Region:Global

Author(s):Dev

Product Code:KRAA1525

Pages:84

Published On:August 2025

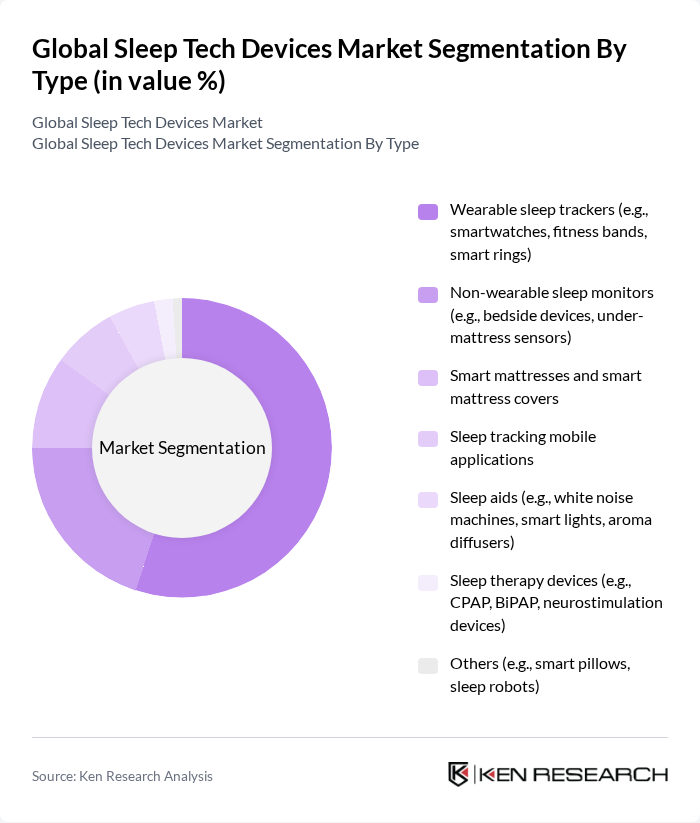

By Type:The market is segmented into various types of sleep tech devices, each catering to different consumer needs and preferences. The subsegments include wearable sleep trackers, non-wearable sleep monitors, smart mattresses, sleep tracking mobile applications, sleep aids, sleep therapy devices, and others. Among these, wearable sleep trackers have gained significant traction due to their convenience and ability to provide real-time data on sleep patterns. Wearables, including smartwatches, fitness bands, and smart rings, are the leading product category, driven by user comfort and continuous monitoring capabilities.

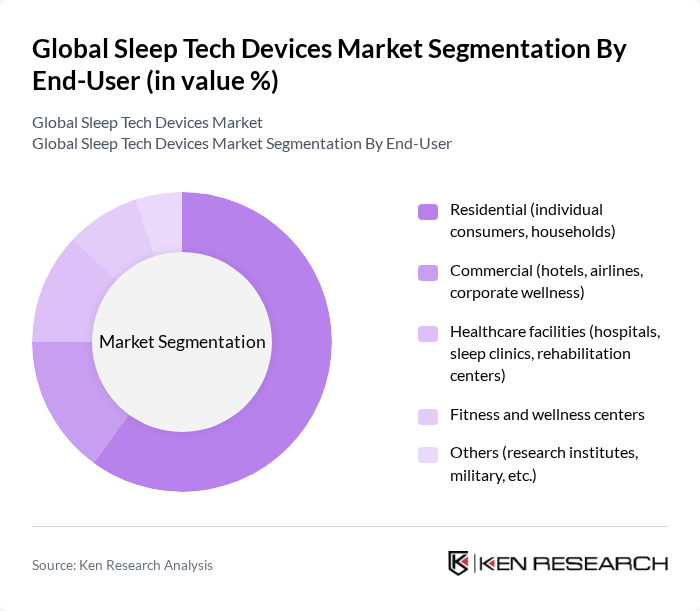

By End-User:The end-user segmentation includes residential consumers, commercial establishments, healthcare facilities, fitness and wellness centers, and others. The residential segment dominates the market as more individuals seek personal solutions for sleep improvement. The growing trend of health and wellness among consumers has led to increased adoption of sleep tech devices in households, while healthcare facilities and commercial establishments are also expanding their use of advanced sleep monitoring technologies.

The Global Sleep Tech Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Sleep Number Corporation, ResMed Inc., Fitbit Inc., Oura Health Ltd., Withings S.A., ZEEQ Smart Pillow (REM-Fit), Eight Sleep Inc., SNOOZ Inc. (White Noise Machine), Dreem (Rhythm), Beddit (Apple Inc.), Somnox B.V., Sleepace, Nox Medical, Sleepio (Big Health Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sleep tech devices market appears promising, driven by ongoing technological advancements and increasing consumer awareness. As more individuals prioritize sleep health, the demand for innovative solutions is expected to rise. Companies are likely to focus on integrating sleep tech with broader health management systems, enhancing user engagement. Additionally, the trend towards personalized sleep solutions will likely create new avenues for growth, particularly in emerging markets where awareness is still developing.

| Segment | Sub-Segments |

|---|---|

| By Type | Wearable sleep trackers (e.g., smartwatches, fitness bands) Non-wearable sleep monitors (e.g., bedside devices, under-mattress sensors) Smart mattresses and smart mattress covers Sleep tracking mobile applications Sleep aids (e.g., white noise machines, smart lights, aroma diffusers) Sleep therapy devices (e.g., CPAP, BiPAP, neurostimulation devices) Others (e.g., smart pillows, sleep robots) |

| By End-User | Residential (individual consumers, households) Commercial (hotels, airlines, corporate wellness) Healthcare facilities (hospitals, sleep clinics, rehabilitation centers) Fitness and wellness centers Others (research institutes, military, etc.) |

| By Distribution Channel | Online retail (e-commerce platforms, brand websites) Offline retail (electronics stores, pharmacies, specialty stores) Direct sales (B2B, institutional sales) Distributors and resellers Others |

| By Price Range | Budget (entry-level devices) Mid-range Premium Luxury (high-end, advanced features) |

| By Application | Sleep monitoring (tracking sleep stages, patterns, and quality) Sleep improvement (devices and apps for enhancing sleep quality) Sleep therapy (treatment of sleep disorders such as apnea, insomnia) Others (research, wellness programs) |

| By Consumer Demographics | Age group (children, adults, seniors) Gender Lifestyle (active, sedentary, shift workers) |

| By Brand Loyalty | Brand loyal consumers Price-sensitive consumers First-time buyers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Sleep Tech Usage | 120 | Sleep Tech Users, Health-Conscious Consumers |

| Healthcare Professional Insights | 90 | Sleep Specialists, General Practitioners |

| Retail Market Feedback | 60 | Retail Managers, Product Buyers |

| Technology Adoption Trends | 50 | Tech Enthusiasts, Early Adopters |

| Market Barriers and Challenges | 40 | Industry Analysts, Market Researchers |

The Global Sleep Tech Devices Market is valued at approximately USD 25 billion, driven by the rising prevalence of sleep disorders, increased awareness of sleep health, and advancements in technology that enhance sleep quality.