Region:Global

Author(s):Geetanshi

Product Code:KRAA1287

Pages:100

Published On:August 2025

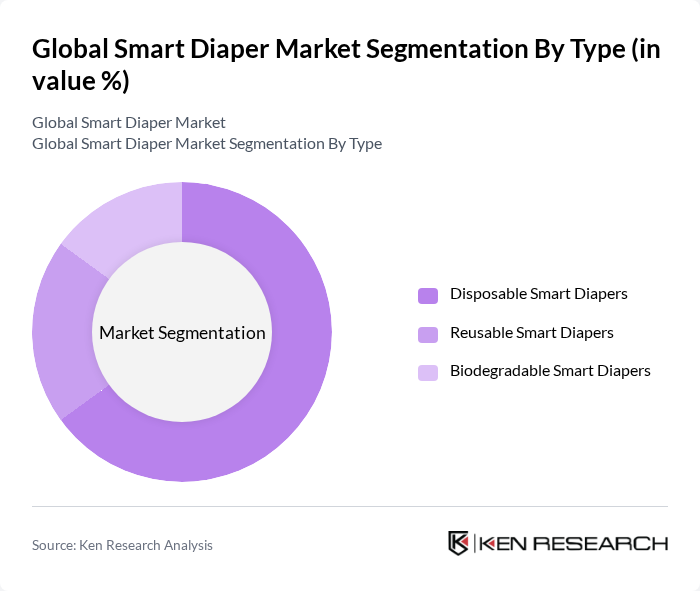

By Type:The market is segmented into three main types: Disposable Smart Diapers, Reusable Smart Diapers, and Biodegradable Smart Diapers. Disposable Smart Diapers dominate the market due to their convenience, widespread availability, and integration of advanced sensor technologies. Reusable Smart Diapers are gaining traction among environmentally conscious consumers, offering cost-effectiveness and reduced waste. Biodegradable Smart Diapers are emerging as a sustainable alternative, driven by regulatory changes and increasing consumer demand for eco-friendly products. Manufacturers are focusing on innovative materials and designs to enhance sustainability and performance .

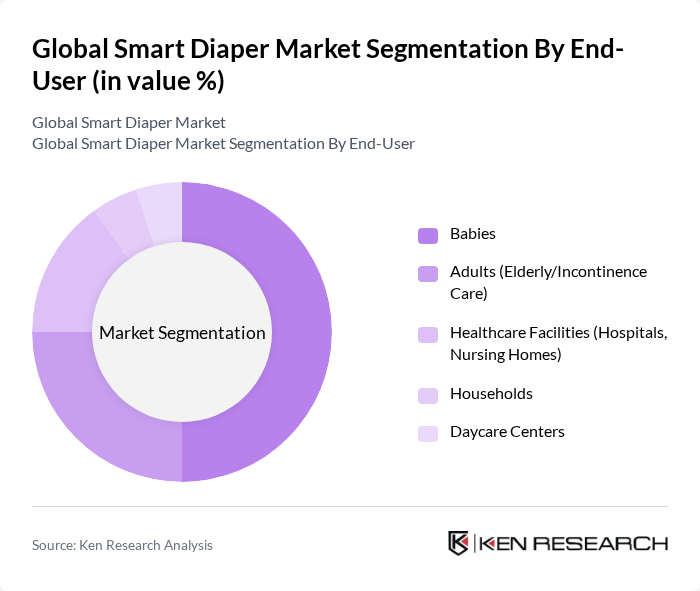

By End-User:The end-user segmentation includes Babies, Adults (Elderly/Incontinence Care), Healthcare Facilities (Hospitals, Nursing Homes), Households, and Daycare Centers. The Baby segment holds the largest share due to high birth rates, increasing parental awareness regarding infant hygiene, and the adoption of smart monitoring solutions. The Adult segment is also growing rapidly, driven by an aging population, rising awareness of incontinence issues, and the need for advanced care solutions in healthcare settings. Healthcare facilities are adopting smart diapers for improved patient care and operational efficiency .

The Global Smart Diaper Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble Co., Kimberly-Clark Corporation, Unicharm Corporation, Huggies (Kimberly-Clark Corporation), Pampers (Procter & Gamble), Moony (Unicharm Corporation), Abena A/S, Ontex Group NV, Essity AB, Domtar Corporation, Chiaus (Fujian) Industrial Development Co., Ltd., Kao Corporation, Medline Industries, LP, Monit Corp., Smardii Inc., Sinopulsar Technology Inc., Wonderkin Co., Ltd., Verily Life Sciences (Alphabet Inc.), CviCloud Corporation (CviLux Co. Ltd.), ATZ Global Co. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart diaper market appears promising, driven by technological advancements and changing consumer preferences. As parents increasingly prioritize health monitoring and convenience, the demand for smart diapers is expected to rise. Additionally, the integration of eco-friendly materials and mobile applications will likely enhance product appeal. Companies that invest in consumer education and strategic partnerships with healthcare providers will be well-positioned to capitalize on emerging trends and expand their market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Disposable Smart Diapers Reusable Smart Diapers Biodegradable Smart Diapers |

| By End-User | Babies Adults (Elderly/Incontinence Care) Healthcare Facilities (Hospitals, Nursing Homes) Households Daycare Centers |

| By Distribution Channel | Online Retail/E-commerce Supermarkets/Hypermarkets Specialty Baby Stores Pharmacies/Drugstores |

| By Features | Moisture Detection Sensors Temperature Monitoring Odor Detection Connectivity with Mobile Apps (Bluetooth, RFID, etc.) Data Analytics/Health Tracking |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Established Brands Emerging Brands Private Labels |

| By Region | North America Europe Asia Pacific Middle East & Africa Latin America |

| By Others | Customizable Smart Diapers Subscription Services Smart Diaper Accessories |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Diaper Retail Market | 100 | Retail Managers, Category Buyers |

| Healthcare Professionals Insights | 80 | Pediatricians, Child Health Specialists |

| Consumer Preferences Survey | 120 | Parents of infants and toddlers |

| Technology Adoption in Diapers | 60 | Product Developers, R&D Managers |

| Market Trends and Innovations | 50 | Industry Analysts, Market Researchers |

The Global Smart Diaper Market is valued at approximately USD 3.97 billion, reflecting significant growth driven by the demand for innovative solutions in infant and adult incontinence care, as well as increased awareness of hygiene and health monitoring.