Region:Global

Author(s):Dev

Product Code:KRAC0443

Pages:99

Published On:August 2025

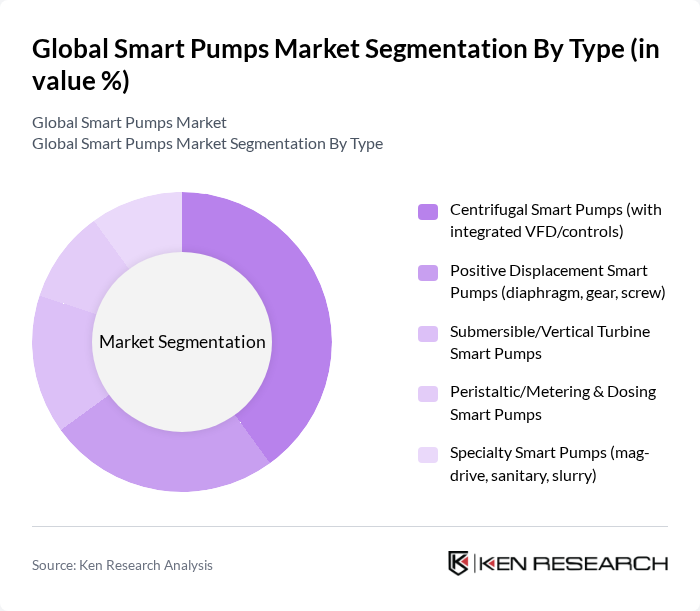

By Type:The smart pumps market is segmented into various types, including Centrifugal Smart Pumps (with integrated VFD/controls), Positive Displacement Smart Pumps (diaphragm, gear, screw), Submersible/Vertical Turbine Smart Pumps, Peristaltic/Metering & Dosing Smart Pumps, and Specialty Smart Pumps (mag-drive, sanitary, slurry). Each type serves different applications and industries, catering to specific operational needs .

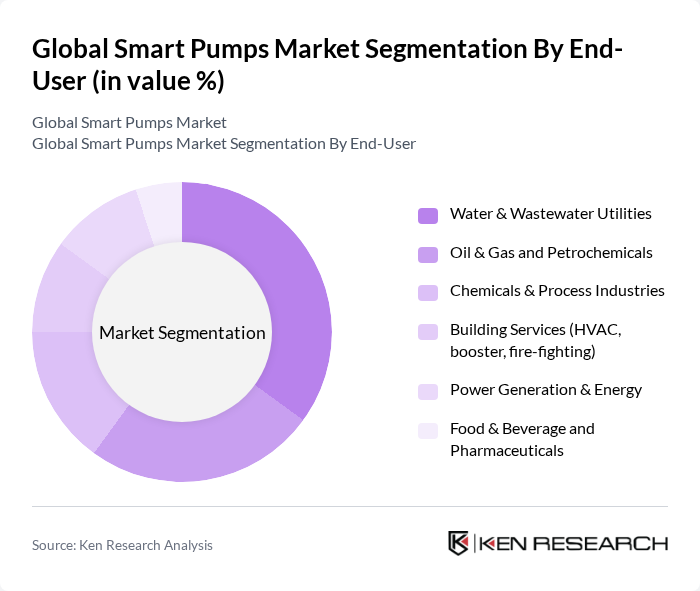

By End-User:The end-user segmentation includes Water & Wastewater Utilities, Oil & Gas and Petrochemicals, Chemicals & Process Industries, Building Services (HVAC, booster, fire-fighting), Power Generation & Energy, and Food & Beverage and Pharmaceuticals. Each sector has unique requirements that drive the demand for smart pumps .

The Global Smart Pumps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Flowserve Corporation, Grundfos Holding A/S, Xylem Inc., KSB SE & Co. KGaA, Sulzer Ltd., Pentair plc, Ebara Corporation, ITT Inc., Wilo SE, Schneider Electric SE, Emerson Electric Co., Danfoss A/S, ABB Ltd., The Weir Group plc, Tsurumi Manufacturing Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the smart pumps market appears promising, driven by technological innovations and increasing environmental awareness. As industries prioritize sustainability, the integration of smart pumps with renewable energy sources is expected to gain traction. Additionally, the rise of smart cities will further propel the demand for efficient water management systems, creating a favorable environment for smart pump adoption. Companies that invest in R&D and workforce training will likely lead the market in the coming years, capitalizing on these trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Centrifugal Smart Pumps (with integrated VFD/controls) Positive Displacement Smart Pumps (diaphragm, gear, screw) Submersible/Vertical Turbine Smart Pumps Peristaltic/Metering & Dosing Smart Pumps Specialty Smart Pumps (mag-drive, sanitary, slurry) |

| By End-User | Water & Wastewater Utilities Oil & Gas and Petrochemicals Chemicals & Process Industries Building Services (HVAC, booster, fire-fighting) Power Generation & Energy Food & Beverage and Pharmaceuticals |

| By Application | Pressure/Flow Control and Booster Systems Predictive Maintenance & Condition Monitoring Dosing, Metering, and Chemical Injection Water Management (treatment, desalination, wastewater) Industrial Processes & Utilities (cooling, CIP, transfer) |

| By Connectivity & Control | Integrated VFD and Onboard Controllers IoT/IIoT-Enabled (Modbus, BACnet, Ethernet/IP) Cloud/Remote Monitoring Platforms Advanced Analytics/AI-Enabled Control |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Capacity/Power Rating | Up to 30 kW –90 kW Above 90 kW |

| By Sales Channel | Direct (OEM/Project Sales) Distributor/Channel Partner EPC/System Integrator Online/Marketplace |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Water Treatment Facilities | 120 | Plant Managers, Process Engineers |

| Oil & Gas Sector | 90 | Operations Managers, Field Engineers |

| HVAC Systems | 70 | Building Managers, HVAC Technicians |

| Agricultural Irrigation | 60 | Agronomists, Farm Equipment Managers |

| Industrial Manufacturing | 100 | Production Managers, Maintenance Supervisors |

The Global Smart Pumps Market is valued at approximately USD 1.1 billion, reflecting a consistent demand for IoT-enabled pumping solutions, variable frequency drive (VFD) integration, and digital monitoring across various industries, including water, HVAC, and process sectors.