Region:Global

Author(s):Rebecca

Product Code:KRAA2147

Pages:94

Published On:August 2025

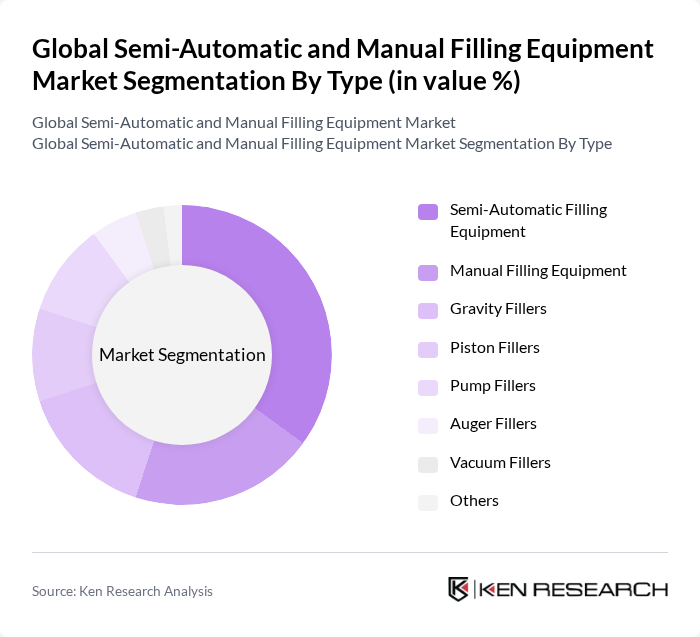

By Type:The market is segmented into Semi-Automatic Filling Equipment, Manual Filling Equipment, Gravity Fillers, Piston Fillers, Pump Fillers, Auger Fillers, Vacuum Fillers, and Others. Semi-Automatic Filling Equipment is gaining traction due to its balance of efficiency and cost-effectiveness, making it a preferred choice for small to medium-sized enterprises. Manual Filling Equipment remains relevant for niche applications where precision and operator control are paramount. Gravity, piston, and pump fillers are widely used for liquid and semi-liquid products, while auger and vacuum fillers cater to powders and viscous materials .

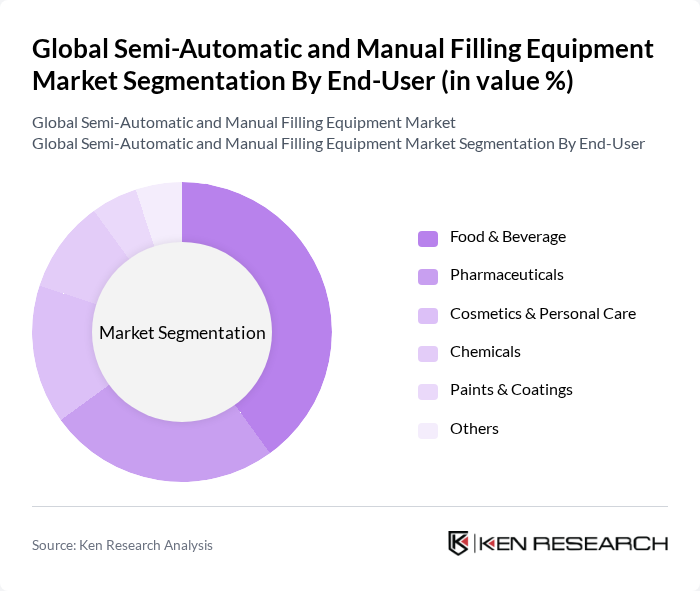

By End-User:The end-user segmentation includes Food & Beverage, Pharmaceuticals, Cosmetics & Personal Care, Chemicals, Paints & Coatings, and Others. The Food & Beverage sector is the largest consumer of filling equipment, driven by the rising demand for packaged and processed foods, as well as the expansion of the global beverage industry. The Pharmaceuticals sector follows, where compliance with regulatory standards and the need for precise dosing are critical. Cosmetics, chemicals, and paints industries also utilize specialized filling solutions for product safety and consistency .

The Global Semi-Automatic and Manual Filling Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bosch Packaging Technology (Syntegon Technology GmbH), KHS GmbH, Accutek Packaging Equipment Companies, Inc., Tetra Pak International S.A., Coesia S.p.A., IMA S.p.A., Scholle IPN, Universal Filling Machine Company, LFA Machines Oxford Ltd., Inline Filling Systems, Serac Group, Pester Pac Automation GmbH, Sidel Group, MachPack Process Machines, and Nordson Corporation contribute to innovation, geographic expansion, and service delivery in this space .

The future of the semi-automatic and manual filling equipment market appears promising, driven by technological advancements and a shift towards smart manufacturing. As industries increasingly adopt IoT technologies, the integration of smart features into filling equipment will enhance operational efficiency and data analytics capabilities. Additionally, the growing emphasis on sustainability will likely lead to innovations in eco-friendly filling solutions, aligning with global environmental goals and consumer preferences for sustainable practices in manufacturing.

| Segment | Sub-Segments |

|---|---|

| By Type | Semi-Automatic Filling Equipment Manual Filling Equipment Gravity Fillers Piston Fillers Pump Fillers Auger Fillers Vacuum Fillers Others |

| By End-User | Food & Beverage Pharmaceuticals Cosmetics & Personal Care Chemicals Paints & Coatings Others (including petroleum, automotive, industrial & agricultural) |

| By Application | Liquid Filling Cream Filling Powder Filling Granule Filling Paste Filling Others |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Others |

| By Distribution Mode | Offline Distribution Online Distribution Hybrid Distribution |

| By Price Range | Low Price Mid Price High Price |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Filling Equipment | 120 | Production Managers, Quality Assurance Leads |

| Pharmaceutical Filling Systems | 90 | Regulatory Affairs Specialists, Operations Directors |

| Cosmetics and Personal Care Filling Equipment | 60 | Product Development Managers, Supply Chain Coordinators |

| Industrial Chemicals Filling Solutions | 50 | Procurement Managers, Facility Engineers |

| Contract Packaging Services | 70 | Business Development Managers, Operations Supervisors |

The Global Semi-Automatic and Manual Filling Equipment Market is valued at approximately USD 4.5 billion, reflecting a significant growth trend driven by the demand for efficient filling solutions across various industries, including food and beverage, pharmaceuticals, and cosmetics.