Region:Global

Author(s):Shubham

Product Code:KRAC0681

Pages:90

Published On:August 2025

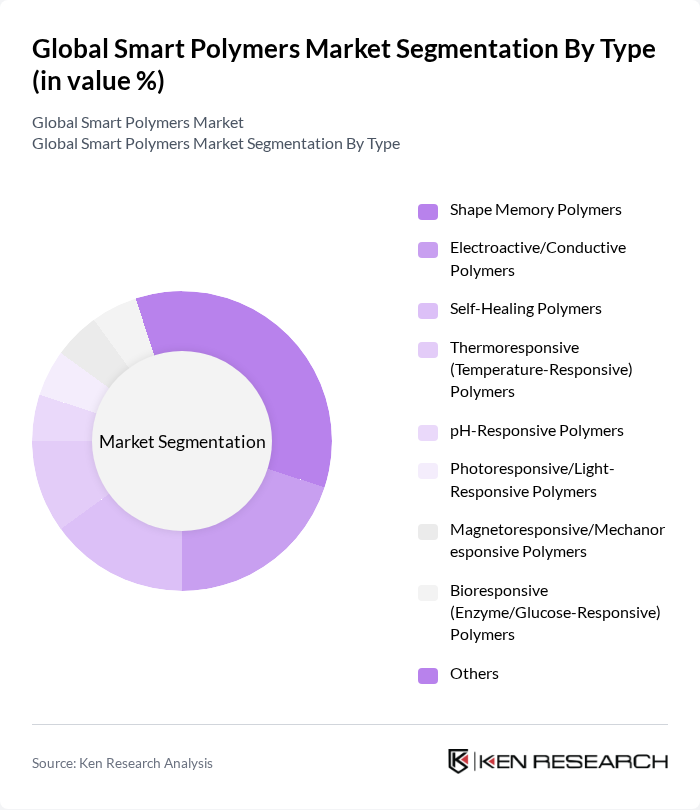

By Type:The smart polymers market can be segmented into various types, including Shape Memory Polymers, Electroactive/Conductive Polymers, Self-Healing Polymers, Thermoresponsive Polymers, pH-Responsive Polymers, Photoresponsive Polymers, Magnetoresponsive Polymers, Bioresponsive Polymers, and Others. Among these, Shape Memory Polymers are gaining significant traction due to their unique ability to return to a predetermined shape when exposed to specific stimuli, making them ideal for applications in biomedical devices and automotive components .

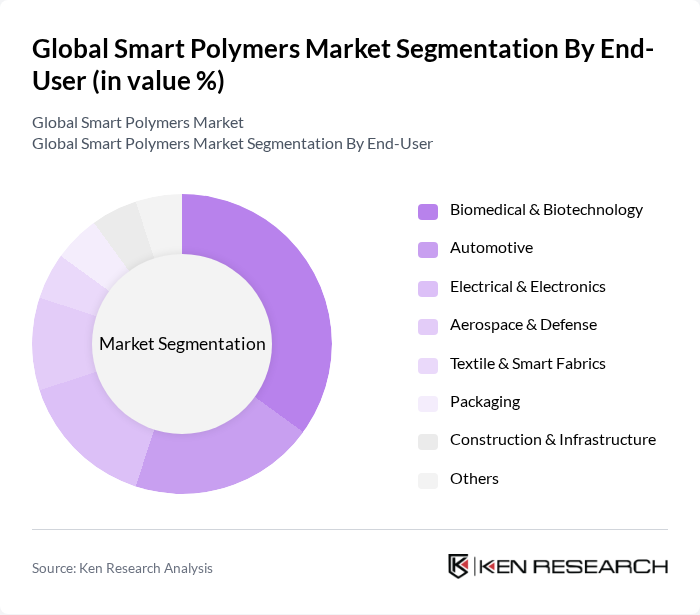

By End-User:The end-user segmentation of the smart polymers market includes Biomedical & Biotechnology, Automotive, Electrical & Electronics, Aerospace & Defense, Textile & Smart Fabrics, Packaging, Construction & Infrastructure, and Others. The Biomedical & Biotechnology sector is the leading end-user, driven by demand for drug delivery systems, tissue engineering scaffolds, minimally invasive devices, and adaptive medical components that leverage stimuli responsiveness for performance and patient outcomes .

The Global Smart Polymers Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Inc., Evonik Industries AG, Covestro AG, Huntsman Corporation, DuPont de Nemours, Inc., 3M Company, Mitsubishi Chemical Group Corporation, Solvay S.A., LG Chem Ltd., Eastman Chemical Company, Arkema S.A., SABIC, Wacker Chemie AG, The Lubrizol Corporation, Ashland Inc., DSM-Firmenich AG (Materials heritage: DSM Engineering Materials), Nippon Shokubai Co., Ltd., Synthomer plc, SEKISUI CHEMICAL CO., LTD. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart polymers market appears promising, driven by continuous technological advancements and increasing applications across various sectors. As industries prioritize sustainability, the demand for eco-friendly smart polymers is expected to rise significantly. Additionally, the integration of smart polymers with IoT technologies will likely create new opportunities for innovation, enhancing product functionalities and user experiences. This convergence of technology and materials science is set to redefine market dynamics and expand the scope of applications in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Shape Memory Polymers Electroactive/Conductive Polymers Self-Healing Polymers Thermoresponsive (Temperature-Responsive) Polymers pH-Responsive Polymers Photoresponsive/Light-Responsive Polymers Magnetoresponsive/Mechanoresponsive Polymers Bioresponsive (Enzyme/Glucose-Responsive) Polymers Others |

| By End-User | Biomedical & Biotechnology Automotive Electrical & Electronics Aerospace & Defense Textile & Smart Fabrics Packaging Construction & Infrastructure Others |

| By Application | Drug Delivery Systems Tissue Engineering & Regenerative Medicine Biosensors & Diagnostics Smart Coatings & Paints Actuators & Soft Robotics Smart Textiles & Wearables Adhesives & Sealants D Printing/Advanced Manufacturing Others |

| By Distribution Channel | Direct (OEMs and Large Accounts) Specialty Chemical Distributors Online/Inside Sales Research/Academic Supply Channels Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Low Medium High |

| By Technology | Polymer Synthesis (Controlled/RAFT, ATRP, Click Chemistry) Compounding & Formulation Injection Molding D Printing/Additive Manufacturing Extrusion Coating/Deposition (Dip, Spray, Layer-by-Layer) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biomedical Applications of Smart Polymers | 100 | Medical Device Engineers, Biopolymer Researchers |

| Smart Polymers in Electronics | 80 | Product Development Managers, Electronics Engineers |

| Textile Innovations with Smart Polymers | 70 | Textile Engineers, Materials Scientists |

| Automotive Applications of Smart Polymers | 90 | Automotive Engineers, Materials Procurement Managers |

| Research and Development in Smart Polymers | 60 | Academic Researchers, Industry Analysts |

The Global Smart Polymers Market is valued at approximately USD 3.4 billion, based on a five-year historical analysis. This valuation reflects the market's growth and the increasing demand for smart materials across various industries, including healthcare and automotive.