Region:Global

Author(s):Rebecca

Product Code:KRAC0223

Pages:98

Published On:August 2025

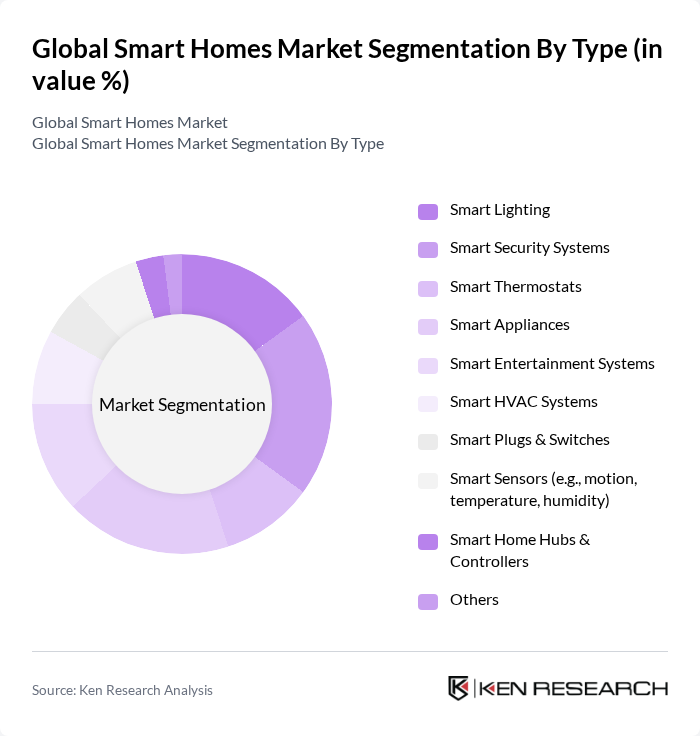

By Type:This segmentation includes various categories of smart home devices that enhance convenience, security, and energy efficiency. The subsegments are Smart Lighting, Smart Security Systems, Smart Thermostats, Smart Appliances, Smart Entertainment Systems, Smart HVAC Systems, Smart Plugs & Switches, Smart Sensors (e.g., motion, temperature, humidity), Smart Home Hubs & Controllers, and Others. Each of these subsegments plays a crucial role in the overall market dynamics .

The Smart Security Systems subsegment is currently dominating the market due to increasing concerns over home safety and security. Consumers are increasingly investing in advanced security solutions that offer features such as remote monitoring, smart locks, and integrated alarm systems. The rise in smart home burglaries and heightened awareness of personal safety have further propelled the demand for these systems, making them a priority for homeowners. As technology advances, the integration of AI and machine learning into security systems is expected to enhance their effectiveness, further driving market growth .

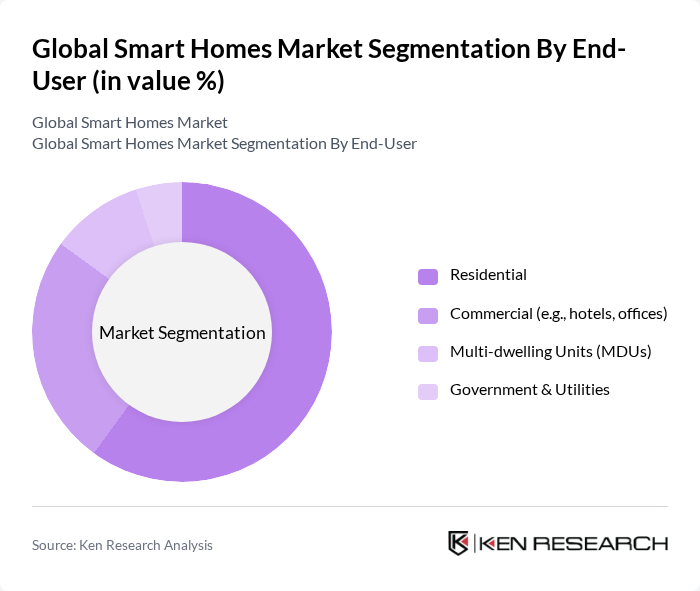

By End-User:This segmentation categorizes the market based on the end-users of smart home technologies. The subsegments include Residential, Commercial (e.g., hotels, offices), Multi-dwelling Units (MDUs), and Government & Utilities. Each end-user segment has unique requirements and preferences that influence the adoption of smart home solutions .

The Residential segment is the largest end-user category, driven by the growing trend of home automation and the increasing number of smart home device installations. Homeowners are increasingly looking for solutions that enhance convenience, security, and energy efficiency. The rise in disposable income and the growing awareness of smart technologies have further fueled the demand in this segment. As more consumers prioritize smart home features, this segment is expected to continue leading the market .

The Global Smart Homes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon.com, Inc., Google LLC, Apple Inc., Samsung Electronics Co., Ltd., Signify N.V. (formerly Philips Lighting), Honeywell International Inc., Johnson Controls International plc, Siemens AG, LG Electronics Inc., Ecobee Inc., Google Nest (subsidiary of Google LLC), Schneider Electric SE, Legrand S.A., Vivint Smart Home, Inc., Ring LLC (subsidiary of Amazon.com, Inc.), Robert Bosch GmbH, ASSA ABLOY AB, ABB Ltd., Sony Group Corporation, Lutron Electronics Co., Inc., Panasonic Holdings Corporation, Snap One, LLC, Comcast Corporation (Xfinity Home), Hubbell Incorporated, Carrier Global Corporation contribute to innovation, geographic expansion, and service delivery in this space .

The future of the smart homes market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As artificial intelligence and machine learning become more integrated into smart home systems, personalized automation will enhance user experiences. Additionally, the increasing focus on sustainability will drive demand for energy-efficient solutions, aligning with global environmental goals. The market is expected to witness significant innovations, fostering a more interconnected and efficient living environment for consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Lighting Smart Security Systems Smart Thermostats Smart Appliances Smart Entertainment Systems Smart HVAC Systems Smart Plugs & Switches Smart Sensors (e.g., motion, temperature, humidity) Smart Home Hubs & Controllers Others |

| By End-User | Residential Commercial (e.g., hotels, offices) Multi-dwelling Units (MDUs) Government & Utilities |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Wireless Technology (Wi-Fi, Zigbee, Z-Wave, Bluetooth, Thread) Wired Technology (Ethernet, Powerline) Cloud-Based Technology Edge Computing/Local Processing |

| By Application | Home Security & Surveillance Energy Management & Climate Control Home Automation & Control Entertainment & Media Health & Wellness Monitoring |

| By Investment Source | Private Investment Public Funding Venture Capital |

| By Policy Support | Government Subsidies Tax Incentives Grants for Smart Home Technologies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Security Systems | 100 | Homeowners, Security System Installers |

| Smart Lighting Solutions | 80 | Interior Designers, Home Automation Specialists |

| Smart HVAC Controls | 60 | HVAC Technicians, Energy Efficiency Consultants |

| Smart Appliances | 90 | Product Managers, Retail Buyers |

| Home Automation Systems | 70 | Tech Enthusiasts, Homeowners with Smart Devices |

The Global Smart Homes Market is valued at approximately USD 122 billion, reflecting significant growth driven by the increasing adoption of IoT devices, consumer demand for energy-efficient solutions, and advancements in home automation technologies.