Region:Global

Author(s):Rebecca

Product Code:KRAA1387

Pages:82

Published On:August 2025

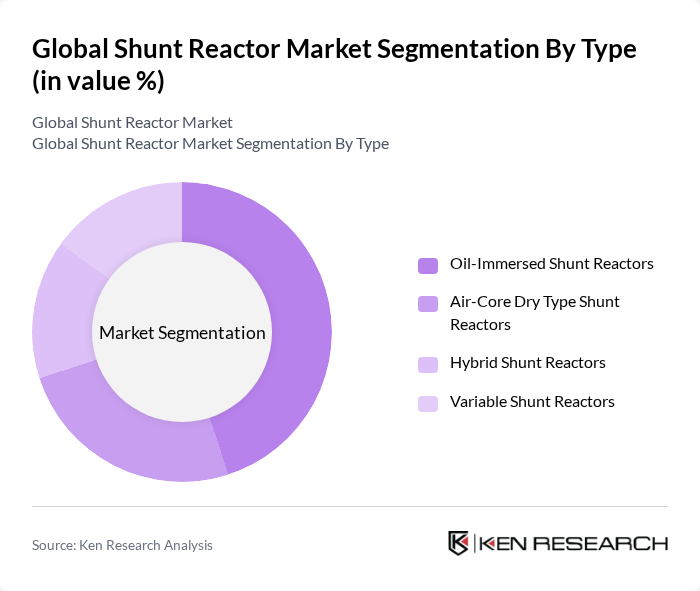

By Type:The market is segmented into four main types: Oil-Immersed Shunt Reactors, Air-Core Dry Type Shunt Reactors, Hybrid Shunt Reactors, and Variable Shunt Reactors. Among these, Oil-Immersed Shunt Reactors dominate the market due to their high efficiency and reliability in high voltage applications. They are widely used in electrical utilities for voltage regulation and reactive power compensation, making them a preferred choice for many utility companies. The increasing demand for stable and efficient power systems further solidifies their market position.

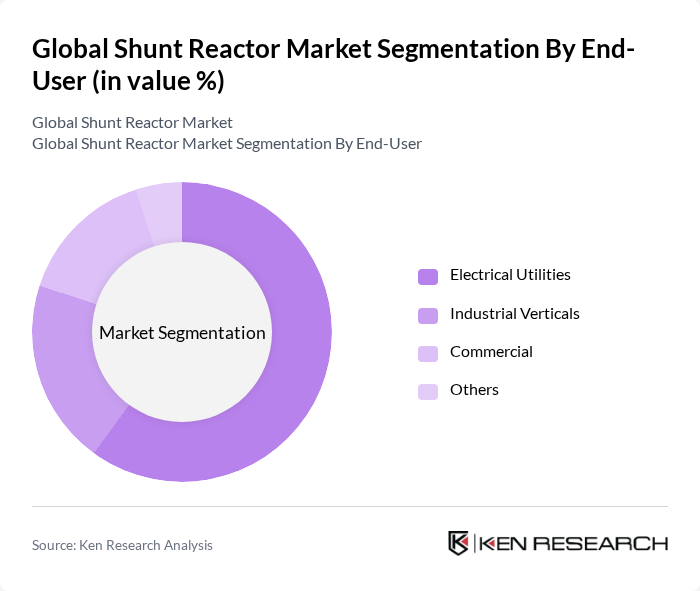

By End-User:The end-user segmentation includes Electrical Utilities, Industrial Verticals, Commercial, and Others. Electrical Utilities are the leading end-users, driven by the need for reliable power supply and grid stability. The increasing investments in infrastructure and the growing focus on renewable energy integration have led to a surge in demand for shunt reactors among utility companies. This trend is expected to continue as utilities seek to enhance their operational efficiency and meet regulatory requirements.

The Global Shunt Reactor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Energy AG, General Electric Company (GE Grid Solutions), Hitachi Energy Ltd., Schneider Electric SE, Eaton Corporation plc, Mitsubishi Electric Corporation, Toshiba Energy Systems & Solutions Corporation, Nissin Electric Co., Ltd., CG Power and Industrial Solutions Limited, Bharat Heavy Electricals Limited (BHEL), Fuji Electric Co., Ltd., Hyosung Heavy Industries Corporation, TBEA Co., Ltd., SGB-SMIT Group, S&C Electric Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the shunt reactor market appears promising, driven by the increasing need for grid stability and the integration of renewable energy sources. As global electricity consumption rises, utilities are expected to invest more in advanced technologies. Additionally, the shift towards smart grid solutions will likely enhance the demand for shunt reactors, as they are essential for managing the complexities of modern energy systems. The focus on sustainability will further propel innovation in this sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Oil-Immersed Shunt Reactors Air-Core Dry Type Shunt Reactors Hybrid Shunt Reactors Variable Shunt Reactors |

| By End-User | Electrical Utilities Industrial Verticals Commercial Others |

| By Application | Transmission Systems Distribution Systems Renewable Energy Integration Electric Vehicle Infrastructure |

| By Voltage Level | High Voltage (>72.5 kV) Medium Voltage (1 kV–72.5 kV) Low Voltage (<1 kV) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Frameworks |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility Companies | 100 | Electrical Engineers, Project Managers |

| Manufacturers of Shunt Reactors | 60 | Product Development Managers, Sales Directors |

| Power Generation Sector | 50 | Procurement Specialists, Operations Managers |

| Renewable Energy Projects | 40 | Project Coordinators, Sustainability Managers |

| Electrical Engineering Consultants | 40 | Consultants, Industry Analysts |

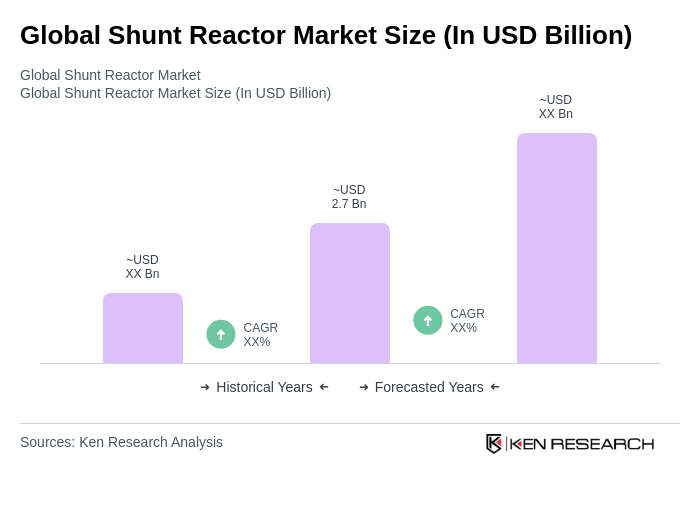

The Global Shunt Reactor Market is valued at approximately USD 2.7 billion, driven by the increasing demand for efficient power transmission and distribution systems, as well as the integration of renewable energy sources into the grid.