Region:Global

Author(s):Rebecca

Product Code:KRAA2915

Pages:84

Published On:August 2025

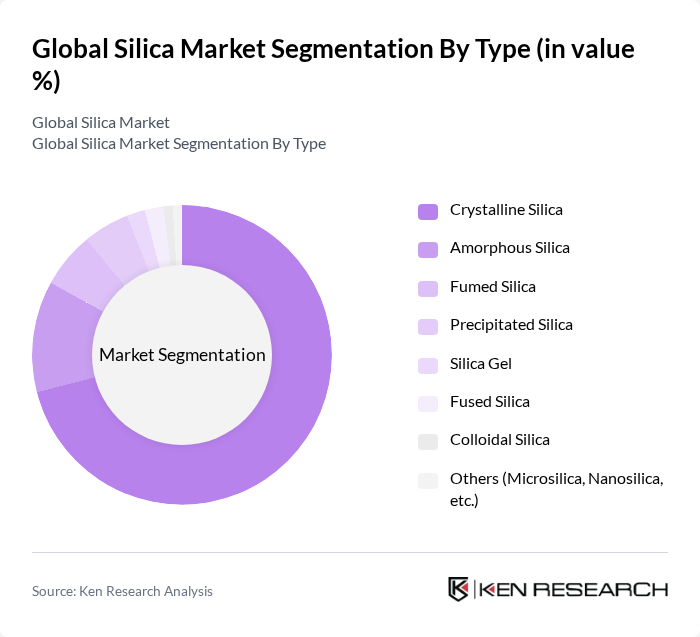

By Type:The silica market is segmented into Crystalline Silica, Amorphous Silica, Fumed Silica, Precipitated Silica, Silica Gel, Fused Silica, Colloidal Silica, and Others (Microsilica, Nanosilica, etc.). Crystalline silica dominates due to its widespread use in construction, glass, and foundry applications. Amorphous and specialty silicas (such as fumed and precipitated) are increasingly important in electronics, rubber, and personal care products, reflecting the market's diversification into high-value applications.

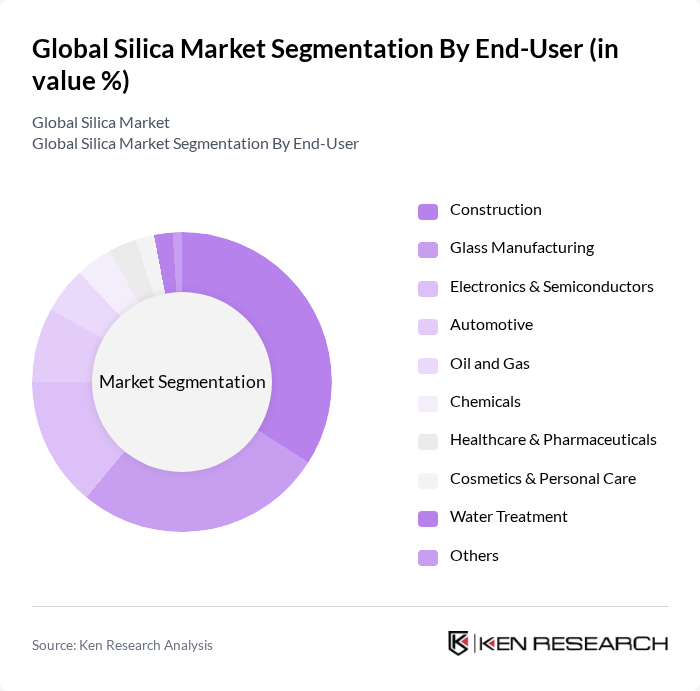

By End-User:The end-user segmentation includes Construction, Glass Manufacturing, Electronics & Semiconductors, Automotive, Oil and Gas, Chemicals, Healthcare & Pharmaceuticals, Cosmetics & Personal Care, Water Treatment, and Others. Construction and glass manufacturing remain the largest consumers, driven by infrastructure growth and demand for high-performance building materials. Electronics and automotive sectors are rapidly expanding end-uses, leveraging silica for advanced composites, semiconductors, and lightweight components.

The Global Silica Market is characterized by a dynamic mix of regional and international players. Leading participants such as Evonik Industries AG, Cabot Corporation, Wacker Chemie AG, PPG Industries, Inc., Solvay SA, Sibelco NV, Imerys S.A., Saint-Gobain S.A., Covia Holdings Corporation, U.S. Silica Holdings, Inc., Tata Chemicals Limited, Quarzwerke GmbH, Oriental Silicas Corporation, Nissan Chemical Corporation, W. R. Grace & Co. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the silica market appears promising, driven by technological advancements and a shift towards sustainable practices. Innovations in silica production techniques are expected to enhance efficiency and reduce environmental impact. Additionally, the increasing demand for high-purity silica in specialized applications, such as electronics and pharmaceuticals, will likely create new market segments. Companies that adapt to these trends and invest in sustainable practices will be well-positioned for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Crystalline Silica Amorphous Silica Fumed Silica Precipitated Silica Silica Gel Fused Silica Colloidal Silica Others (Microsilica, Nanosilica, etc.) |

| By End-User | Construction Glass Manufacturing Electronics & Semiconductors Automotive Oil and Gas Chemicals Healthcare & Pharmaceuticals Cosmetics & Personal Care Water Treatment Others |

| By Application | Coatings Adhesives & Sealants Rubber & Tire Manufacturing Plastics Paints & Inks Catalysts Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Quality Grade | Industrial Grade Food Grade Pharmaceutical Grade High Purity Grade |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Silica Usage | 100 | Project Managers, Material Procurement Officers |

| Glass Manufacturing Sector Insights | 80 | Production Managers, Quality Control Supervisors |

| Silica in Electronics Applications | 60 | R&D Engineers, Product Development Managers |

| Silica Mining Operations | 50 | Site Managers, Environmental Compliance Officers |

| Silica Market Trends and Innovations | 40 | Industry Analysts, Market Strategists |

The Global Silica Market is valued at approximately USD 40.5 billion, driven by increasing demand across various sectors such as construction, electronics, automotive, and glass manufacturing, reflecting robust infrastructure development and technological advancements.