Region:Global

Author(s):Dev

Product Code:KRAA1496

Pages:96

Published On:August 2025

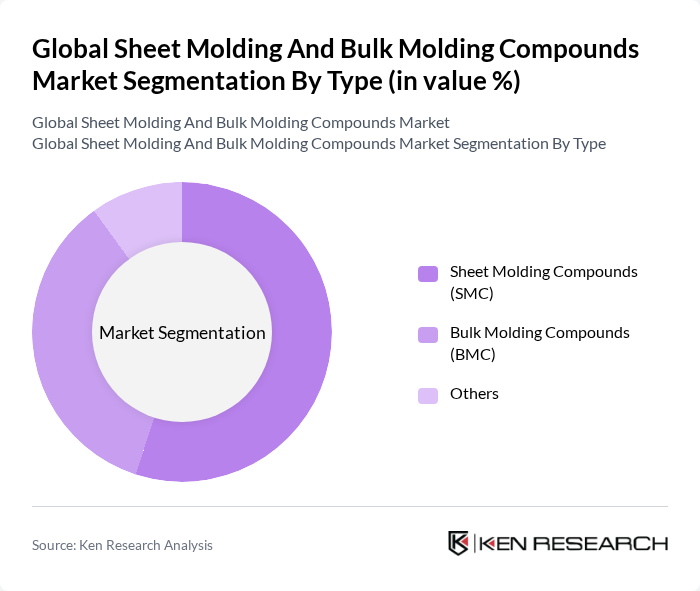

By Type:The market is segmented into three main types: Sheet Molding Compounds (SMC), Bulk Molding Compounds (BMC), and Others. Among these, SMC is the leading subsegment due to its superior mechanical properties, lightweight characteristics, and versatility in applications, particularly in the automotive and construction sectors. BMC is also significant, favored for its ease of processing, electrical insulation properties, and cost-effectiveness. The "Others" category includes niche products such as specialty thermoset and thermoplastic compounds tailored for specific industrial requirements.

By End-User:The end-user segmentation includes Automotive, Aerospace, Construction, Electrical & Electronics, Sanitary and Medical, and Others. The automotive sector is the dominant end-user, driven by the increasing demand for lightweight and fuel-efficient vehicles, as well as the adoption of electric vehicles which require advanced composite materials for battery enclosures and structural components. Aerospace follows closely, as the industry seeks advanced materials to enhance performance and reduce weight. The construction sector is also growing, with a rising need for durable and sustainable building materials, while electrical & electronics applications benefit from the compounds' insulation and flame-retardant properties.

The Global Sheet Molding And Bulk Molding Compounds Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, DuPont de Nemours, Inc., Huntsman Corporation, Sika AG, Ashland Global Holdings Inc., Continental Structural Plastics (CSP), AOC, LLC, Polynt-Reichhold Group, Mitsubishi Chemical Corporation, Wacker Chemie AG, Hexion Inc., Solvay S.A., Momentive Performance Materials Inc., Jushi Group Co., Ltd., TPR Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sheet molding and bulk molding compounds market appears promising, driven by technological advancements and increasing demand across various sectors. The automotive and aerospace industries are expected to continue their shift towards lightweight materials, enhancing fuel efficiency and performance. Additionally, the construction sector's focus on sustainable practices will likely lead to greater adoption of these compounds. As manufacturers innovate and adapt to market needs, the industry is poised for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Sheet Molding Compounds (SMC) Bulk Molding Compounds (BMC) Others |

| By End-User | Automotive Aerospace Construction Electrical & Electronics Sanitary and Medical Others |

| By Application | Interior Components Exterior Components Structural Components Panels Housings Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Product Form | Prepregs Sheets Molds Pellets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 120 | Product Engineers, Procurement Managers |

| Aerospace Sector Usage | 90 | Quality Assurance Managers, R&D Directors |

| Construction Industry Demand | 60 | Project Managers, Material Suppliers |

| Consumer Goods Manufacturing | 50 | Operations Managers, Product Development Leads |

| Market Trends and Innovations | 70 | Industry Analysts, Market Strategists |

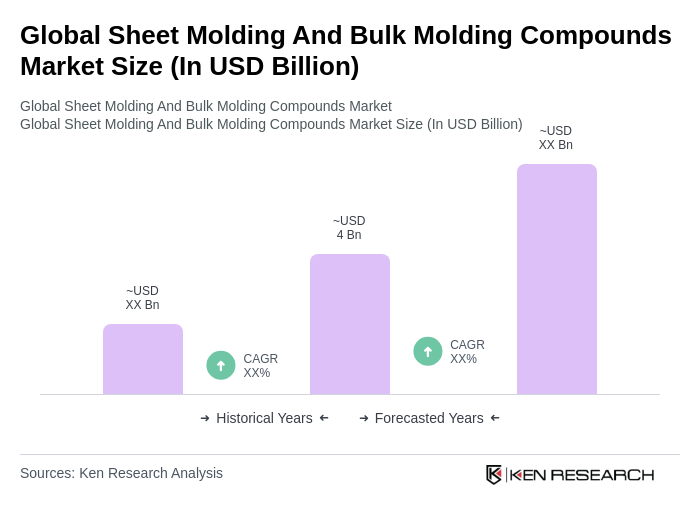

The Global Sheet Molding and Bulk Molding Compounds Market is valued at approximately USD 4 billion, driven by the increasing demand for lightweight materials in industries such as automotive and aerospace, which prioritize fuel efficiency and performance.