Region:Global

Author(s):Rebecca

Product Code:KRAD2825

Pages:93

Published On:November 2025

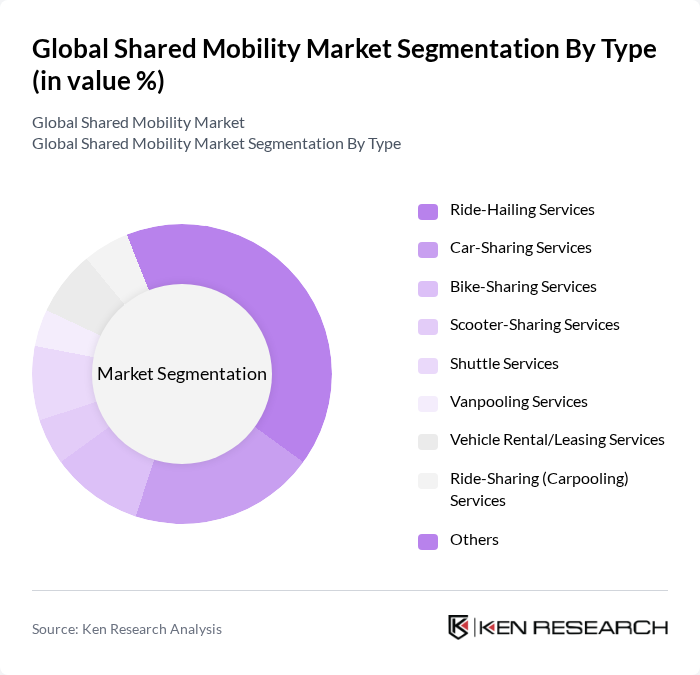

By Type:The shared mobility market is segmented into ride-hailing services, car-sharing services, bike-sharing services, scooter-sharing services, shuttle services, vanpooling services, vehicle rental/leasing services, ride-sharing (carpooling) services, and others. Each segment addresses distinct consumer needs, with ride-hailing and car-sharing leading due to their flexibility and integration with digital platforms. Bike- and scooter-sharing are gaining traction in urban centers, driven by micro-mobility trends and environmental policies .

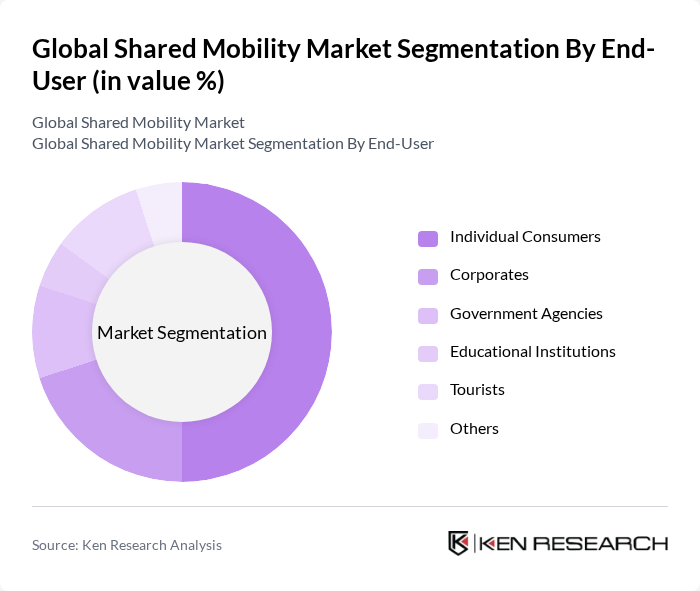

By End-User:The end-user segmentation includes individual consumers, corporates, government agencies, educational institutions, tourists, and others. Individual consumers account for the largest share, driven by urban commuters and young professionals. Corporates and government agencies increasingly adopt shared mobility for employee and fleet management, while tourists and educational institutions contribute to seasonal and location-specific demand .

The Global Shared Mobility Market is characterized by a dynamic mix of regional and international players. Leading participants such as Uber Technologies, Inc., Lyft, Inc., Didi Chuxing Technology Co., Grab Holdings Inc., ANI Technologies Pvt. Ltd. (Ola Cabs), Zipcar, Inc., SHARE NOW GmbH (formerly Car2Go and DriveNow), BlaBlaCar (Comuto SA), Turo Inc., Getaround, Inc., Bird Rides, Inc., Neutron Holdings, Inc. (Lime), Via Transportation, Inc., GoTo Global Mobility Ltd. (formerly ReachNow), SHARE NOW GmbH, Gojek (PT Aplikasi Karya Anak Bangsa), Bolt Technology OÜ, Yandex.Taxi, Free2Move (Stellantis), and Careem Networks FZ LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of shared mobility is poised for significant transformation, driven by technological innovations and changing consumer behaviors. As urbanization continues, cities will increasingly adopt Mobility-as-a-Service (MaaS) models, integrating various transport modes into seamless user experiences. Additionally, the push for sustainability will accelerate the adoption of electric and autonomous vehicles, reshaping the landscape of shared mobility. Partnerships with local governments will also play a crucial role in developing infrastructure that supports these advancements, ensuring a more efficient and eco-friendly transportation ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Ride-Hailing Services Car-Sharing Services Bike-Sharing Services Scooter-Sharing Services Shuttle Services Vanpooling Services Vehicle Rental/Leasing Services Ride-Sharing (Carpooling) Services Others |

| By End-User | Individual Consumers Corporates Government Agencies Educational Institutions Tourists Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Mobile Applications GPS and Navigation Systems Payment Processing Solutions Fleet Management Software IoT Connectivity Others |

| By Application | Urban Mobility Last-Mile Connectivity Corporate Transportation Event Transportation Airport Transfers Others |

| By Investment Source | Private Investments Venture Capital Government Funding Public-Private Partnerships Others |

| By Policy Support | Subsidies for Shared Mobility Services Tax Incentives for Electric Vehicles Grants for Infrastructure Development Regulatory Mandates for Emission Reduction Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ride-Sharing Services | 100 | Operations Managers, Marketing Directors |

| Bike-Sharing Programs | 60 | City Planners, Program Coordinators |

| Car-Sharing Platforms | 50 | Fleet Managers, Customer Experience Leaders |

| Public-Private Mobility Partnerships | 40 | Policy Makers, Transportation Analysts |

| Shared Mobility Technology Providers | 45 | Product Managers, Technology Officers |

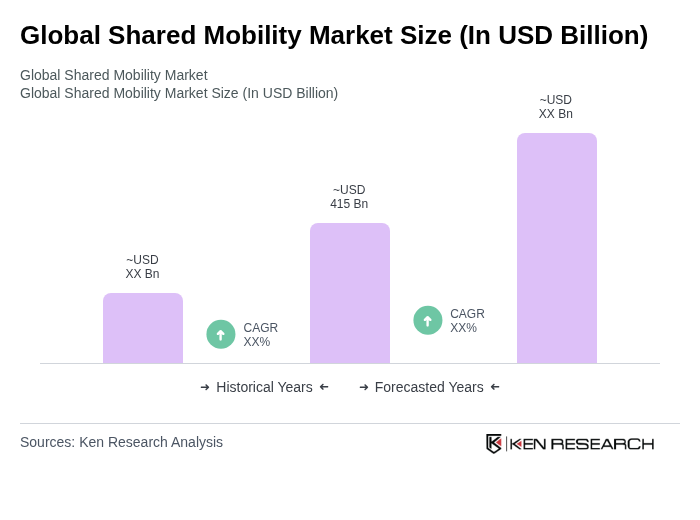

The Global Shared Mobility Market is valued at approximately USD 415 billion, reflecting a significant growth trend driven by urbanization, demand for cost-effective transportation, and environmental sustainability awareness.