shubham

Product Code:KRAB0751

Pages:88

Published On:August 2025

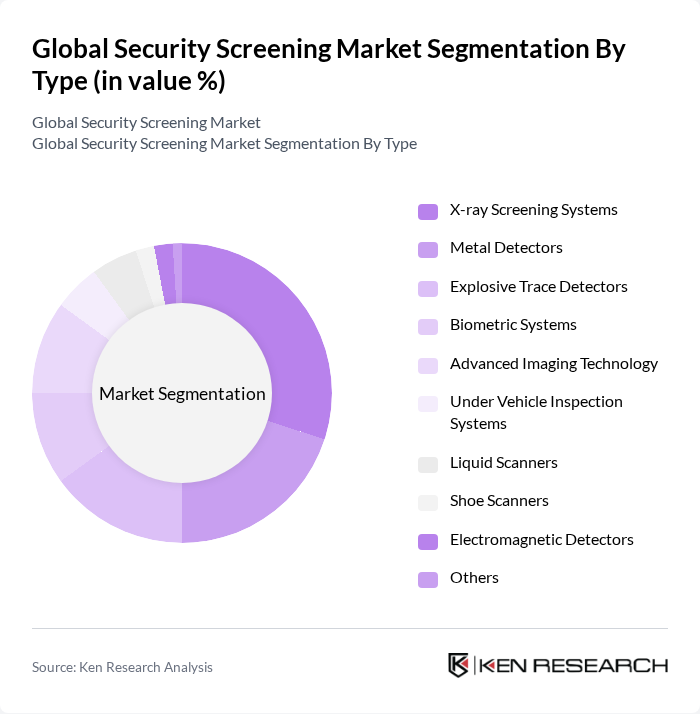

By Type:The market is segmented into various types of security screening technologies, including X-ray Screening Systems, Metal Detectors, Explosive Trace Detectors, Biometric Systems, Advanced Imaging Technology, Under Vehicle Inspection Systems, Liquid Scanners, Shoe Scanners, Electromagnetic Detectors, and Others. Each of these technologies plays a crucial role in enhancing security measures across different sectors. The adoption of biometric and advanced imaging technologies is accelerating due to their ability to provide rapid, non-intrusive, and accurate threat detection, while traditional systems such as X-ray and metal detectors remain foundational in high-traffic environments .

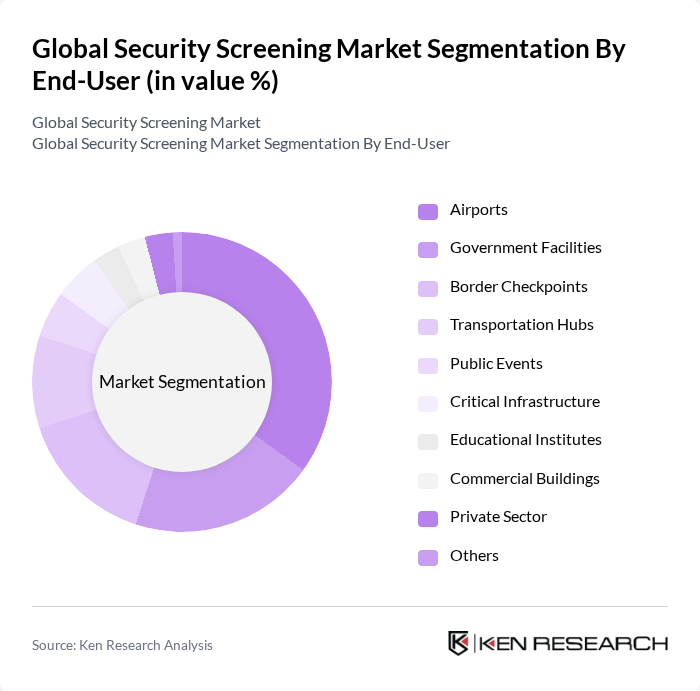

By End-User:The end-user segmentation includes Airports, Government Facilities, Border Checkpoints, Transportation Hubs, Public Events, Critical Infrastructure, Educational Institutes, Commercial Buildings, Private Sector, and Others. Each segment has unique security requirements that drive the demand for specific screening technologies. Airports remain the largest end-user segment due to regulatory mandates and the critical need for high-throughput, reliable screening. Government facilities and border checkpoints are also significant, driven by national security priorities and increased cross-border movement .

The Global Security Screening Market is characterized by a dynamic mix of regional and international players. Leading participants such as Smiths Detection, Leidos Holdings, Inc., Rapiscan Systems (OSI Systems, Inc.), L3Harris Technologies, Inc., Nuctech Company Limited, Analogic Corporation, Teledyne Technologies Incorporated, Safran Identity & Security (Morpho), Garrett Metal Detectors, Astrophysics Inc., CEIA SpA, VOTI Detection Inc., Bruker Corporation, Chemring Group PLC, and Cobalt Light Systems (Agilent Technologies) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the security screening market is poised for significant transformation, driven by technological innovations and evolving security needs. As organizations increasingly adopt biometric screening technologies and integrate IoT solutions, the efficiency and effectiveness of security measures will improve. Additionally, the focus on sustainability will lead to the development of eco-friendly screening solutions. These trends indicate a robust growth trajectory, with an emphasis on automation and enhanced user experience shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | X-ray Screening Systems Metal Detectors Explosive Trace Detectors Biometric Systems Advanced Imaging Technology Under Vehicle Inspection Systems Liquid Scanners Shoe Scanners Electromagnetic Detectors Others |

| By End-User | Airports Government Facilities Border Checkpoints Transportation Hubs Public Events Critical Infrastructure Educational Institutes Commercial Buildings Private Sector Others |

| By Application | Passenger Screening Baggage Screening Cargo Screening Perimeter Security Access Control Contraband Detection Others |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Retail Wholesale E-commerce |

| By Price Range | Low Range Mid Range High Range |

| By Region | North America Europe Asia Pacific Middle East & Africa South America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aviation Security Screening | 100 | Airport Security Managers, TSA Officials |

| Maritime Security Solutions | 60 | Port Security Directors, Customs Officers |

| Public Event Security Management | 50 | Event Security Coordinators, Venue Managers |

| Critical Infrastructure Protection | 40 | Infrastructure Security Analysts, Risk Management Officers |

| Government Security Agencies | 50 | Policy Makers, Security Analysts |

The Global Security Screening Market is valued at approximately USD 13.1 billion, driven by increasing security concerns and advancements in detection technologies. This market is expected to grow as the demand for efficient screening solutions rises across various sectors.