Region:Global

Author(s):Geetanshi

Product Code:KRAC0035

Pages:93

Published On:August 2025

By Type:The market is segmented into various types, including Smart Health Monitors, Home Automation Systems for Healthcare, Wearable Health Devices, Medication Management Systems, Remote Patient Monitoring Solutions, Health Management Apps & Platforms, Emergency Response & Fall Detection Systems, and Others. Among these, Smart Health Monitors and Wearable Health Devices are particularly prominent due to their increasing adoption among consumers for health tracking and management .

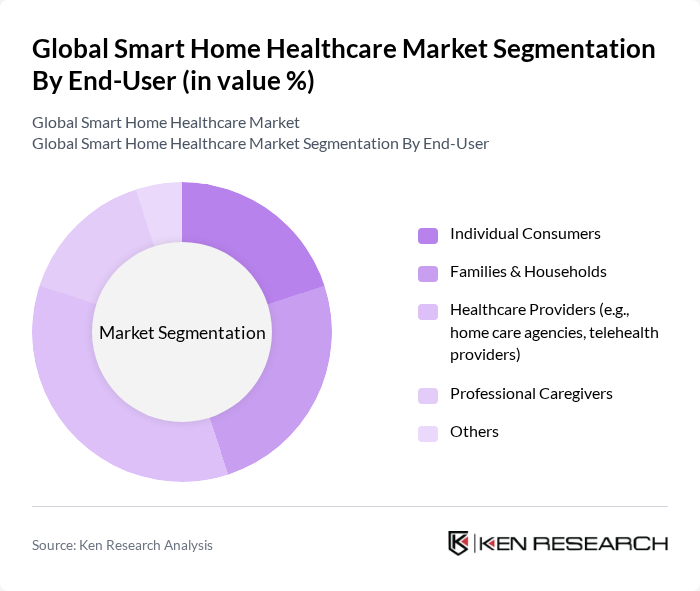

By End-User:The end-user segmentation includes Individual Consumers, Families & Households, Healthcare Providers, Professional Caregivers, and Others. The healthcare providers segment is leading due to the increasing adoption of telehealth services and home care solutions, which are essential for managing patient care effectively .

The Global Smart Home Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Honeywell Life Care Solutions, Samsung Health, GE Healthcare, Medtronic, Abbott Laboratories, Siemens Healthineers, Fitbit, Inc., Apple Inc., OMRON Healthcare, Withings, Tunstall Healthcare, ResMed, CarePredict, iHealth Labs, MedTech Nova, Xiaomi Corporation, Google (Nest/Google Health), Alarm.com, Teladoc Health contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart home healthcare market is poised for significant transformation, driven by technological advancements and changing consumer preferences. As the aging population grows, the demand for personalized healthcare solutions will increase, fostering innovation in device development. Additionally, the integration of AI and IoT technologies will enhance remote monitoring capabilities, improving patient outcomes. The market is expected to see a surge in telehealth services in future, further solidifying the role of smart home healthcare in modern healthcare delivery systems.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Health Monitors Home Automation Systems for Healthcare Wearable Health Devices (e.g., smartwatches, fitness trackers) Medication Management Systems (e.g., smart pill dispensers) Remote Patient Monitoring Solutions (e.g., connected blood pressure, glucose, and ECG monitors) Health Management Apps & Platforms Emergency Response & Fall Detection Systems Others |

| By End-User | Individual Consumers Families & Households Healthcare Providers (e.g., home care agencies, telehealth providers) Professional Caregivers Others |

| By Application | Chronic Disease Management (e.g., diabetes, hypertension, COPD) Elderly Care & Assisted Living Post-Acute & Rehabilitation Care Wellness & Preventive Monitoring Remote Diagnostics Others |

| By Distribution Channel | Online Retail (e-commerce platforms, company websites) Offline Retail (pharmacies, electronics stores) Direct Sales (B2B, B2C) Distributors & System Integrators Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Budget Mid-Range Premium |

| By Policy Support | Government Subsidies Tax Incentives Grants for Technology Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Home Monitoring Systems | 100 | Healthcare Providers, Home Care Managers |

| Wearable Health Devices | 80 | Patients, Fitness Enthusiasts |

| Telehealth Solutions | 90 | Telehealth Coordinators, IT Managers in Healthcare |

| Smart Home Integration | 60 | Smart Home Technology Developers, System Integrators |

| Chronic Disease Management Tools | 50 | Chronic Care Managers, Patient Advocates |

The Global Smart Home Healthcare Market is valued at approximately USD 23 billion, driven by factors such as the increasing prevalence of chronic diseases, an aging population, and a growing demand for remote healthcare solutions.