Region:Global

Author(s):Geetanshi

Product Code:KRAC0045

Pages:86

Published On:August 2025

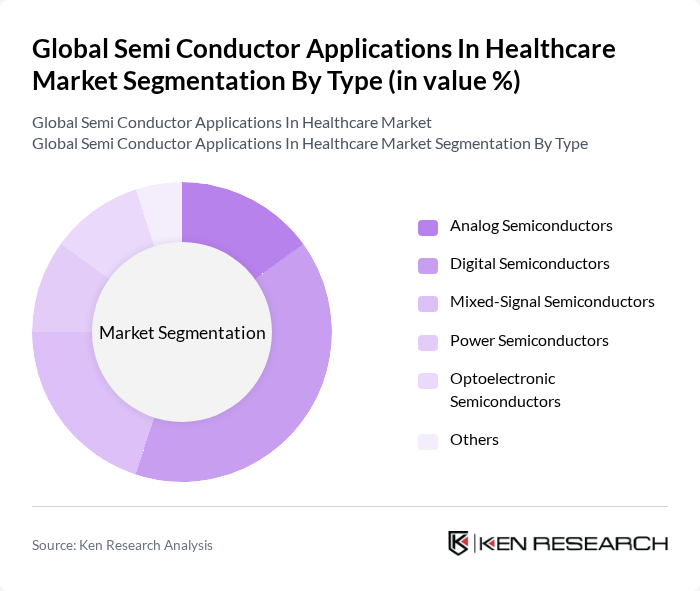

By Type:The semiconductor applications in healthcare can be categorized into various types, including Integrated Circuits, Sensors, Discrete Components, and Optoelectronics. Among these, Optoelectronic Semiconductors are leading the market due to their critical role in high-resolution imaging and non-invasive diagnostics. The increasing adoption of digital health solutions, such as telehealth and remote monitoring, has significantly boosted the demand for sensors and integrated circuits, making them essential for modern healthcare applications .

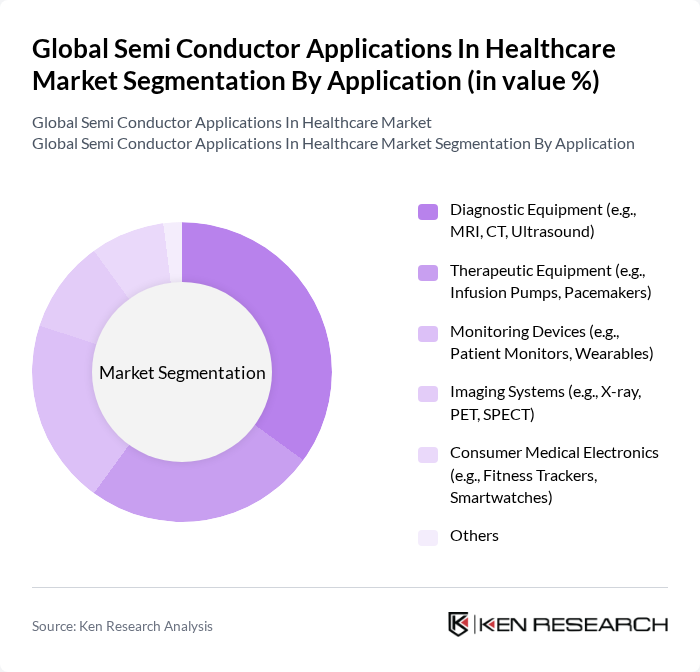

By Application:The applications of semiconductors in healthcare include Diagnostic Equipment, Therapeutic Equipment, Monitoring Devices, Imaging Systems, Consumer Medical Electronics, and Others. Medical imaging and diagnostic equipment, such as MRI and CT scanners, are currently the dominant application segments. The increasing prevalence of chronic diseases and the need for early diagnosis have led to a surge in demand for advanced diagnostic tools, driving the growth of these segments. The rapid adoption of wearable and remote monitoring devices is also a significant trend, supporting continuous patient management and telehealth .

The Global Semiconductor Applications in Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intel Corporation, Texas Instruments Incorporated, Analog Devices, Inc., STMicroelectronics N.V., NXP Semiconductors N.V., Qualcomm Incorporated, Infineon Technologies AG, Microchip Technology Incorporated, Broadcom Inc., Renesas Electronics Corporation, onsemi (ON Semiconductor Corporation), AMS AG, Maxim Integrated Products, Inc., Medtronic plc, Abbott Laboratories, Omron Healthcare, Inc., GE Healthcare, Philips Healthcare, Roche Diagnostics Limited, Spacelabs Healthcare contribute to innovation, geographic expansion, and service delivery in this space.

The future of semiconductor applications in healthcare appears promising, driven by ongoing technological advancements and increasing healthcare demands. As the industry embraces digital transformation, the integration of AI and IoT technologies will enhance patient care and operational efficiency. Furthermore, the growing emphasis on personalized medicine will likely spur innovation in semiconductor applications, enabling tailored healthcare solutions that meet individual patient needs. This evolution will create a dynamic landscape for semiconductor technologies in the healthcare sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Analog Semiconductors Digital Semiconductors Mixed-Signal Semiconductors Power Semiconductors Optoelectronic Semiconductors Others |

| By Application | Diagnostic Equipment (e.g., MRI, CT, Ultrasound) Therapeutic Equipment (e.g., Infusion Pumps, Pacemakers) Monitoring Devices (e.g., Patient Monitors, Wearables) Imaging Systems (e.g., X-ray, PET, SPECT) Consumer Medical Electronics (e.g., Fitness Trackers, Smartwatches) Others |

| By End-User | Hospitals Clinics Home Healthcare Research Institutions Diagnostic Centers Others |

| By Component | Sensors (e.g., Biosensors, Image Sensors) Microcontrollers & Microprocessors Integrated Circuits (ICs) Discrete Semiconductors Optoelectronic Components Others |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Sales Others |

| By Distribution Mode | Offline Distribution Online Distribution Hybrid Distribution |

| By Price Range | Budget Mid-Range Premium |

| By Geography | North America Europe Asia Pacific Middle East & Africa Latin America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Medical Device Manufacturers | 100 | Product Managers, R&D Directors |

| Healthcare IT Solutions Providers | 70 | IT Managers, Software Developers |

| Clinical Practitioners Using Semiconductor Devices | 60 | Doctors, Nurses, Technicians |

| Regulatory Bodies and Compliance Experts | 40 | Regulatory Affairs Managers, Compliance Officers |

| Healthcare Technology Consultants | 50 | Consultants, Analysts |

The Global Semiconductor Applications in Healthcare Market is valued at approximately USD 51 billion, driven by the increasing demand for advanced medical devices, telemedicine, and IoT integration in healthcare.