Region:Global

Author(s):Rebecca

Product Code:KRAA1393

Pages:98

Published On:August 2025

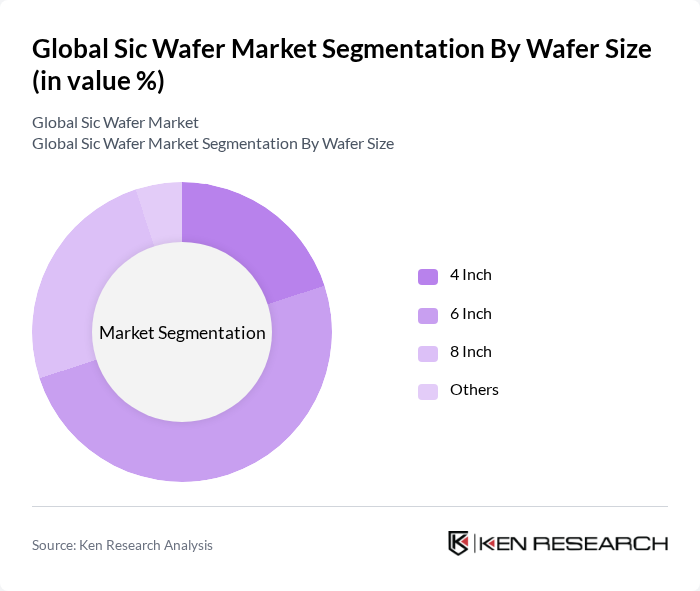

By Wafer Size:The wafer size segmentation includes 4 Inch, 6 Inch, 8 Inch, and Others. The 6 Inch wafers are currently leading the market due to their balance of cost, performance, and compatibility with existing manufacturing lines, making them suitable for a wide range of power electronics and automotive applications. The demand for 8 Inch wafers is increasing as manufacturers seek to enhance production efficiency, support higher device volumes, and reduce per-unit costs. The 4 Inch wafers, while less dominant, continue to serve niche markets and specialized device fabrication.

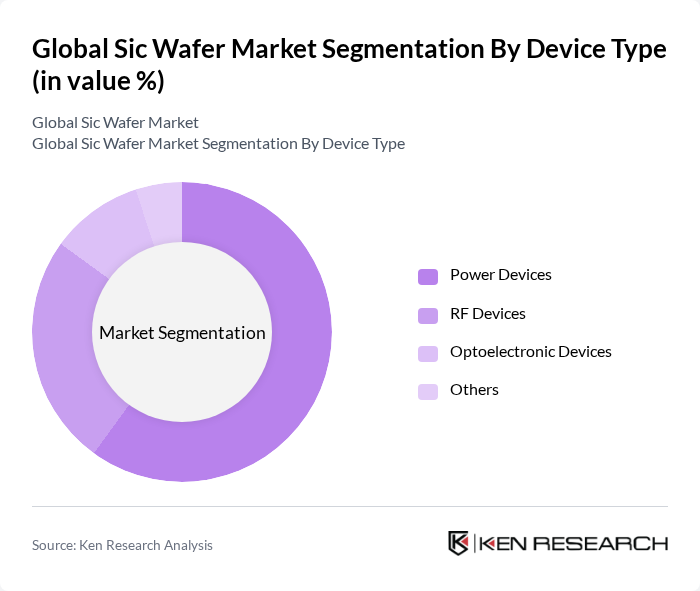

By Device Type:The device type segmentation includes Power Devices, RF Devices, Optoelectronic Devices, and Others. Power devices are the leading segment, driven by the growing demand for energy-efficient solutions in electric vehicles, renewable energy systems, and industrial automation. RF devices are gaining traction due to the global expansion of 5G and wireless communication technologies, leveraging SiC’s superior RF performance and thermal management. Optoelectronic devices serve applications in lighting, displays, and sensors, while other segments address specialized uses in aerospace and defense electronics.

The Global Sic Wafer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Wolfspeed, Inc., ROHM Co., Ltd., STMicroelectronics N.V., Infineon Technologies AG, ON Semiconductor Corporation, II-VI Incorporated (now Coherent Corp.), Mitsubishi Electric Corporation, Fuji Electric Co., Ltd., Showa Denko K.K., SK Siltron Co., Ltd., Sumitomo Electric Industries, Ltd., Norstel AB (now part of STMicroelectronics), Cree, Inc. (now Wolfspeed, Inc.), Xiamen Powerway Advanced Material Co., Ltd. (PAM-XIAMEN), SICC Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the SiC wafer market appears promising, driven by technological advancements and increasing applications across various sectors. The shift towards electric vehicles and renewable energy sources will likely accelerate demand for SiC wafers, as manufacturers seek to enhance efficiency and performance. Furthermore, ongoing innovations in wafer manufacturing processes are expected to reduce costs and improve yield, making SiC technology more accessible to a broader range of industries, thereby fostering market expansion.

| Segment | Sub-Segments |

|---|---|

| By Wafer Size | Inch Inch Inch Others |

| By Device Type | Power Devices RF Devices Optoelectronic Devices Others |

| By End-User | Automotive & Electric Vehicles (EVs) Industrial & Energy Telecom and Communications Consumer Electronics Aerospace & Defense Others |

| By Application | Electric Vehicle Powertrains Renewable Energy Systems (Solar, Wind, etc.) Data Centers & Servers Industrial Motor Drives G Base Stations Others |

| By Region | North America Europe Asia-Pacific Rest of World |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| By Technology | High-Voltage Applications High-Frequency Applications High-Temperature Applications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive SiC Wafer Applications | 100 | Product Managers, Automotive Engineers |

| Industrial Power Electronics | 70 | Operations Managers, Technical Directors |

| Consumer Electronics Integration | 60 | Design Engineers, Product Development Leads |

| Renewable Energy Systems | 50 | Project Managers, Sustainability Officers |

| Telecommunications Infrastructure | 80 | Network Engineers, Procurement Specialists |

The Global Sic Wafer Market is valued at approximately USD 690 million, driven by the increasing demand for high-performance semiconductor devices in sectors such as automotive, renewable energy, and industrial power applications.