Region:Global

Author(s):Shubham

Product Code:KRAA2252

Pages:100

Published On:August 2025

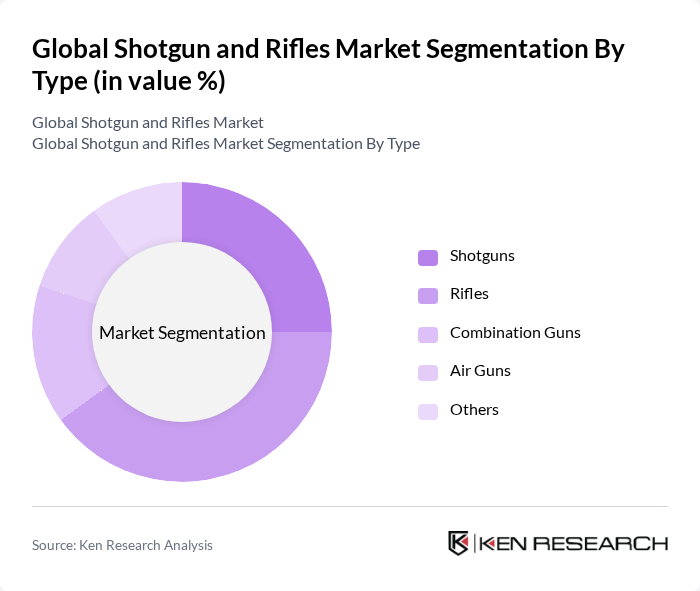

By Type:The market is segmented into Shotguns, Rifles, Combination Guns, Air Guns, and Others. Rifles are the leading sub-segment, driven by their popularity in civilian hunting, sports shooting, and military applications. Their versatility, accuracy, and adaptability to various calibers make rifles a preferred choice for target shooting, hunting, and tactical uses. Shotguns maintain a significant share, especially in hunting and law enforcement, due to their effectiveness in close-range scenarios and versatility in ammunition types. Air Guns are gaining traction for recreational shooting and entry-level sports, supported by growing interest in competitive shooting among youth and broader demographic participation .

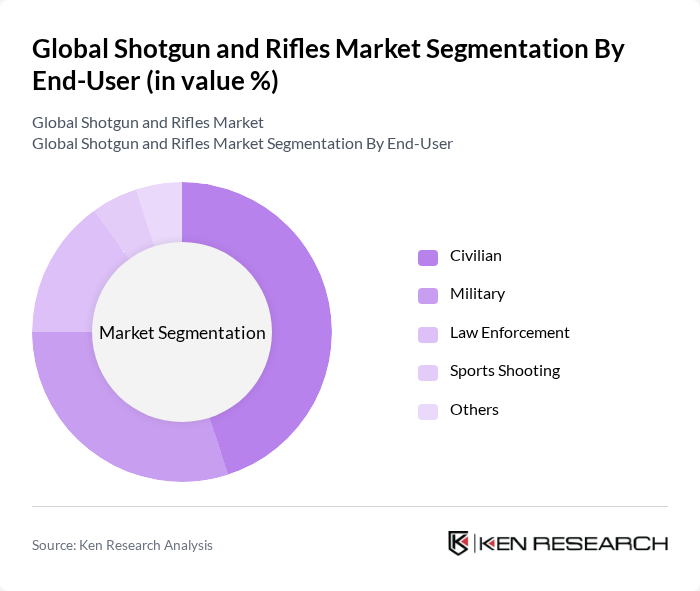

By End-User:The market is categorized into Civilian, Military, Law Enforcement, Sports Shooting, and Others. The Civilian segment is the largest, fueled by rising interest in hunting, recreational shooting, and personal security. Military applications follow, with ongoing investments in advanced firearms for defense modernization and tactical operations. Law enforcement agencies require reliable and adaptable firearms for public safety and tactical response. Sports shooting is a niche but expanding segment, supported by competitive leagues and increased participation in shooting sports globally .

The Global Shotgun and Rifles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Remington Arms Company, LLC, Beretta Holding S.p.A., Sturm, Ruger & Co., Inc., Smith & Wesson Brands, Inc., Browning Arms Company, Winchester Repeating Arms Company, Savage Arms, Inc., FN Herstal S.A., Heckler & Koch GmbH, ?eská zbrojovka Uherský Brod (CZUB), Tikka (Sako Ltd.), O.F. Mossberg & Sons, Inc., Israel Weapon Industries (IWI), SIG Sauer, Inc., Taurus Holdings, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the shotgun and rifles market appears promising, driven by evolving consumer preferences and technological advancements. As the interest in shooting sports and personal protection continues to rise, manufacturers are likely to focus on innovation and customization. Additionally, the integration of digital technologies in firearms is expected to enhance user experience and safety. However, navigating regulatory challenges and public perception will be crucial for sustained growth in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Shotguns Rifles Combination Guns Air Guns Others |

| By End-User | Civilian Military Law Enforcement Sports Shooting Others |

| By Distribution Channel | Online Retail Specialty Stores Department Stores Direct Sales Others |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Brand | Established Brands Emerging Brands Private Labels Others |

| By Material | Steel Aluminum Polymer Wood Others |

| By Usage | Hunting Target Shooting Self-Defense Military Training Others |

| By Range | Short Range Medium Range Long Range |

| By Weapon Loading Mechanism | Manual Semi-Automatic/Automatic |

| By Region | North America (U.S., Canada) Europe (Germany, UK, France, Russia, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Rest of Asia-Pacific) Latin America (Brazil, Mexico, Rest of Latin America) Middle East & Africa (UAE, Saudi Arabia, Egypt, Rest of MEA) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Shotguns | 100 | Store Managers, Sales Representatives |

| Rifle Manufacturing Insights | 80 | Production Managers, Quality Control Officers |

| Consumer Preferences in Shooting Sports | 120 | Hunting Enthusiasts, Competitive Shooters |

| Regulatory Impact on Firearms Sales | 40 | Legal Advisors, Compliance Officers |

| Market Trends in Sporting Goods Retail | 60 | Market Analysts, Retail Buyers |

The Global Shotgun and Rifles Market is valued at approximately USD 7.3 billion, reflecting the combined size of the rifles and shotguns segments, with rifles holding a larger share due to their popularity in hunting and sports shooting.