Region:Global

Author(s):Rebecca

Product Code:KRAB0269

Pages:84

Published On:August 2025

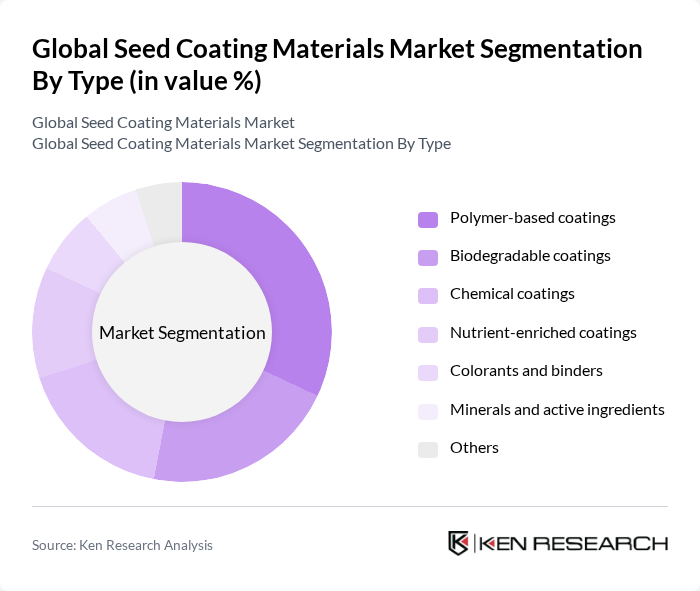

By Type:The seed coating materials market is segmented into polymer-based coatings, biodegradable coatings, chemical coatings, nutrient-enriched coatings, colorants and binders, minerals and active ingredients, and others. Among these, polymer-based coatings are currently leading the market due to their versatility, durability, and effectiveness in protecting seeds from pests and diseases. The increasing trend toward sustainable agriculture has also led to a rise in the demand for biodegradable coatings, which are gaining traction among environmentally conscious consumers .

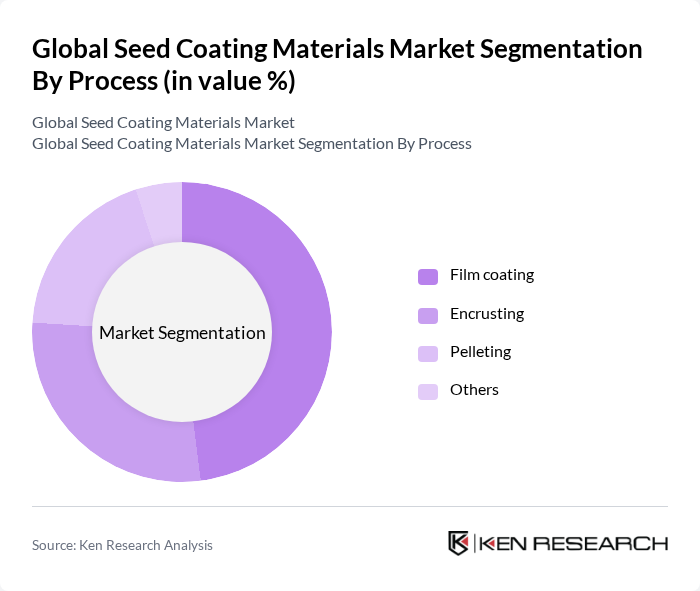

By Process:The market is also segmented by the process of seed coating, which includes film coating, encrusting, pelleting, and others. Film coating is the most widely used method due to its ability to provide a uniform layer that enhances seed performance and protects against environmental stressors. Pelleting is gaining popularity as it improves seed handling and planting efficiency, while encrusting is favored for its ability to add nutrients directly to the seed .

The Global Seed Coating Materials Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Bayer AG, Syngenta AG, Corteva Agriscience, Croda International Plc, Clariant AG, Sumitomo Chemical Co., Ltd., Novozymes A/S, UPL Limited, FMC Corporation, Precision Planting LLC, Verdesian Life Sciences, Nutrien Ltd., Incotec Group BV, Germains Seed Technology contribute to innovation, geographic expansion, and service delivery in this space.

The future of the seed coating materials market appears promising, driven by technological advancements and a shift towards sustainable practices. As precision agriculture gains traction, the integration of smart technologies is expected to enhance seed performance and reduce waste. Furthermore, increased investment in agricultural research and development, projected to reach $50 billion in future, will likely foster innovation in seed coatings, ensuring they meet the evolving needs of farmers and consumers alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Polymer-based coatings Biodegradable coatings Chemical coatings Nutrient-enriched coatings Colorants and binders Minerals and active ingredients Others |

| By Process | Film coating Encrusting Pelleting Others |

| By Crop Type | Cereals & grains Oilseeds & pulses Fruits & vegetables Flowers & ornamentals Others |

| By Application | Field crops Vegetable seeds Flower seeds Others |

| By End-User | Commercial farmers Agricultural cooperatives Seed producers Research institutions Others |

| By Distribution Channel | Direct sales Online retail Distributors Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low price Mid-range Premium |

| By Policy Support | Subsidies Tax incentives Research grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Seed Coating Manufacturers | 60 | Product Managers, R&D Directors |

| Agricultural Distributors | 50 | Sales Managers, Supply Chain Coordinators |

| Farmers and Growers | 100 | Crop Producers, Agricultural Consultants |

| Research Institutions | 40 | Research Scientists, Agronomy Professors |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Global Seed Coating Materials Market is valued at approximately USD 2.0 billion. This valuation reflects the increasing demand for high-quality seeds and advancements in agricultural technologies, alongside a growing awareness of the benefits of seed coating.