Region:Global

Author(s):Shubham

Product Code:KRAC0804

Pages:95

Published On:August 2025

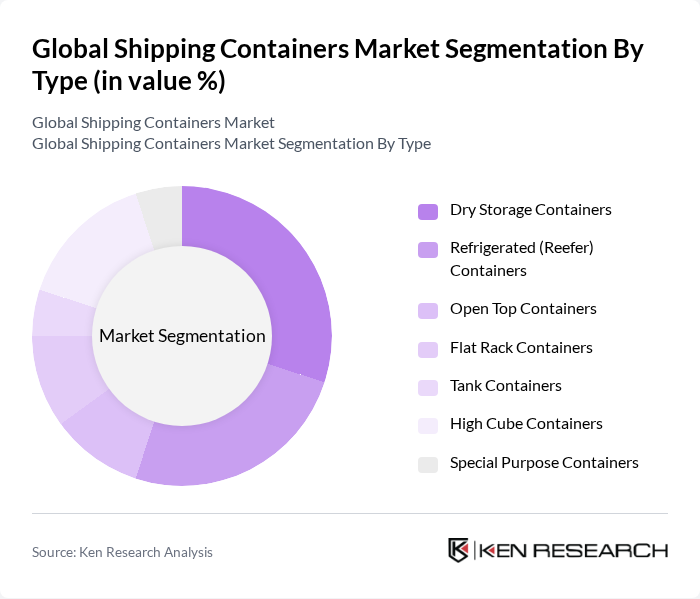

By Type:The shipping containers market is segmented into various types, including Dry Storage Containers, Refrigerated (Reefer) Containers, Open Top Containers, Flat Rack Containers, Tank Containers, High Cube Containers, and Special Purpose Containers. Each type serves distinct purposes, catering to different cargo requirements and industry needs. Dry storage containers remain the most widely used, while the demand for refrigerated and specialized containers is rising due to growth in perishable goods and hazardous material transport.

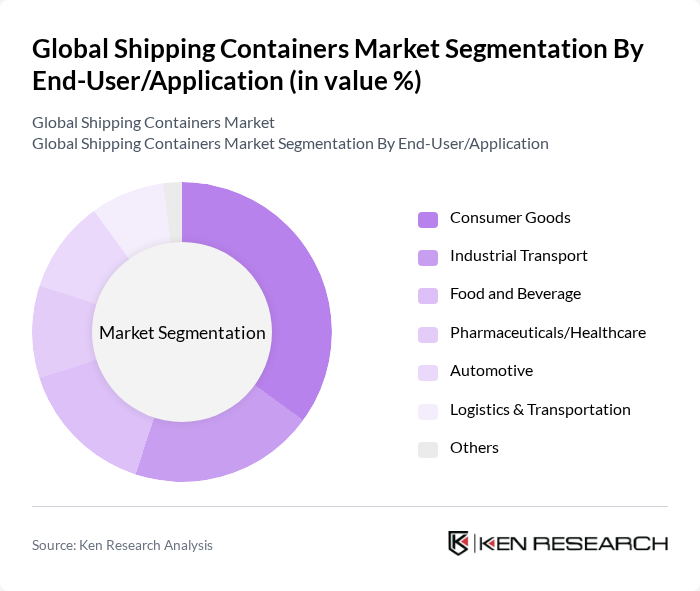

By End-User/Application:The market is also segmented by end-user applications, which include Consumer Goods, Industrial Transport, Food and Beverage, Pharmaceuticals/Healthcare, Automotive, Logistics & Transportation, and Others. Each application has unique requirements that influence the type of containers used. The consumer goods and industrial transport sectors are the largest users, while the food and beverage and pharmaceutical segments are driving demand for temperature-controlled and specialized containers.

The Global Shipping Containers Market is characterized by a dynamic mix of regional and international players. Leading participants such as China International Marine Containers (CIMC), Dong Fang International Container (DFIC), CXIC Group Containers Company Limited, Maersk Container Industry, Singamas Container Holdings Limited, Triton International Limited, Textainer Group Holdings Limited, Florens Container Services Co. Ltd., Seaco Global Ltd., Beacon Intermodal Leasing LLC, CAI International, Inc., SeaCube Container Leasing Ltd., Maersk Line, MSC Mediterranean Shipping Company, CMA CGM Group, Hapag-Lloyd AG, Evergreen Marine Corporation, COSCO Shipping, Yang Ming Marine Transport Corporation, ZIM Integrated Shipping Services, Ocean Network Express (ONE), Pacific International Lines (PIL), Wan Hai Lines, Seaboard Marine, Transworld Group, TCDD Ta??mac?l?k A.?. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the shipping containers market appears promising, driven by ongoing digitalization and sustainability initiatives. As companies increasingly adopt advanced technologies, such as blockchain and IoT, operational efficiencies will improve, reducing costs and enhancing transparency. Furthermore, the focus on eco-friendly practices will likely lead to innovations in container design and materials, aligning with global sustainability goals and attracting environmentally conscious consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Dry Storage Containers Refrigerated (Reefer) Containers Open Top Containers Flat Rack Containers Tank Containers High Cube Containers Special Purpose Containers |

| By End-User/Application | Consumer Goods Industrial Transport Food and Beverage Pharmaceuticals/Healthcare Automotive Logistics & Transportation Others |

| By Sales Channel | Direct Sales Distributors Online Sales Auctions Others |

| By Distribution Mode | Road Transport Rail Transport Sea Transport Air Transport Others |

| By Container Condition | New Containers Used Containers Refurbished Containers |

| By Container Size | foot Containers foot Containers foot Containers Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Global Shipping Lines | 100 | Operations Managers, Fleet Directors |

| Freight Forwarding Companies | 80 | Logistics Coordinators, Business Development Managers |

| Container Manufacturing Firms | 60 | Production Managers, Sales Executives |

| Port Authorities | 50 | Port Operations Managers, Regulatory Compliance Officers |

| Shipping Industry Analysts | 40 | Market Researchers, Economic Analysts |

The Global Shipping Containers Market is valued at approximately USD 10.6 billion, driven by increasing international trade, e-commerce growth, and the need for efficient logistics solutions. This valuation is based on a five-year historical analysis of market trends.