Region:North America

Author(s):Geetanshi

Product Code:KRAA3246

Pages:83

Published On:January 2026

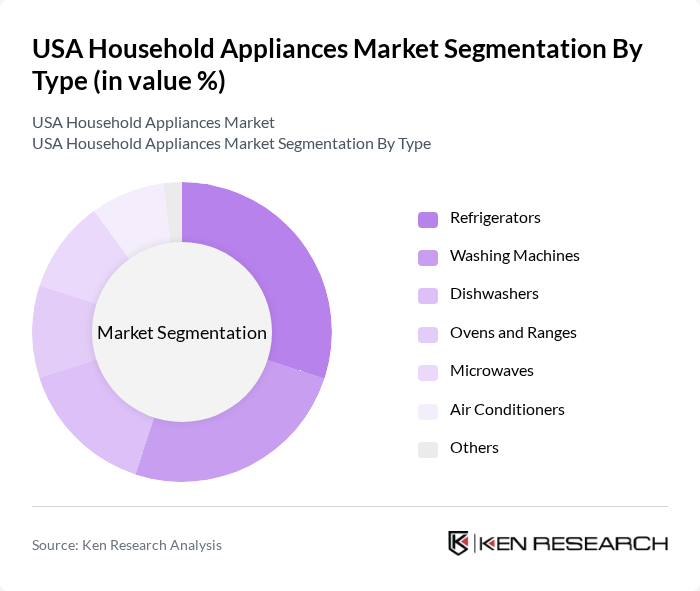

By Type:The market is segmented into various types of household appliances, including refrigerators, washing machines, dishwashers, ovens and ranges, microwaves, air conditioners, and others. Among these, refrigerators and washing machines are the most dominant segments due to their essential role in daily household activities. The increasing focus on energy efficiency and smart technology integration is also shaping consumer preferences, leading to a rise in demand for advanced models.

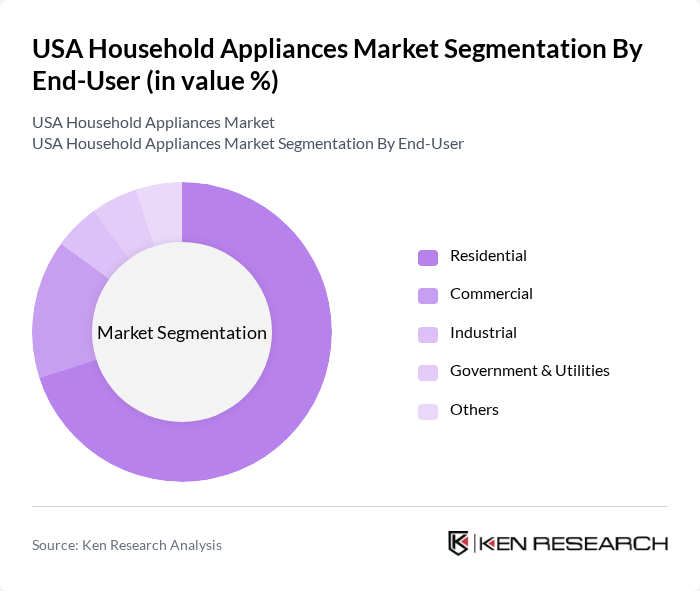

By End-User:The household appliances market is segmented by end-user into residential, commercial, industrial, government & utilities, and others. The residential segment holds the largest share, driven by the growing trend of home renovations and the increasing number of households. Consumers are increasingly investing in modern appliances that enhance convenience and efficiency, leading to a robust demand in this segment.

The USA Household Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Whirlpool Corporation, General Electric (GE) Appliances, Samsung Electronics, LG Electronics, Bosch Home Appliances, Electrolux, Panasonic Corporation, Frigidaire, Maytag, KitchenAid, Miele, Haier, Sharp Corporation, Smeg, Hisense contribute to innovation, geographic expansion, and service delivery in this space.

The USA household appliances market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As smart home integration becomes more prevalent, manufacturers will likely focus on developing interconnected appliances that enhance user experience. Additionally, sustainability will remain a key priority, with brands increasingly adopting eco-friendly practices. The anticipated growth in urbanization will further drive demand for compact, multifunctional appliances, creating a dynamic landscape for innovation and competition in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerators Washing Machines Dishwashers Ovens and Ranges Microwaves Air Conditioners Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale Others |

| By Price Range | Budget Appliances Mid-Range Appliances Premium Appliances Luxury Appliances Others |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Quality-Conscious Customers Others |

| By Energy Efficiency Rating | ENERGY STAR Rated Non-ENERGY STAR Rated Others |

| By Technological Features | Smart Appliances Traditional Appliances Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Refrigerators | 150 | Homeowners, Renters |

| Market Insights on Washing Machines | 120 | Families, Single Professionals |

| Trends in Kitchen Appliances | 100 | Chefs, Home Cooks |

| Consumer Attitudes towards Smart Appliances | 80 | Tech-Savvy Consumers, Early Adopters |

| Feedback on Energy Efficiency in Appliances | 90 | Environmentally Conscious Consumers, Homeowners |

The USA Household Appliances Market is valued at approximately USD 90 billion, reflecting significant growth driven by technological advancements, increased consumer spending on home improvement, and a rising demand for energy-efficient appliances.