Region:Global

Author(s):Geetanshi

Product Code:KRAB0025

Pages:95

Published On:August 2025

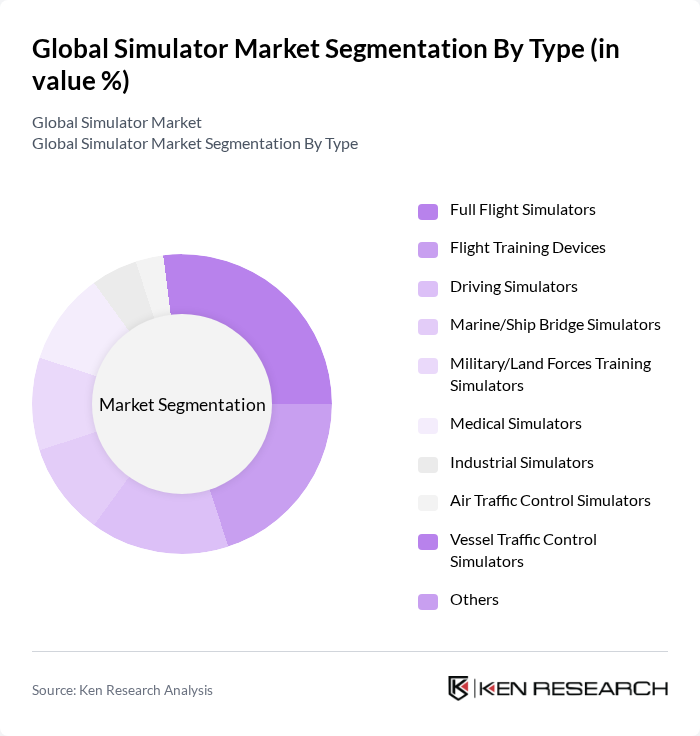

By Type:The market is segmented into various types of simulators, including Full Flight Simulators, Flight Training Devices, Driving Simulators, Marine/Ship Bridge Simulators, Military/Land Forces Training Simulators, Medical Simulators, Industrial Simulators, Air Traffic Control Simulators, Vessel Traffic Control Simulators, and Others. Each type serves distinct training needs across different industries. Full Flight Simulators and Flight Training Devices are primarily used in aviation for pilot training and certification, while Driving Simulators are essential in automotive safety and driver education. Marine/Ship Bridge Simulators and Vessel Traffic Control Simulators support maritime navigation and operational training. Military/Land Forces Training Simulators are utilized for defense readiness and tactical exercises. Medical Simulators enable healthcare professionals to practice procedures and patient care in a risk-free environment. Industrial Simulators facilitate training for complex machinery and process optimization, and Air Traffic Control Simulators are vital for airspace management and controller training.

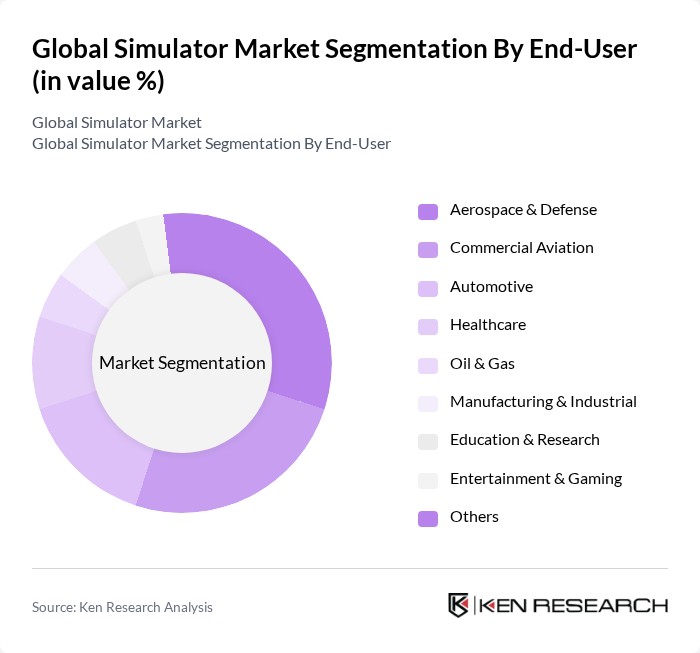

By End-User:The end-user segmentation includes Aerospace & Defense, Commercial Aviation, Automotive, Healthcare, Oil & Gas, Manufacturing & Industrial, Education & Research, Entertainment & Gaming, and Others. Each sector utilizes simulators for specific training and operational needs, contributing to the overall market growth. Aerospace & Defense and Commercial Aviation remain the largest end-users due to stringent safety requirements and regulatory compliance. Automotive and Healthcare sectors are rapidly adopting simulation technologies for skill development and operational efficiency. Oil & Gas, Manufacturing & Industrial, and Education & Research leverage simulators for process optimization and academic training, while Entertainment & Gaming is driven by immersive experiences and interactive content.

The Global Simulator Market is characterized by a dynamic mix of regional and international players. Leading participants such as CAE Inc., FlightSafety International, L3Harris Technologies, Thales Group, Collins Aerospace (Raytheon Technologies), Siemens AG, Dassault Systèmes, BAE Systems, Lockheed Martin, Northrop Grumman, The Boeing Company, Alion Science and Technology (now part of Huntington Ingalls Industries), Avidyne Corporation, ANSYS, Inc., ESI Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the simulator market appears promising, driven by continuous technological advancements and increasing demand across various sectors. As organizations seek to enhance training effectiveness, the integration of virtual and augmented reality is expected to become more prevalent. Additionally, the growing emphasis on personalized training solutions will likely lead to the development of tailored simulation experiences, catering to specific industry needs and improving overall training outcomes in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Full Flight Simulators Flight Training Devices Driving Simulators Marine/Ship Bridge Simulators Military/Land Forces Training Simulators Medical Simulators Industrial Simulators Air Traffic Control Simulators Vessel Traffic Control Simulators Others |

| By End-User | Aerospace & Defense Commercial Aviation Automotive Healthcare Oil & Gas Manufacturing & Industrial Education & Research Entertainment & Gaming Others |

| By Application | Training Research and Development Testing & Evaluation Operational Planning Entertainment Others |

| By Distribution Channel | Direct Sales Online Sales Distributors/Resellers Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Low-End Simulators Mid-Range Simulators High-End Simulators |

| By Technology | Virtual Reality (VR) Augmented Reality (AR) Mixed Reality (MR) Live, Virtual, Constructive, and Hybrid Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Simulation Applications | 100 | Simulation Engineers, Aerospace Project Managers |

| Automotive Design Simulations | 90 | Product Development Engineers, Automotive Designers |

| Healthcare Simulation Technologies | 70 | Clinical Researchers, Medical Device Developers |

| Manufacturing Process Simulations | 80 | Operations Managers, Manufacturing Engineers |

| Educational Simulation Tools | 50 | Academic Researchers, Educational Technology Specialists |

The Global Simulator Market is valued at approximately USD 18 billion, reflecting significant growth driven by advancements in technology and increasing demand for effective training solutions across various sectors, including aerospace, healthcare, and automotive.