Region:Global

Author(s):Shubham

Product Code:KRAC0625

Pages:93

Published On:August 2025

By Type:The smart wearables market can be segmented into various types, including smartwatches, fitness trackers, smart glasses & XR headsets, smart clothing & smart textiles, hearables (TWS, smart earbuds, hearing aids), medical-grade wearables (patches, biosensors), and smart rings & other emerging wearables. Among these, smartwatches and fitness trackers are the most popular due to their multifunctionality and integration with mobile devices, supported by strong OEM ecosystems and expanding health features such as ECG, SpO2, sleep staging, and irregular rhythm notifications that drive repeat purchases and upgrades .

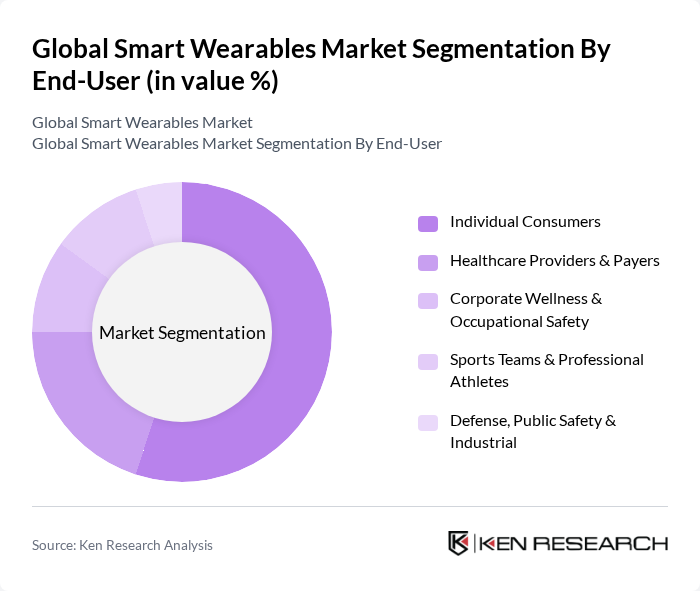

By End-User:The end-user segmentation of the smart wearables market includes individual consumers, healthcare providers & payers, corporate wellness & occupational safety, sports teams & professional athletes, and defense, public safety & industrial sectors. Individual consumers dominate the market, driven by widespread health and fitness tracking adoption, maturing smartwatch ecosystems, and integration with mobile OS services and app stores that simplify onboarding and engagement .

The Global Smart Wearables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apple Inc., Samsung Electronics Co., Ltd., Google LLC (Fitbit), Garmin Ltd., Huawei Technologies Co., Ltd., Xiaomi Corporation, Zepp Health Corporation (Amazfit), Withings SA, Polar Electro Oy, Suunto Oy, Whoop, Inc., Oura Health Oy, Sony Group Corporation, BOSE Corporation, GN Audio A/S (Jabra), Meta Platforms, Inc. (Ray-Ban Meta), Alphabet Inc. (Google Pixel Watch & Glass/AR), OPPO Mobile Telecommunications Corp., Ltd., vivo Mobile Communication Co., Ltd., Amazfit Health (Zepp Med, medical wearables) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart wearables market appears promising, driven by continuous technological advancements and increasing health consciousness among consumers. As manufacturers focus on integrating AI and machine learning, wearables will become more intuitive and personalized. Additionally, the rise of telehealth services is expected to create new avenues for wearables, enhancing their role in remote patient monitoring and chronic disease management, thereby expanding their market presence significantly.

| Segment | Sub-Segments |

|---|---|

| By Type | Smartwatches Fitness Trackers Smart Glasses & XR Headsets Smart Clothing & Smart Textiles Hearables (TWS, smart earbuds, hearing aids) Medical-Grade Wearables (patches, biosensors) Smart Rings & Other Emerging Wearables |

| By End-User | Individual Consumers Healthcare Providers & Payers Corporate Wellness & Occupational Safety Sports Teams & Professional Athletes Defense, Public Safety & Industrial |

| By Distribution Channel | Online Retail & Marketplaces Offline Retail (brand stores, electronics chains) Direct-to-Consumer (OEM online) Value-Added Resellers & Enterprise Distributors |

| By Price Range | Budget Wearables (sub-$100) Mid-range Wearables ($100–$300) Premium Wearables ($300+) |

| By Application | Health Monitoring & Vital Signs Fitness & Activity Tracking Communication & Payments Navigation & Location Services Workplace Safety & Remote Monitoring |

| By Component | Sensors (PPG, ECG, SpO2, IMU, temperature) Displays & Optics (OLED, microLED, waveguides) Batteries & Power Management Connectivity (Bluetooth, GPS/GNSS, LTE/5G) Software & Services (apps, cloud, AI/ML) |

| By User Demographics | Age Group Gender Lifestyle & Activity Level Health Status (chronic conditions, athletes) Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fitness Tracker Users | 120 | Health-conscious Consumers, Fitness Trainers |

| Smartwatch Owners | 110 | Tech Enthusiasts, Early Adopters |

| Healthcare Professionals | 90 | Doctors, Physiotherapists, Health Coaches |

| Retailers of Smart Wearables | 70 | Store Managers, Product Buyers |

| Consumers Interested in Wearable Tech | 130 | General Consumers, Tech Savvy Individuals |

The Global Smart Wearables Market is valued at approximately USD 110 billion, reflecting strong demand for multifunctional devices that integrate health monitoring, fitness tracking, and connectivity features, appealing to a tech-savvy consumer base.