Region:Global

Author(s):Dev

Product Code:KRAD0588

Pages:96

Published On:August 2025

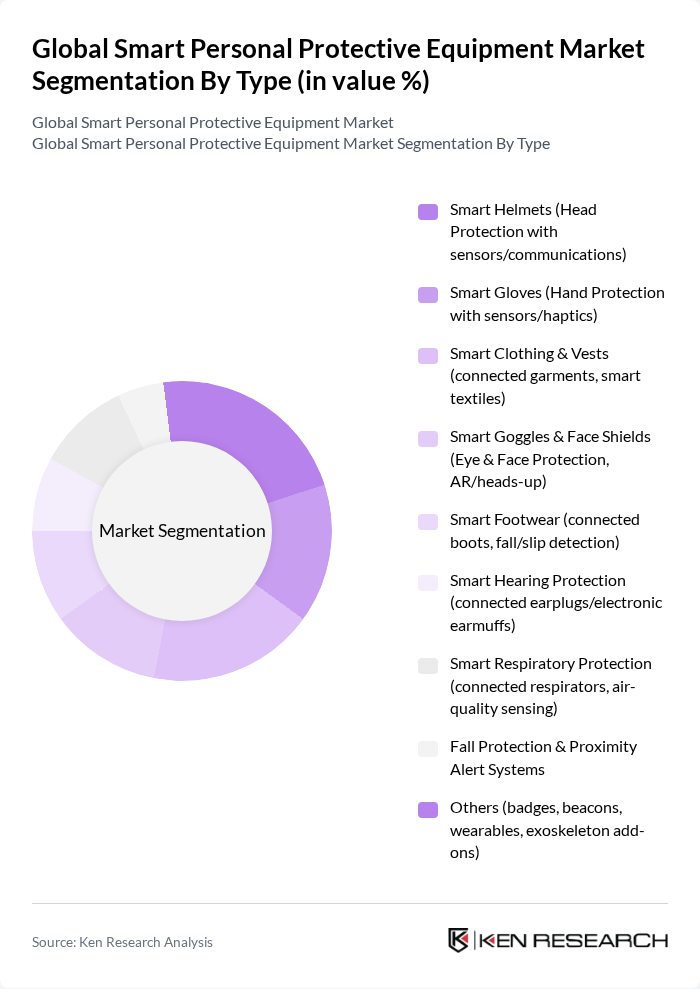

By Type:The smart personal protective equipment market is segmented into various types, including smart helmets, gloves, clothing, goggles, footwear, hearing protection, respiratory protection, fall protection systems, and others. Each type serves specific safety needs and incorporates advanced technologies such as IoT sensors, AR-enabled displays, connected communications, and environmental/biometric monitoring to enhance user safety and efficiency.

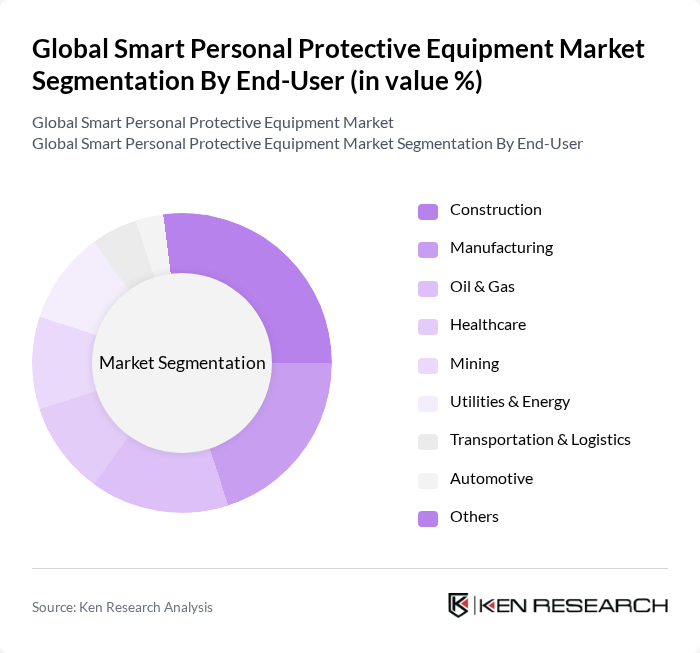

By End-User:The market is segmented by end-user industries, including construction, manufacturing, oil & gas, healthcare, mining, utilities & energy, transportation & logistics, automotive, and others. Each sector has unique safety requirements, driving the demand for tailored smart PPE solutions such as connected-worker platforms, AR/VR-enabled eyewear for remote guidance, and sensor-enabled monitoring for hazardous environments.

The Global Smart Personal Protective Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., 3M Company, DuPont de Nemours, Inc., MSA Safety Incorporated, Ansell Limited, Kimberly-Clark Corporation, Drägerwerk AG & Co. KGaA, Lakeland Industries, Inc., Radians, Inc., Bullard (E.D. Bullard Company), JSP Limited, Avon Protection plc, Delta Plus Group, Uvex Safety Group, Pyramex Safety Products, LLC, Guardhat Inc., Vuzix Corporation, RealWear, Inc., Kenzen Inc., Triax Technologies, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Enhancements and validation notes (key sources):

The future of the smart personal protective equipment market appears promising, driven by technological innovations and increasing regulatory pressures. As industries prioritize worker safety, the integration of IoT and AI technologies will enhance the functionality of PPE. Additionally, the growing emphasis on sustainability will likely lead to the development of eco-friendly materials, further attracting investment. Companies that adapt to these trends will be well-positioned to capture market share and drive growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Helmets (Head Protection with sensors/communications) Smart Gloves (Hand Protection with sensors/haptics) Smart Clothing & Vests (connected garments, smart textiles) Smart Goggles & Face Shields (Eye & Face Protection, AR/heads-up) Smart Footwear (connected boots, fall/slip detection) Smart Hearing Protection (connected earplugs/electronic earmuffs) Smart Respiratory Protection (connected respirators, air-quality sensing) Fall Protection & Proximity Alert Systems Others (badges, beacons, wearables, exoskeleton add-ons) |

| By End-User | Construction Manufacturing Oil & Gas Healthcare Mining Utilities & Energy Transportation & Logistics Automotive Others |

| By Application | Worker Location & Proximity Detection Vital Signs & Fatigue Monitoring Environmental & Hazard Monitoring (gas, heat, noise) Communications & AR-assisted Operations Fall Detection & Lone Worker Safety Infection Control & Clinical Monitoring Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Retail Stores System Integrators & EHS Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Entry (basic connectivity) Mid-Range (enhanced sensors/analytics) Premium (advanced AR/AI, integrated suites) |

| By Technology | IoT & Connected Sensors Bluetooth/Wi?Fi/LPWAN Connectivity GPS/RTLS/Ultra?Wideband AR/VR & Heads-Up Displays AI/Analytics & Edge Computing Battery & Energy Harvesting Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Safety Managers | 120 | Safety Officers, Site Managers |

| Healthcare Sector PPE Users | 100 | Healthcare Workers, Infection Control Specialists |

| Manufacturing Plant Safety Coordinators | 110 | Plant Managers, Safety Engineers |

| Emergency Services Personnel | 80 | Firefighters, Paramedics |

| Research and Development in Smart PPE | 60 | Product Developers, Innovation Managers |

The Global Smart Personal Protective Equipment Market is valued at approximately USD 5 billion, with estimates ranging from USD 4.9 billion to USD 6.1 billion. This growth is driven by increased workplace safety focus and technological advancements in wearable devices.