Region:Global

Author(s):Geetanshi

Product Code:KRAA2321

Pages:100

Published On:August 2025

Market.png)

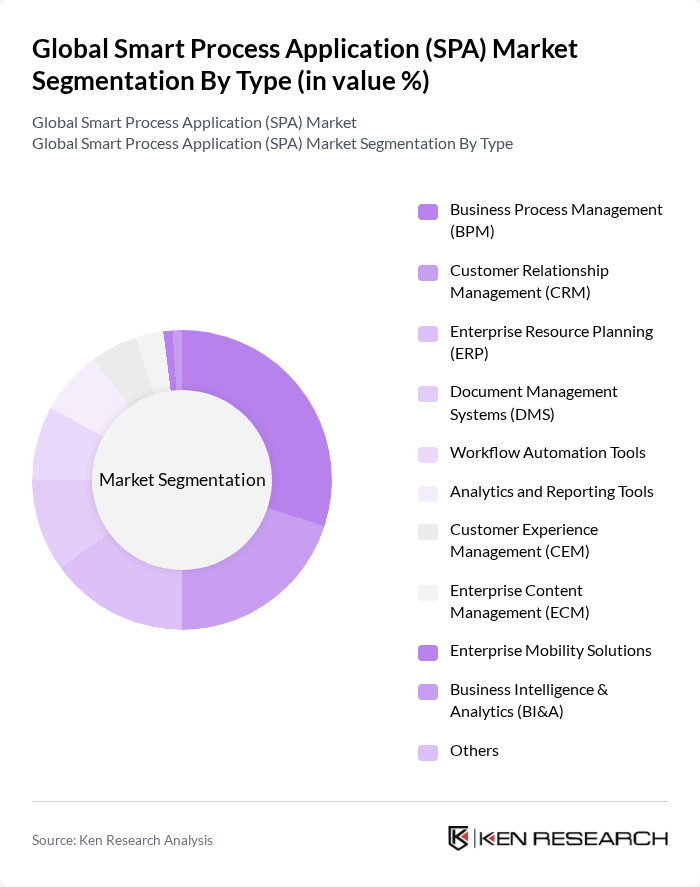

By Type:The market is segmented into various types, including Business Process Management (BPM), Customer Relationship Management (CRM), Enterprise Resource Planning (ERP), Document Management Systems (DMS), Workflow Automation Tools, Analytics and Reporting Tools, Customer Experience Management (CEM), Enterprise Content Management (ECM), Enterprise Mobility Solutions, Business Intelligence & Analytics (BI&A), and Others. Among these, Business Process Management (BPM) is the leading sub-segment due to its critical role in optimizing organizational workflows, enhancing operational efficiency, and enabling real-time process adaptation. The increasing integration of AI, low-code platforms, and cloud-based BPM tools is further strengthening this segment’s dominance .

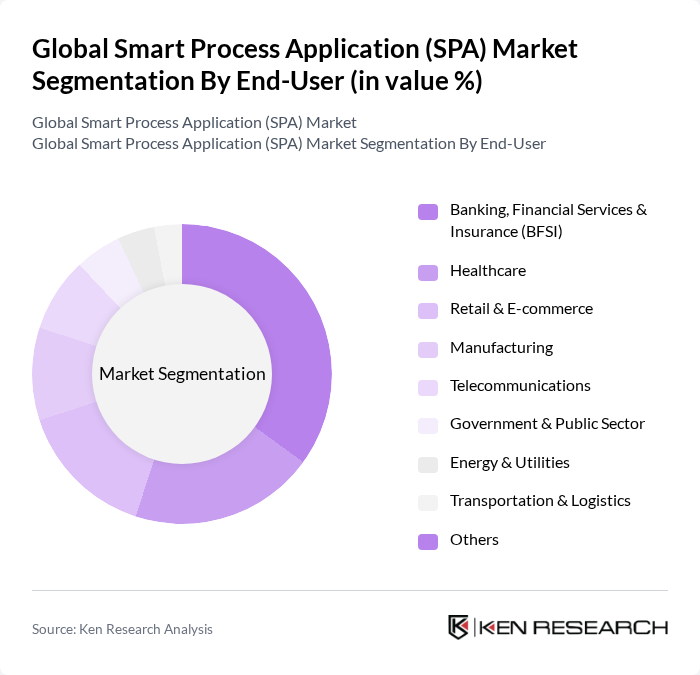

By End-User:The end-user segmentation includes Banking, Financial Services & Insurance (BFSI), Healthcare, Retail & E-commerce, Manufacturing, Telecommunications, Government & Public Sector, Energy & Utilities, Transportation & Logistics, and Others. The BFSI sector is the dominant segment, driven by the need for enhanced customer service, regulatory compliance, and risk management solutions. The sector’s focus on digital transformation, automation of core processes, and adoption of cloud-based SPA platforms is accelerating growth in this segment .

The Global Smart Process Application (SPA) Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, SAP SE, Oracle Corporation, Microsoft Corporation, Salesforce, Inc., Appian Corporation, Pegasystems Inc., ServiceNow, Inc., Nintex Global Ltd., Bizagi Limited, K2 Software, Inc., TIBCO Software Inc., Zoho Corporation Pvt. Ltd., Mendix B.V., OutSystems, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart process application market in None is poised for significant transformation, driven by technological advancements and evolving business needs. As organizations increasingly embrace digital transformation, the integration of AI and machine learning will enhance process automation capabilities. Furthermore, the growing emphasis on customer experience will compel businesses to adopt innovative solutions that streamline operations and improve service delivery, fostering a competitive edge in the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Business Process Management (BPM) Customer Relationship Management (CRM) Enterprise Resource Planning (ERP) Document Management Systems (DMS) Workflow Automation Tools Analytics and Reporting Tools Customer Experience Management (CEM) Enterprise Content Management (ECM) Enterprise Mobility Solutions Business Intelligence & Analytics (BI&A) Others |

| By End-User | Banking, Financial Services & Insurance (BFSI) Healthcare Retail & E-commerce Manufacturing Telecommunications Government & Public Sector Energy & Utilities Transportation & Logistics Others |

| By Industry Vertical | IT & Software Education Transportation & Logistics Energy & Utilities Real Estate Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Functionality | Process Automation Data Management Integration Capabilities User Interface and Experience |

| By Sales Channel | Direct Sales Online Sales Distributors and Resellers Others |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector SPA Adoption | 100 | Operations Managers, Process Engineers |

| Healthcare Process Automation | 60 | Healthcare Administrators, IT Directors |

| Financial Services SPA Implementation | 50 | Compliance Officers, Risk Management Executives |

| Retail Sector Smart Process Applications | 40 | Supply Chain Managers, E-commerce Directors |

| Telecommunications SPA Solutions | 45 | Network Operations Managers, Product Development Leads |

The Global Smart Process Application (SPA) Market is valued at approximately USD 66 billion, reflecting a significant growth driven by the increasing demand for automation and efficiency in business processes across various sectors.