Region:Global

Author(s):Dev

Product Code:KRAC0394

Pages:96

Published On:August 2025

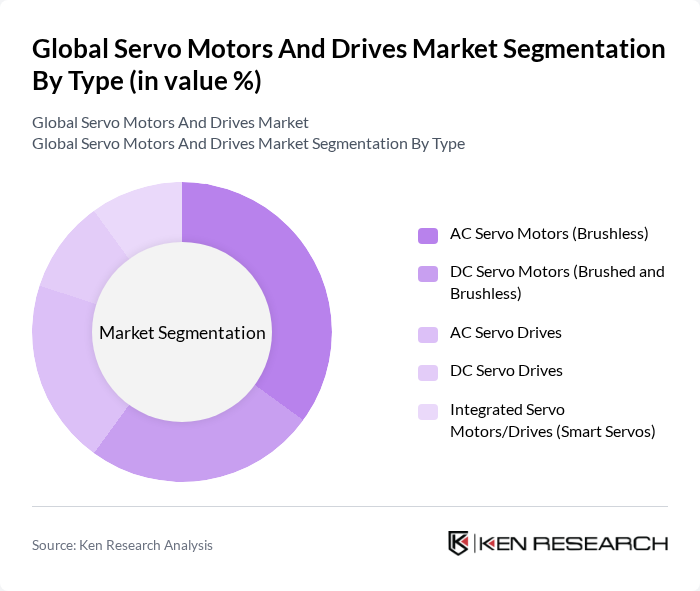

By Type:The servo motors and drives market can be segmented into various types, including AC Servo Motors (Brushless), DC Servo Motors (Brushed and Brushless), AC Servo Drives, DC Servo Drives, and Integrated Servo Motors/Drives (Smart Servos). Among these, AC Servo Motors (Brushless) are gaining traction due to their high efficiency and reliability, making them suitable for a wide range of applications. The demand for Integrated Servo Motors/Drives is also increasing as they offer compact solutions with enhanced performance.

By End-User:The end-user segmentation of the servo motors and drives market includes Automotive and EV, Semiconductors & Electronics, Food & Beverage and Packaging, Industrial Machinery and Machine Tools, Healthcare, Pharma & Medical Devices, Aerospace & Defense, Logistics, Warehousing & AGVs/AMRs, and Others. The Automotive and EV sector is a significant contributor to market growth, driven by the increasing demand for electric vehicles and automation in manufacturing processes.

The Global Servo Motors and Drives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Mitsubishi Electric Corporation, Rockwell Automation, Inc., Schneider Electric SE, Yaskawa Electric Corporation, ABB Ltd., FANUC Corporation, Omron Corporation, Bosch Rexroth AG, Delta Electronics, Inc., Parker Hannifin Corporation, Kollmorgen (Altra Industrial Motion), Panasonic Corporation, B&R Industrial Automation GmbH (ABB Group), Lenze SE, Beckhoff Automation GmbH & Co. KG, Sanyo Denki Co., Ltd., Nidec Corporation (Nidec Servo), Fuji Electric Co., Ltd., Schneider Electric Motion USA (formerly Applied Motion Products) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the servo motors and drives market appears promising, driven by the increasing integration of IoT technologies and the shift towards smart manufacturing. As industries embrace digital transformation, the demand for connected servo systems that enhance operational efficiency and data analytics capabilities will rise. Furthermore, government initiatives aimed at promoting automation and energy efficiency will likely provide additional support, fostering innovation and investment in this sector, ultimately leading to sustainable growth.

| Segment | Sub-Segments |

|---|---|

| By Type | AC Servo Motors (Brushless) DC Servo Motors (Brushed and Brushless) AC Servo Drives DC Servo Drives Integrated Servo Motors/Drives (Smart Servos) |

| By End-User | Automotive and EV Semiconductors & Electronics Food & Beverage and Packaging Industrial Machinery and Machine Tools Healthcare, Pharma & Medical Devices Aerospace & Defense Logistics, Warehousing & AGVs/AMRs Others |

| By Application | Robotics and Cobots CNC Machining and Motion Control Packaging, Labeling & Print Converting Material Handling, Conveying & Pick-and-Place Winding, Extrusion & Textile Machinery HVAC, Pumps & Compressors Others |

| By Distribution Channel | Direct (OEM/End-User) Sales Authorized Distributors & System Integrators Online (E-commerce/Marketplace) Retail/Trade Counters Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Component | Servo Motors Servo Drives/Amplifiers Motion Controllers (Standalone & PLC-based) Feedback Devices (Encoders/Resolvers) Cables, Gearboxes & Accessories |

| By Pricing Strategy | Premium (High-Performance/Industry-Grade) Mid-Tier (Competitive/Value) Entry-Level (Cost-Optimized) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Automation Applications | 120 | Automation Engineers, Production Managers |

| Aerospace and Defense Sector | 80 | Project Managers, Systems Engineers |

| Robotics and Mechatronics | 70 | Robotics Engineers, R&D Managers |

| Automotive Manufacturing | 100 | Manufacturing Engineers, Quality Control Managers |

| Consumer Electronics Production | 60 | Product Development Managers, Supply Chain Analysts |

The Global Servo Motors and Drives Market is valued at approximately USD 13 billion, driven by increasing automation, technological advancements, and the demand for energy-efficient solutions across various industries.