Region:Global

Author(s):Shubham

Product Code:KRAA1867

Pages:99

Published On:August 2025

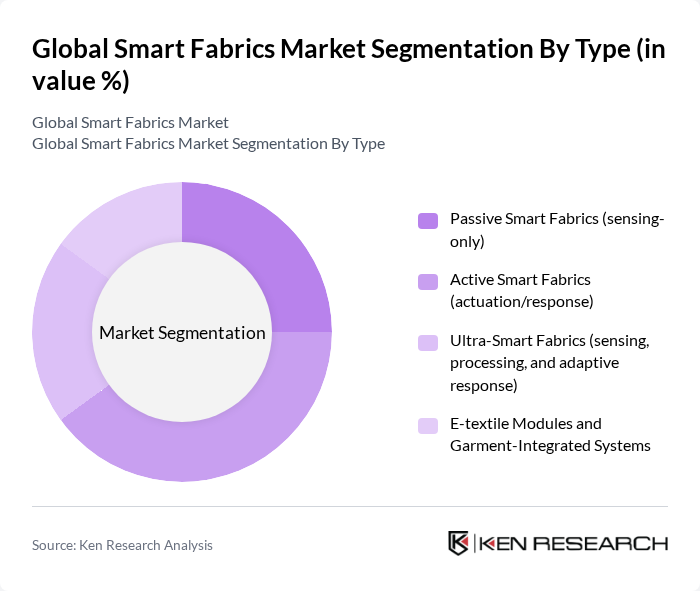

By Type:The smart fabrics market is segmented into four main types: Passive Smart Fabrics (sensing-only), Active Smart Fabrics (actuation/response), Ultra-Smart Fabrics (sensing, processing, and adaptive response), and E-textile Modules and Garment-Integrated Systems. Active Smart Fabrics are broadly viewed as market-leading in adoption where responsive thermoregulation, haptics, and compression/actuation are valued, particularly in sports, defense, and select medical use cases.

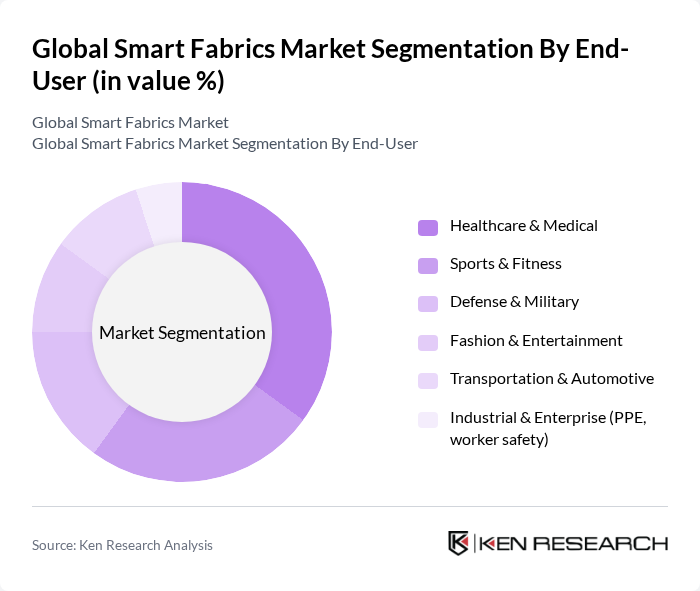

By End-User:The end-user segmentation includes Healthcare & Medical, Sports & Fitness, Defense & Military, Fashion & Entertainment, Transportation & Automotive, and Industrial & Enterprise (PPE, worker safety). Healthcare & Medical remains a leading adopter given the use of textile-based sensors for continuous vitals tracking, rehabilitation monitoring, and remote patient management by providers and consumers. Sports & Fitness continues to scale with performance analytics wearables and smart garments, while defense demand is supported by soldier systems and situational awareness textiles.

The Global Smart Fabrics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DuPont de Nemours, Inc., Textronics, Inc. (India), Schoeller Textil AG, Ohmatex ApS, Wearable X, Google LLC (Project Jacquard), Adidas AG, Under Armour, Inc., Sensoria Inc., Hexoskin (Carre Technologies Inc.), Myant Inc., Ambiq Health (formerly Lumo Bodytech), Intelligent Textiles Ltd, AiQ Smart Clothing Inc., Heddoko Inc., Nextiles, V Wearables (formerly OMsignal), Fibretronic Ltd, Siren Care, Inc., Toray Industries, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart fabrics market appears promising, driven by continuous technological advancements and increasing consumer interest in health and fitness. As manufacturers focus on integrating smart textiles with IoT devices, the market is expected to witness significant growth. Additionally, the development of eco-friendly fabrics will likely attract environmentally conscious consumers, further expanding market reach. Collaborations with fashion brands will also enhance product visibility, making smart fabrics more mainstream in everyday apparel.

| Segment | Sub-Segments |

|---|---|

| By Type | Passive Smart Fabrics (sensing-only) Active Smart Fabrics (actuation/response) Ultra?Smart Fabrics (sensing, processing, and adaptive response) E?textile Modules and Garment-Integrated Systems |

| By End-User | Healthcare & Medical Sports & Fitness Defense & Military Fashion & Entertainment Transportation & Automotive Industrial & Enterprise (PPE, worker safety) |

| By Application/Functionality | Sensing & Performance Tracking Energy Harvesting & Storage Thermoregulation & Heating/Cooling Compression & Electrostimulation Aesthetics & Luminescence |

| By Distribution Channel | Direct-to-Consumer (Brand E?commerce) Online Marketplaces Specialty Retail (sports/medical) B2B/OEM Sales |

| By Material/Technology | Conductive Yarns & Fibers Sensor-Embedded Textiles Phase?Change/Shape?Memory & Thermochromic Materials Printed/Flexible Electronics & Nanomaterials |

| By Price Range | Entry (mass sportswear/accessories) Mid (specialty garments, medical-grade consumer) Premium/Professional (clinical, defense, enterprise) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wearable Technology Applications | 110 | Product Managers, R&D Directors |

| Healthcare Smart Fabrics | 85 | Healthcare Professionals, Medical Device Developers |

| Fashion Industry Innovations | 65 | Fashion Designers, Brand Managers |

| Smart Home Textiles | 55 | Home Automation Specialists, Interior Designers |

| Sports and Fitness Applications | 95 | Sports Equipment Manufacturers, Fitness Trainers |

The Global Smart Fabrics Market is valued at approximately USD 4.6 billion, driven by advancements in technology and increasing adoption in sectors such as healthcare, sports, and automotive. This market is expected to grow significantly in the coming years.