Region:Global

Author(s):Shubham

Product Code:KRAC0614

Pages:84

Published On:August 2025

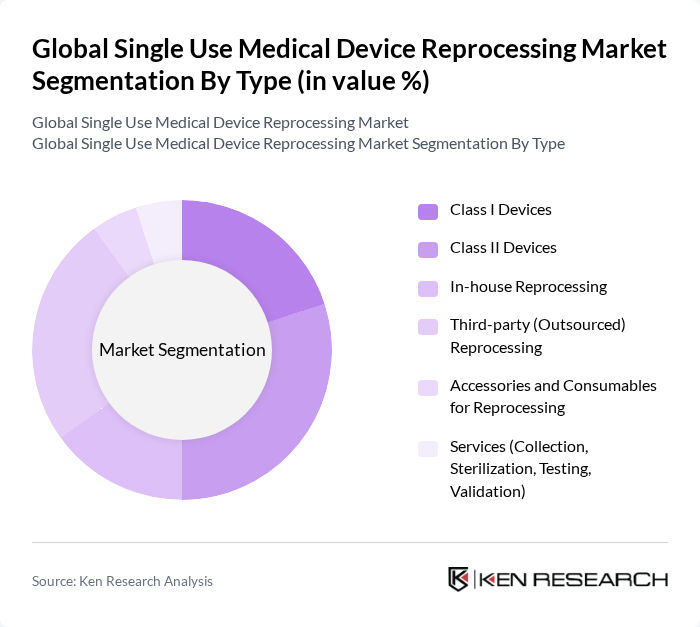

By Type:The market is segmented into Class I Devices, Class II Devices, In-house Reprocessing, Third-party (Outsourced) Reprocessing, Accessories and Consumables for Reprocessing, and Services (Collection, Sterilization, Testing, Validation). Among these, Class II Devices and Third-party Reprocessing are leading segments due to their widespread use and the growing trend of outsourcing reprocessing services to specialized companies.

By Device Category:The device categories include Electrophysiology Catheters (EP Diagnostic and Ablation), Laparoscopic Instruments, Electrosurgical Pencils and Cautery Tips, Compression Sleeves (DVT), Tourniquet Cuffs, Balloon Angioplasty Catheters and Guidewires, Pulse Oximeter Sensors and Cables, and Others. The Electrophysiology Catheters segment is currently leading the market due to the increasing prevalence of cardiovascular diseases and the growing demand for minimally invasive procedures.

The Global Single Use Medical Device Reprocessing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stryker (Stryker Sustainability Solutions), Medline ReNewal (Medline Industries, LP), Innovative Health, LLC, ReNu Medical, Inc. (a division of Stryker), Vanguard AG, Sterilmed, Inc. (a Johnson & Johnson company), NEScientific (formerly Northeast Scientific), Arjo AB (DVT compression sleeves reprocessing partnerships), Cardinal Health, Inc. (reprocessing distribution partnerships), 3M Company (sterilization and validation solutions ecosystem), Johnson & Johnson MedTech, B. Braun Melsungen AG, Boston Scientific Corporation, ConvaTec Group plc, Olympus Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the single-use medical device reprocessing market appears promising, driven by increasing healthcare costs and a growing emphasis on sustainability. As healthcare providers seek to balance cost efficiency with environmental responsibility, the adoption of reprocessing practices is likely to rise. Additionally, advancements in technology will enhance the safety and reliability of reprocessed devices, fostering greater acceptance among healthcare professionals. The market is poised for significant growth as these trends continue to evolve, shaping the industry's landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Class I Devices Class II Devices In-house Reprocessing Third-party (Outsourced) Reprocessing Accessories and Consumables for Reprocessing Services (Collection, Sterilization, Testing, Validation) |

| By Device Category | Electrophysiology Catheters (EP Diagnostic and Ablation) Laparoscopic Instruments Electrosurgical Pencils and Cautery Tips Compression Sleeves (DVT) Tourniquet Cuffs Balloon Angioplasty Catheters and Guidewires Pulse Oximeter Sensors and Cables Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Cardiology and EP Labs Group Purchasing Organizations (GPO)-affiliated Facilities Others |

| By Distribution Channel | Direct Contracts with Healthcare Providers Group Purchasing Organizations (GPOs) Distributors Online Procurement Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Regulatory Compliance | FDA 510(k) and QSR-compliant Reprocessors (U.S.) EU MDR/IVDR and CE-marked Reprocessors (Europe) ISO 13485 and ISO 14971 Certified National Competent Authority-approved (e.g., Health Canada, PMDA) Others |

| By Price/Contract Model | Per-Device Reprocessing Fee Volume-based Contracting Subscription/Capitated Savings Programs Pay-per-use and Hybrid Models Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 120 | Procurement Managers, Supply Chain Coordinators |

| Reprocessing Service Providers | 90 | Operations Managers, Business Development Executives |

| Healthcare Facility Administrators | 110 | Facility Managers, Compliance Officers |

| Regulatory Bodies and Associations | 60 | Policy Makers, Regulatory Affairs Specialists |

| Waste Management Experts | 60 | Environmental Officers, Waste Management Consultants |

The Global Single Use Medical Device Reprocessing Market is valued at approximately USD 900 million, driven by factors such as sustainability, cost reduction in healthcare, and the increasing prevalence of chronic diseases requiring medical devices.