Region:Global

Author(s):Shubham

Product Code:KRAD0609

Pages:99

Published On:August 2025

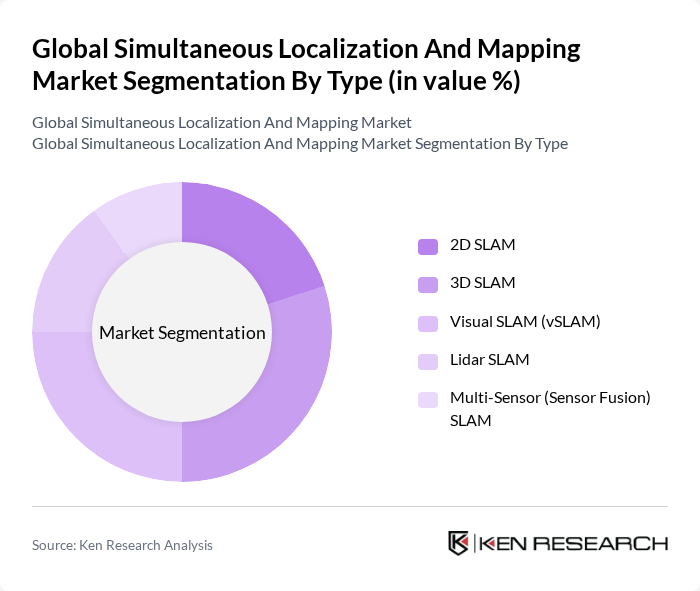

By Type:The segmentation of the market by type includes various technologies that cater to different applications and industries. The subsegments are 2D SLAM, 3D SLAM, Visual SLAM (vSLAM), Lidar SLAM, and Multi-Sensor (Sensor Fusion) SLAM. Each of these technologies has unique advantages and is suited for specific use cases, contributing to the overall growth of the market.

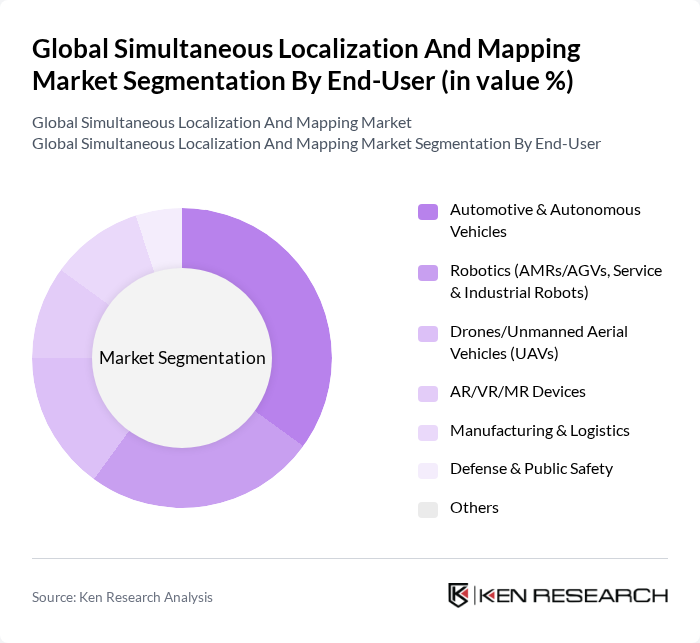

By End-User:The market is segmented by end-user applications, which include Automotive & Autonomous Vehicles, Robotics (AMRs/AGVs, Service & Industrial Robots), Drones/Unmanned Aerial Vehicles (UAVs), AR/VR/MR Devices, Manufacturing & Logistics, Defense & Public Safety, and Others. Each end-user segment has distinct requirements and applications for SLAM technologies, driving demand across various sectors.

The Global Simultaneous Localization And Mapping Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google LLC, Apple Inc., Microsoft Corporation, Amazon Robotics LLC, HERE Technologies, Qualcomm Technologies, Inc., NavVis GmbH, SLAMcore Ltd., Niantic, Inc. (8th Wall, Visual Positioning System), Skydio, Inc., Clearpath Robotics Inc., LeddarTech Inc., SICK AG, Ouster, Inc., Velodyne Lidar (a brand of Ouster, Inc.), RoboSense (Suteng Innovation Technology Co., Ltd.), Innoviz Technologies Ltd., Hexagon AB (Leica Geosystems), FARO Technologies, Inc., Zhejiang Tupu Robotics Co., Ltd. (Tpbot) contribute to innovation, geographic expansion, and service delivery in this space.

The future of SLAM technologies appears promising, driven by continuous advancements in artificial intelligence and machine learning. As industries increasingly adopt cloud-based solutions, the demand for real-time data processing will rise, enhancing operational efficiency. Furthermore, the integration of multi-sensor fusion technologies is expected to improve mapping accuracy and reliability. These trends indicate a robust growth trajectory, with significant investments in R&D and collaborations shaping the landscape of SLAM applications across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | D SLAM D SLAM Visual SLAM (vSLAM) Lidar SLAM Multi-Sensor (Sensor Fusion) SLAM |

| By End-User | Automotive & Autonomous Vehicles Robotics (AMRs/AGVs, Service & Industrial Robots) Drones/Unmanned Aerial Vehicles (UAVs) AR/VR/MR Devices Manufacturing & Logistics Defense & Public Safety Others |

| By Application | Autonomous Navigation & Path Planning Mapping & Surveying AR/VR Spatial Mapping & Tracking Inspection, Monitoring & Maintenance Warehouse Automation Others |

| By Component | Hardware (Lidar, Cameras/RGB?D, IMU, GPS, Processors) Software (Algorithms, SDKs, Middleware) Services (Integration, Consulting, Managed Services) |

| By Distribution Channel | Direct (Enterprise/OEM) Online (Developer Platforms/Marketplaces) Distributors/Systems Integrators |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Strategy | Per-Device License Subscription (SaaS) Usage-Based (API/Cloud) Enterprise/Custom |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Robotics and Automation | 120 | R&D Managers, Robotics Engineers |

| Automotive Navigation Systems | 90 | Product Managers, Automotive Engineers |

| Augmented Reality Applications | 60 | UX Designers, Software Developers |

| Drones and Aerial Mapping | 50 | Drone Operators, Geographic Information Systems Analysts |

| Consumer Electronics Integration | 80 | Product Development Managers, Marketing Directors |

The Global Simultaneous Localization and Mapping market is valued at approximately USD 640 million, driven by advancements in robotics, autonomous vehicles, and augmented reality technologies, which have increased the demand for accurate mapping and localization solutions across various industries.