Region:Global

Author(s):Geetanshi

Product Code:KRAA2299

Pages:97

Published On:August 2025

By Type:The market is segmented into various types of smart cleaning devices, including robotic vacuum cleaners, robotic mops, automated window cleaners, smart air purifiers, UV disinfection robots, pool cleaning robots, lawn cleaning robots, and others such as HVAC duct-cleaning robots and solar panel cleaning robots. Among these, robotic vacuum cleaners are leading the market due to their convenience, efficiency in household cleaning, and widespread adoption in both residential and commercial settings. The integration of advanced navigation, mapping, and connectivity features has further accelerated their market leadership .

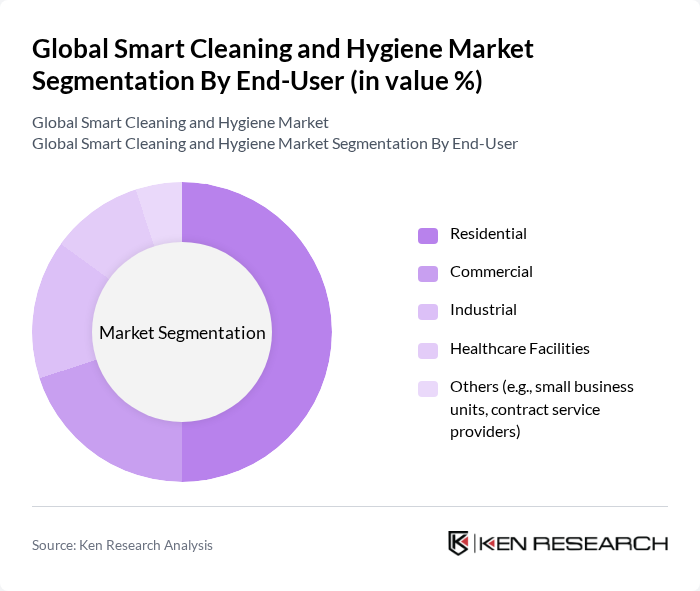

By End-User:The smart cleaning and hygiene market is categorized by end-users, including residential, commercial, industrial, healthcare facilities, and others such as small business units and contract service providers. The residential segment is currently the most significant contributor, driven by the increasing adoption of smart home technologies and the growing demand for convenience in household cleaning. The commercial and healthcare segments are also expanding rapidly, propelled by stricter hygiene protocols and the need for efficient, automated cleaning in high-traffic environments .

The Global Smart Cleaning and Hygiene Market is characterized by a dynamic mix of regional and international players. Leading participants such as iRobot Corporation, Ecovacs Robotics Co., Ltd., Roborock Technology Co., Ltd., Samsung Electronics Co., Ltd., LG Electronics Inc., Panasonic Corporation, Xiaomi Corporation, SharkNinja Operating LLC, Neato Robotics, Inc., Cecotec Innovaciones S.L., Kärcher GmbH & Co. KG, Nilfisk Group, Tennant Company, Ecolab Inc., Diversey Holdings, Ltd., Procter & Gamble Co., The Clorox Company, 3M Company, Bissell Homecare, Inc., Stanley Black & Decker, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart cleaning and hygiene market appears promising, driven by ongoing technological advancements and increasing consumer expectations for cleanliness. As urbanization continues, particularly in emerging markets, the demand for efficient cleaning solutions will rise. Additionally, the integration of AI and IoT technologies will enhance operational efficiency, enabling businesses to optimize their cleaning processes. Companies that invest in innovation and sustainability will likely gain a competitive edge, positioning themselves favorably in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Robotic Vacuum Cleaners Robotic Mops Automated Window Cleaners Smart Air Purifiers UV Disinfection Robots Pool Cleaning Robots Lawn Cleaning Robots Others (e.g., HVAC duct-cleaning robots, solar panel cleaning robots) |

| By End-User | Residential Commercial Industrial Healthcare Facilities Others (e.g., small business units, contract service providers) |

| By Application | Floor Cleaning Surface Disinfection Air Purification Window Cleaning Pool Cleaning Waste Management Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales B2B Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Brand | Established Brands Emerging Brands Private Labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Cleaning Services | 60 | Operations Managers, Facility Supervisors |

| Residential Smart Cleaning Devices | 50 | Homeowners, Product Reviewers |

| Healthcare Facility Hygiene Solutions | 40 | Healthcare Administrators, Infection Control Officers |

| Industrial Cleaning Equipment | 45 | Maintenance Managers, Procurement Specialists |

| Retail Cleaning Product Adoption | 55 | Store Managers, Supply Chain Coordinators |

The Global Smart Cleaning and Hygiene Market is valued at approximately USD 5 billion, driven by urbanization, rising disposable incomes, and increased hygiene awareness, particularly following global health crises.