Region:Global

Author(s):Shubham

Product Code:KRAB0699

Pages:82

Published On:August 2025

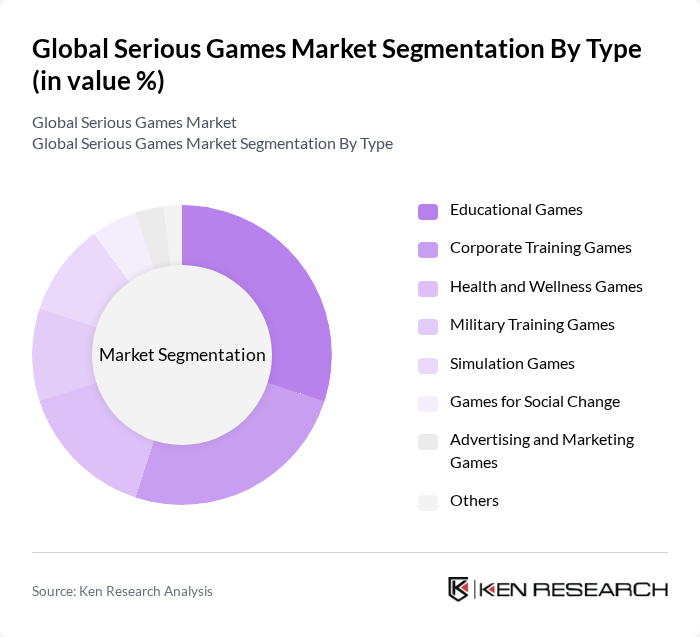

By Type:The serious games market can be segmented into Educational Games, Corporate Training Games, Health and Wellness Games, Military Training Games, Simulation Games, Games for Social Change, Advertising and Marketing Games, and Others. Each of these sub-segments addresses specific needs and applications, driving overall market growth. Educational Games and Simulation Games are particularly prominent, reflecting the demand for interactive, skills-based, and immersive learning experiences in both academic and professional environments .

The Educational Games segment is currently dominating the market due to the increasing integration of gamified learning in schools and universities. This trend is driven by the need for interactive and engaging educational tools that enhance student participation and retention. As educational institutions continue to adopt technology in their teaching methodologies, the demand for educational games remains strong. The rise of online learning platforms and the growing emphasis on STEM education further contribute to the growth of this segment .

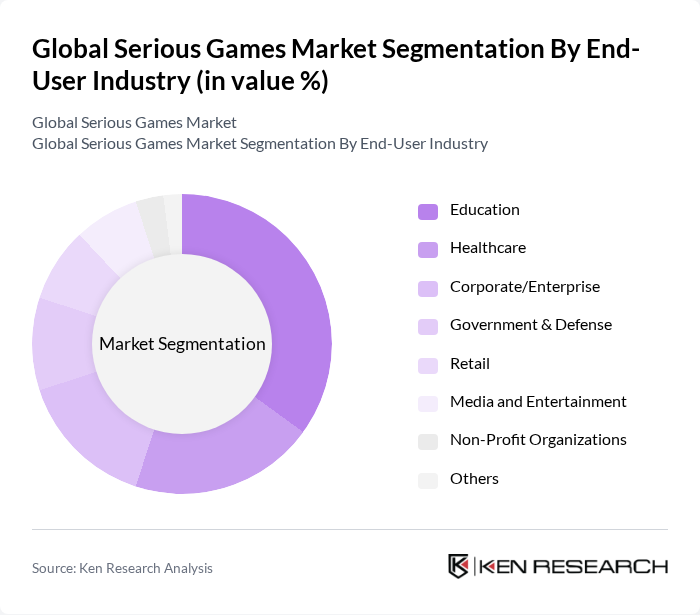

By End-User Industry:The serious games market can also be segmented by end-user industry, including Education, Healthcare, Corporate/Enterprise, Government & Defense, Retail, Media and Entertainment, Non-Profit Organizations, and Others. Each industry utilizes serious games for different purposes, contributing to overall market dynamics. Education and Healthcare are the leading segments, reflecting the widespread adoption of serious games for learning, training, and therapeutic applications .

The Education sector is the leading end-user industry for serious games, driven by the increasing demand for innovative teaching methods and the integration of technology in classrooms. Educational institutions are increasingly adopting serious games to enhance learning experiences, improve student engagement, and facilitate skill development. The growing emphasis on personalized learning and the need for effective assessment tools further bolster the demand for serious games in this sector .

The Global Serious Games Market is characterized by a dynamic mix of regional and international players. Leading participants such as Unity Technologies, IBM Corporation, Microsoft Corporation, Epic Games, Inc., Cisco Systems, Inc., MPS Interactive Systems Limited, BreakAway Games, LLC, Grendel Games, Serious Games Interactive, Totem Learning, Gamelearn, Kognito, Axonify, Designing Digitally, Inc., and Diginext SRL (CS Communication & Systèmes) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the serious games market appears promising, driven by technological advancements and increasing recognition of their educational value. As organizations prioritize employee engagement and effective training methods, serious games are likely to gain traction. Furthermore, the integration of augmented and virtual reality technologies is expected to enhance user experiences, making serious games more immersive and effective. This evolution will likely attract new investments and partnerships, fostering innovation and expanding market reach in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Educational Games Corporate Training Games Health and Wellness Games Military Training Games Simulation Games Games for Social Change Advertising and Marketing Games Others |

| By End-User Industry | Education Healthcare Corporate/Enterprise Government & Defense Retail Media and Entertainment Non-Profit Organizations Others |

| By Application | Training and Simulation Learning and Education Assessment and Evaluation Engagement and Motivation Research and Planning Human Resources Others |

| By Platform | Smartphone/Mobile Apps PC-Based Console-Based Web-Based Virtual Reality (VR) Systems Augmented Reality (AR) Games Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By User Demographics | Age Group (Children, Adults, Seniors) Skill Level (Beginner, Intermediate, Advanced) Learning Styles (Visual, Auditory, Kinesthetic) Others |

| By Pricing Model | Subscription-Based One-Time Purchase Freemium Model Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Education Sector Serious Games | 100 | Teachers, Educational Administrators |

| Healthcare Training Simulations | 80 | Medical Trainers, Healthcare Professionals |

| Corporate Training Programs | 60 | HR Managers, Training Coordinators |

| Military and Defense Applications | 50 | Defense Analysts, Training Officers |

| Non-profit and Community Engagement | 40 | Program Directors, Community Leaders |

The Global Serious Games Market is valued at approximately USD 11.7 billion, reflecting significant growth driven by the adoption of gamification in education, healthcare, and corporate training sectors.