Region:Global

Author(s):Shubham

Product Code:KRAA1764

Pages:89

Published On:August 2025

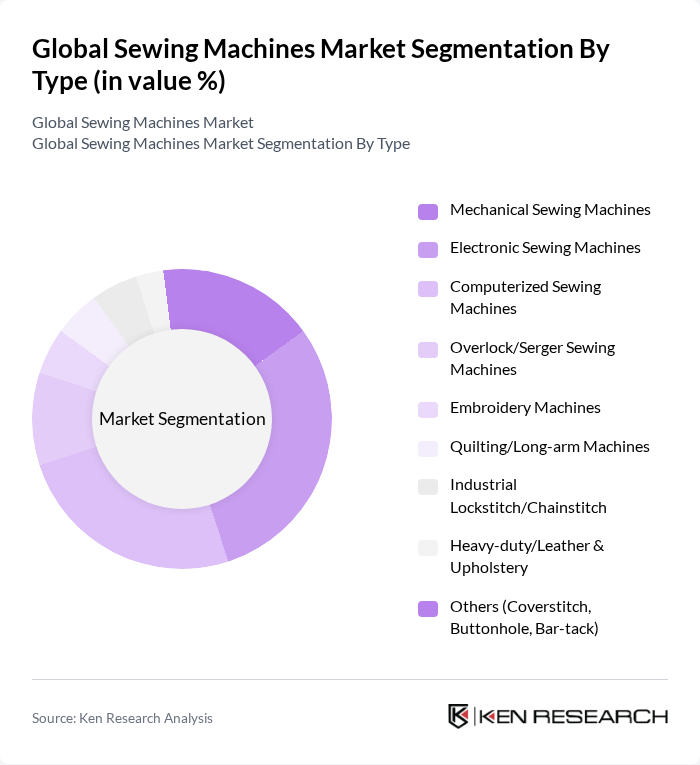

By Type:The sewing machines market is segmented into various types, including Mechanical Sewing Machines, Electronic Sewing Machines, Computerized Sewing Machines, Overlock/Serger Sewing Machines, Embroidery Machines, Quilting/Long-arm Machines, Industrial Lockstitch/Chainstitch, Heavy-duty/Leather & Upholstery, and Others (Coverstitch, Buttonhole, Bar-tack). Electronic and computerized machines are gaining traction due to user-friendly interfaces, programmable stitches, and connectivity features that support precision and automation for both hobbyists and professionals; industrial classes (lockstitch/chainstitch, overlock/coverstitch) continue to expand with apparel and technical textile demand.

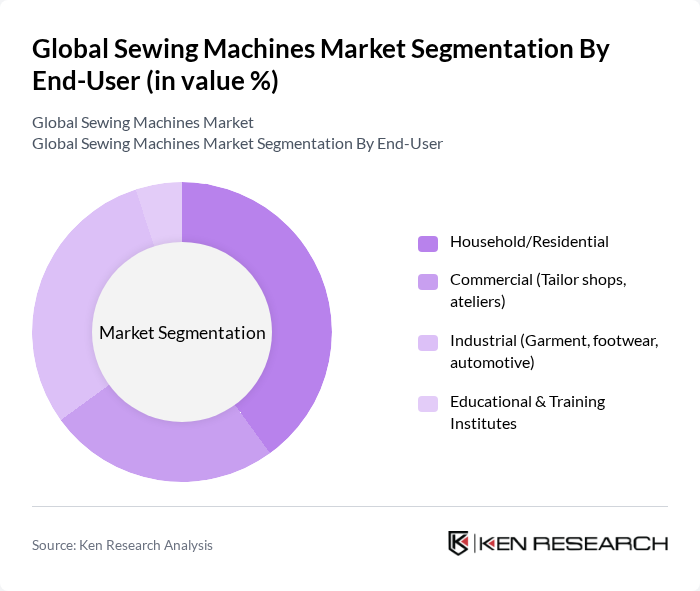

By End-User:The market is segmented by end-user into Household/Residential, Commercial (Tailor shops, ateliers), Industrial (Garment, footwear, automotive), and Educational & Training Institutes. Household/Residential demand benefits from DIY, quilting, repair-and-reuse trends, and e-commerce distribution; the Industrial segment remains robust on the back of apparel manufacturing, furniture/upholstery, automotive interiors, and technical textiles requiring high-speed, durable, and often computerized machines.

The Global Sewing Machines Market is characterized by a dynamic mix of regional and international players. Leading participants such as Brother Industries, Ltd., Janome Sewing Machine Co., Ltd., JUKI Corporation, SVP Worldwide (Singer, Husqvarna Viking, PFAFF), BERNINA International AG, Pegasus Sewing Machine Mfg. Co., Ltd., Jack Sewing Machine Co., Ltd., Zoje Sewing Machine Co., Ltd., Typical (China Typical Sewing Machine Co., Ltd.), Merrow Sewing Machine Company, Durkopp Adler GmbH, Shanggong Group Co., Ltd. (including Dürkopp Adler, Pfaff Industrial), Consew (Consolidated Sewing Machine Corp.), Tacony Corporation (Baby Lock), Toyota Industries Corporation (AISIN Group heritage) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sewing machine market appears promising, driven by technological advancements and a growing interest in sustainable practices. As consumers increasingly prioritize eco-friendly products, manufacturers are likely to innovate in creating energy-efficient machines. Additionally, the rise of online platforms for sewing education and community engagement will further stimulate demand. The integration of smart technology will continue to enhance user experience, making sewing more accessible and appealing to a broader audience.

| Segment | Sub-Segments |

|---|---|

| By Type | Mechanical Sewing Machines Electronic Sewing Machines Computerized Sewing Machines Overlock/Serger Sewing Machines Embroidery Machines Quilting/Long?arm Machines Industrial Lockstitch/Chainstitch Heavy?duty/Leather & Upholstery Others (Coverstitch, Buttonhole, Bar?tack) |

| By End-User | Household/Residential Commercial (Tailor shops, ateliers) Industrial (Garment, footwear, automotive) Educational & Training Institutes |

| By Application | Apparel & Fashion Home Textiles & Furnishings Technical Textiles (automotive, medical, PPE) Leather Goods & Upholstery Crafts, Quilting & DIY |

| By Distribution Channel | Offline Retail (brand stores, dealers) Online Retail & Marketplaces Direct/Institutional Sales |

| By Price Range | Entry/Budget Mid-Range Premium/Prosumer Industrial?grade |

| By Brand Ownership | Global Brands Regional/Local Brands Private Labels |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Sewing Machines | 120 | Manufacturing Managers, Production Supervisors |

| Domestic Sewing Machines | 100 | Retail Store Owners, Home Sewing Enthusiasts |

| Sewing Machine Accessories | 80 | Product Buyers, Merchandisers |

| Repair and Maintenance Services | 60 | Service Technicians, Workshop Owners |

| Emerging Markets for Sewing Machines | 90 | Market Analysts, Regional Sales Managers |

The Global Sewing Machines Market is valued at approximately USD 5.6 billion, reflecting a significant growth trend driven by increasing demand in both household and industrial applications, as well as the rise of computerized and automated systems.