Region:Global

Author(s):Dev

Product Code:KRAC0370

Pages:98

Published On:August 2025

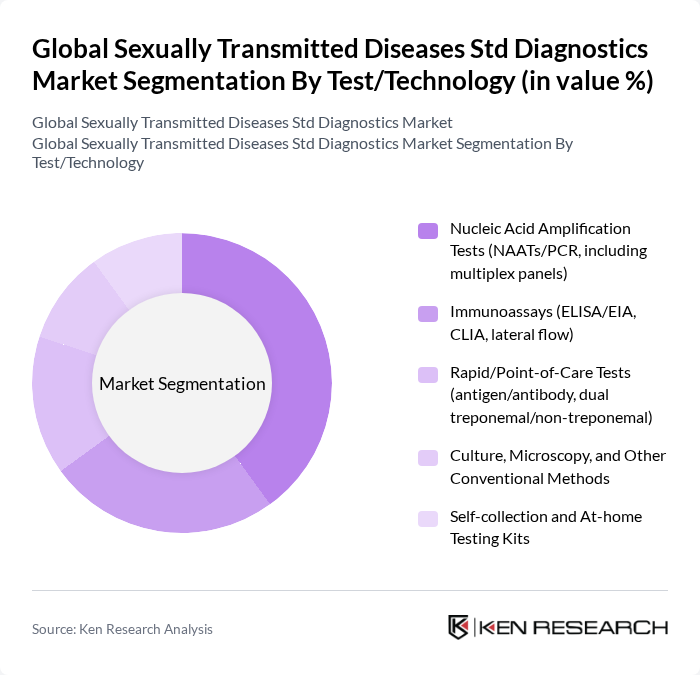

By Test/Technology:The STD diagnostics market is segmented by various testing technologies, each catering to different diagnostic needs. The leading sub-segment is Nucleic Acid Amplification Tests (NAATs/PCR), which are favored for their high sensitivity and specificity in detecting CT/NG, trichomonas, Mycoplasma genitalium, and other pathogens. Immunoassays, including ELISA and rapid tests, are widely used for HIV, syphilis, and HSV due to ease of use and faster turnaround, especially at point-of-care. The market is witnessing a shift towards self-collection and at-home testing kits, supported by telehealth integration and consumer demand for privacy and convenience .

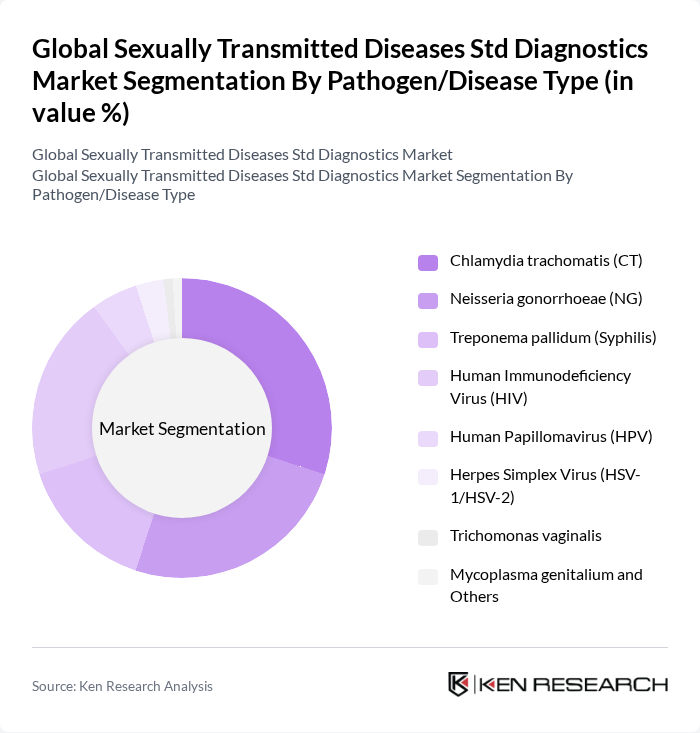

By Pathogen/Disease Type:The market is also segmented by the type of pathogens causing STDs. The most prevalent pathogens include Chlamydia trachomatis, Neisseria gonorrhoeae, and Treponema pallidum (syphilis). Human Immunodeficiency Virus (HIV) testing remains critical due to its global impact. The increasing awareness and education about these diseases are driving the demand for testing, particularly among high-risk populations .

The Global Sexually Transmitted Diseases Std Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Hologic, Inc., Cepheid (Danaher Corporation), Becton, Dickinson and Company (BD), Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., QuidelOrtho Corporation, GenMark Diagnostics, Inc. (a Roche company), OraSure Technologies, Inc., Alere Inc. (now part of Abbott Laboratories), MedMira Inc., Chembio Diagnostics, Inc., bioMérieux SA, Seegene Inc., Qiagen N.V., Trinity Biotech plc, Trinity Biotech’s subsidiary: Medusa Scientific Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of STD diagnostics is poised for transformation, driven by technological advancements and changing healthcare delivery models. The integration of telemedicine and remote testing solutions is expected to enhance accessibility, particularly in underserved regions. Additionally, the focus on personalized medicine will likely lead to tailored diagnostic approaches, improving patient outcomes. As public awareness continues to grow, the market is set to evolve, fostering innovation and collaboration among stakeholders to address the ongoing challenges in STD management.

| Segment | Sub-Segments |

|---|---|

| By Test/Technology | Nucleic Acid Amplification Tests (NAATs/PCR, including multiplex panels) Immunoassays (ELISA/EIA, CLIA, lateral flow) Rapid/Point-of-Care Tests (antigen/antibody, dual treponemal/non-treponemal) Culture, Microscopy, and Other Conventional Methods Self-collection and At-home Testing Kits |

| By Pathogen/Disease Type | Chlamydia trachomatis (CT) Neisseria gonorrhoeae (NG) Treponema pallidum (Syphilis) Human Immunodeficiency Virus (HIV) Human Papillomavirus (HPV) Herpes Simplex Virus (HSV-1/HSV-2) Trichomonas vaginalis Mycoplasma genitalium and Others |

| By Sample Type | Urine Genital/Anorectal/Throat Swabs Blood/Serum/Plasma Self-collected Samples (e.g., vaginal swabs, dried blood spots) Others |

| By Testing Location | Central/Reference Laboratories Hospital and Clinic-based Labs Point-of-Care Settings At-home/Remote Testing Public Health and Screening Programs |

| By End-User | Hospitals and Clinics Diagnostic Laboratories Public Health Agencies and NGOs Home Users (Direct-to-Consumer) Others |

| By Distribution Channel | Direct/Tender Sales (institutional and government) Distributors Online/D2C Platforms Retail Pharmacies Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 140 | Doctors, Nurses, Public Health Officials |

| Diagnostic Laboratories | 100 | Lab Technicians, Laboratory Managers |

| Pharmaceutical Distributors | 80 | Sales Representatives, Distribution Managers |

| Public Health Organizations | 70 | Policy Makers, Health Program Coordinators |

| Patient Advocacy Groups | 60 | Advocacy Leaders, Community Health Workers |

The Global STD Diagnostics Market is valued at approximately USD 10.6 billion, reflecting growth driven by increased infection rates, broader screening programs, and advancements in molecular diagnostics and rapid testing technologies.