Region:Global

Author(s):Shubham

Product Code:KRAC0629

Pages:84

Published On:August 2025

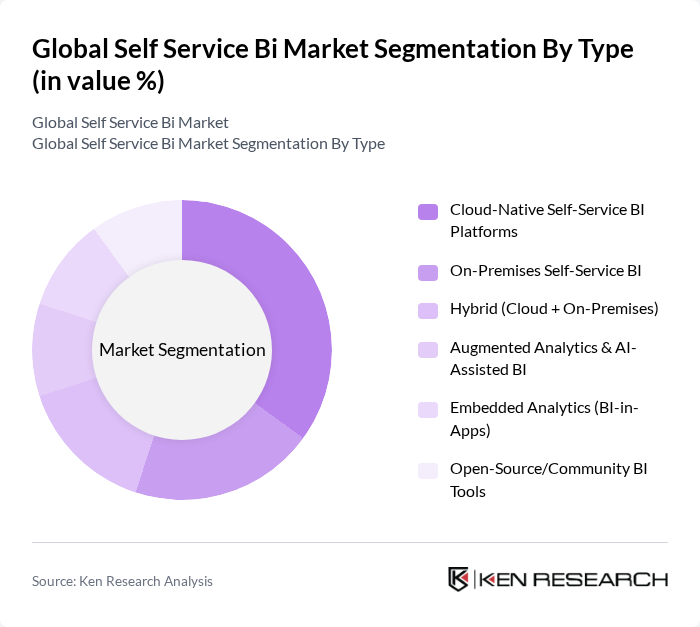

By Type:The self-service BI market can be segmented into various types, including Cloud-Native Self-Service BI Platforms, On-Premises Self-Service BI, Hybrid (Cloud + On-Premises), Augmented Analytics & AI-Assisted BI, Embedded Analytics (BI-in-Apps), and Open-Source/Community BI Tools. Each of these sub-segments caters to different user needs and preferences, with cloud-native solutions gaining traction due to their scalability and ease of use. Vendors and enterprises increasingly favor cloud deployments for flexibility, lower upfront costs, and rapid feature delivery; augmented analytics and NLQ are being embedded across tools to broaden access for non-technical users .

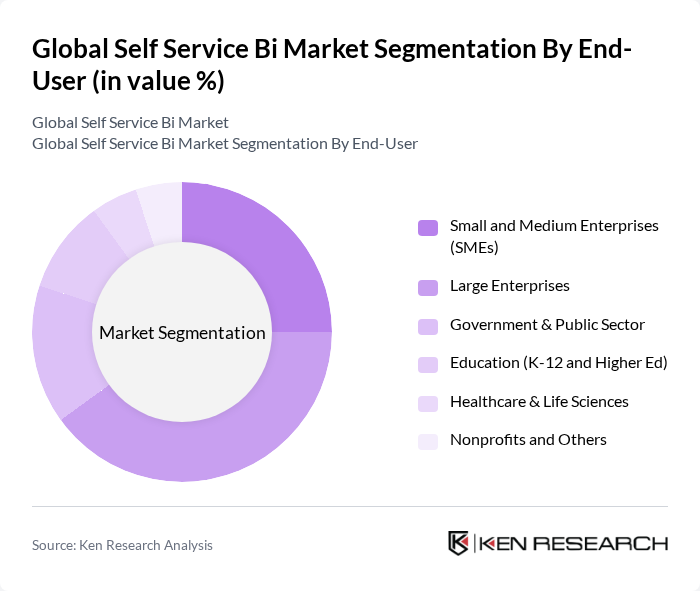

By End-User:The end-user segmentation of the self-service BI market includes Small and Medium Enterprises (SMEs), Large Enterprises, Government & Public Sector, Education (K-12 and Higher Ed), Healthcare & Life Sciences, and Nonprofits and Others. Large enterprises are the dominant users due to their extensive data needs and resources to invest in advanced BI tools, while SMEs are increasingly adopting these solutions to remain competitive. Public sector, healthcare, and education initiatives also emphasize governed self-service and secure cloud analytics adoption .

The Global Self Service BI Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft Corporation (Power BI), Tableau Software, LLC (Salesforce), QlikTech International AB, SAP SE (SAP Analytics Cloud), IBM Corporation (IBM Cognos Analytics, Watsonx BI), MicroStrategy Incorporated, Oracle Corporation (Oracle Analytics Cloud), SAS Institute Inc., TIBCO Software Inc. (Spotfire), Sisense Inc., Domo, Inc., Looker Data Sciences, Inc. (Google Cloud Looker), Zoho Corporation Pvt. Ltd. (Zoho Analytics), ThoughtSpot, Inc., Pyramid Analytics B.V. contribute to innovation, geographic expansion, and service delivery in this space .

The future of self-service BI in the None region is poised for significant transformation, driven by advancements in technology and evolving business needs. Organizations are increasingly prioritizing real-time analytics and data governance, ensuring that insights are both timely and reliable. Additionally, the personalization of BI tools is expected to enhance user engagement, making data more accessible. As companies continue to embrace digital transformation, the demand for intuitive self-service solutions will likely accelerate, fostering innovation and competitive advantage.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-Native Self-Service BI Platforms On-Premises Self-Service BI Hybrid (Cloud + On-Premises) Augmented Analytics & AI-Assisted BI Embedded Analytics (BI-in-Apps) Open-Source/Community BI Tools |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government & Public Sector Education (K-12 and Higher Ed) Healthcare & Life Sciences Nonprofits and Others |

| By Industry Vertical | Retail & E-commerce Banking, Financial Services & Insurance (BFSI) Manufacturing Telecommunications & Media Transport, Logistics & Supply Chain Energy & Utilities Others |

| By Deployment Mode | Public Cloud (SaaS) Private Cloud Hybrid Cloud |

| By Functionality | Self-Service Reporting & Ad Hoc Analysis Data Preparation & Wrangling Data Visualization & Interactive Dashboards Natural Language Query (NLQ) & Search-Driven Analytics Performance Management & KPI Tracking Data Governance, Cataloging & Lineage |

| By Sales Channel | Direct (Vendor) Sales Online Marketplaces Value-Added Resellers (VARs) and System Integrators |

| By Pricing Model | Subscription (Per-User/Per-Capacity) Usage-Based/Consumption Pricing Perpetual License Freemium/Community Editions Enterprise Agreements |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Finance Sector Self-Service BI Adoption | 100 | Data Analysts, Financial Managers |

| Healthcare Analytics Implementation | 80 | IT Directors, Healthcare Data Scientists |

| Retail Business Intelligence Usage | 90 | Marketing Managers, Operations Analysts |

| Manufacturing Data Visualization Tools | 70 | Production Managers, Supply Chain Analysts |

| Telecommunications BI Strategy | 60 | Business Intelligence Managers, Network Analysts |

The Global Self Service BI Market is valued at approximately USD 1011 billion, with recent analyses indicating a base around USD 911 billion. This growth is driven by the increasing demand for data-driven decision-making and big data analytics.