Region:Global

Author(s):Shubham

Product Code:KRAC0829

Pages:86

Published On:August 2025

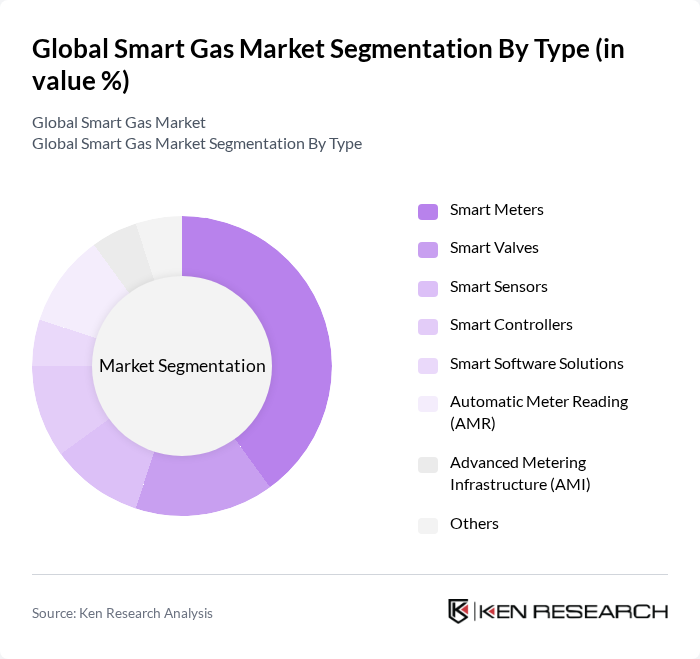

By Type:The market is segmented into various types, including Smart Meters, Smart Valves, Smart Sensors, Smart Controllers, Smart Software Solutions, Automatic Meter Reading (AMR), Advanced Metering Infrastructure (AMI), and Others. Among these,Smart Metersare leading the market due to their ability to provide real-time data, enhance operational efficiency, and support accurate billing. The increasing focus on energy conservation, regulatory mandates for smart meter rollouts, and the need for advanced data analytics are driving the demand for Smart Meters, making them a preferred choice for utilities and consumers alike .

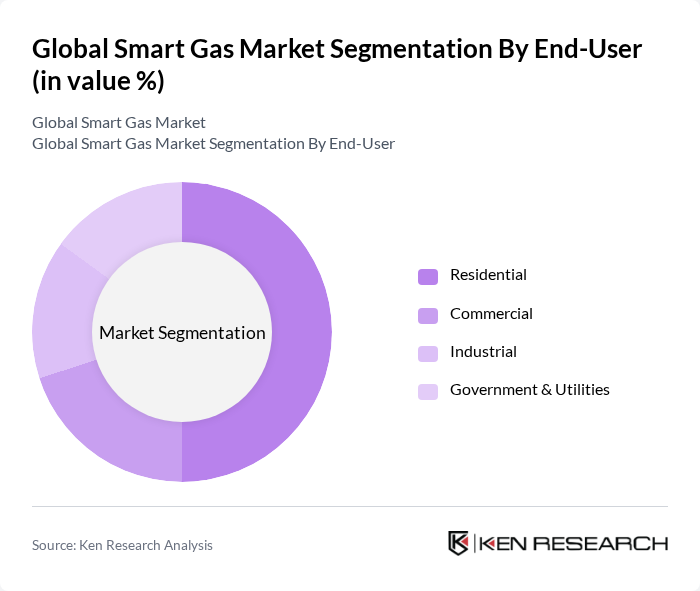

By End-User:The market is segmented into Residential, Commercial, Industrial, and Government & Utilities. TheResidentialsegment is currently dominating the market, driven by the increasing adoption of smart home technologies, government mandates for smart meter installation, and growing consumer awareness of energy efficiency. The trend towards smart homes and the integration of smart gas solutions in residential buildings are significantly contributing to the growth of this segment .

The Global Smart Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Itron, Inc., Sensus USA, Inc., Landis+Gyr AG, Siemens AG, Honeywell International Inc., Aclara Technologies LLC, Elster Group GmbH, Schneider Electric SE, ABB Ltd., General Electric Company, Cisco Systems, Inc., Oracle Corporation, Enel X S.r.l., GasNet, LLC, Xylem Inc., Sagemcom SAS, EDMI Limited, Kamstrup A/S, Diehl Metering GmbH, Secure Meters Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart gas market appears promising, driven by technological advancements and increasing regulatory support. As cities evolve into smart cities, the integration of smart gas systems with IoT technologies will enhance operational efficiency and customer engagement. Furthermore, the focus on sustainability will push utilities to adopt cleaner energy solutions, aligning with global carbon neutrality goals. This convergence of technology and policy will likely create a robust environment for innovation and investment in the smart gas sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Meters Smart Valves Smart Sensors Smart Controllers Smart Software Solutions Automatic Meter Reading (AMR) Advanced Metering Infrastructure (AMI) Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Advanced Metering Infrastructure Remote Monitoring Systems Data Analytics Platforms Communication Technologies Supervisory Control And Data Acquisition (SCADA) Geographical Information System (GIS) Meter Data Management (MDM) Mobile Workforce Management (MWM) |

| By Application | Leak Detection Consumption Monitoring Demand Response Management Asset Management Gas Quality Monitoring Predictive Maintenance |

| By Investment Source | Private Investments Public Funding Joint Ventures Government Grants |

| By Policy Support | Subsidies for Smart Gas Technologies Tax Incentives for Adoption Regulatory Support for Infrastructure Development Research and Development Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Smart Gas Solutions | 100 | Homeowners, Property Managers |

| Commercial Gas Management Systems | 80 | Facility Managers, Energy Auditors |

| Industrial Smart Gas Applications | 60 | Operations Managers, Energy Efficiency Consultants |

| Smart Metering Technologies | 90 | Utility Executives, Technology Implementers |

| Gas Leak Detection Systems | 50 | Safety Officers, Compliance Managers |

The Global Smart Gas Market is valued at approximately USD 28 billion, driven by the increasing demand for energy efficiency, real-time monitoring, and the adoption of smart technologies in gas distribution.