Region:Global

Author(s):Shubham

Product Code:KRAD0740

Pages:97

Published On:August 2025

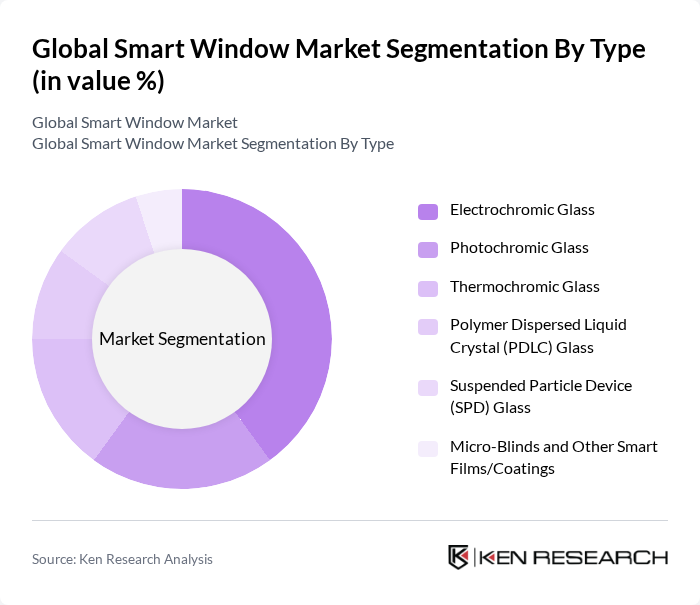

By Type:The smart window market is segmented into various types, including Electrochromic Glass, Photochromic Glass, Thermochromic Glass, Polymer Dispersed Liquid Crystal (PDLC) Glass, Suspended Particle Device (SPD) Glass, and Micro-Blinds and Other Smart Films/Coatings. Among these, Electrochromic Glass is currently the leading sub-segment in architectural applications due to active tint control, low power draw, and ability to integrate with building automation for dynamic daylighting and HVAC load reduction; SPD and PDLC are also gaining in transportation and privacy-on-demand partitions.

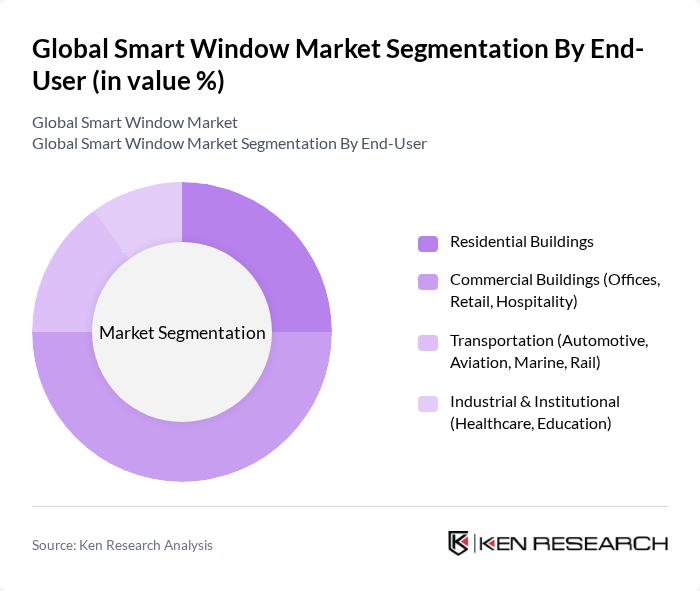

By End-User:The market is segmented by end-user into Residential Buildings, Commercial Buildings (Offices, Retail, Hospitality), Transportation (Automotive, Aviation, Marine, Rail), and Industrial & Institutional (Healthcare, Education). The Commercial Buildings segment is currently the most significant contributor, supported by investment in energy?efficient retrofits/new builds, wellness and glare control in offices, and integration with smart building platforms; transportation demand is rising with OEM programs for sunroofs, side windows, and aircraft dimmable windows.

The Global Smart Window Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saint-Gobain (SageGlass), View, Inc., Research Frontiers Inc. (SPD), AGC Inc. (AGC Glass Europe), Guardian Glass (Koch Industries), Nippon Sheet Glass Co., Ltd. (NSG/Pilkington), Halio International, Smartglass Group (Polytronix/Smartglass), Polytronix, Inc. (PolyVision PDLC), Gentex Corporation (Automotive EC), Gauzy Ltd. (SPD and PDLC Films), Hitachi Chemical Co., Ltd. (Showa Denko Materials), Corning Incorporated, Xinyi Glass Holdings Limited, 3M Company (Smart Films/Coatings) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart window market appears promising, driven by technological advancements and increasing regulatory support for energy-efficient solutions. As building codes evolve to favor sustainable practices, the integration of smart windows in new constructions is expected to rise. Additionally, the growing trend of smart home technologies will likely enhance consumer interest, leading to broader adoption. The market is poised for significant growth as awareness and acceptance of smart window solutions continue to expand.

| Segment | Sub-Segments |

|---|---|

| By Type | Electrochromic Glass Photochromic Glass Thermochromic Glass Polymer Dispersed Liquid Crystal (PDLC) Glass Suspended Particle Device (SPD) Glass Micro-Blinds and Other Smart Films/Coatings |

| By End-User | Residential Buildings Commercial Buildings (Offices, Retail, Hospitality) Transportation (Automotive, Aviation, Marine, Rail) Industrial & Institutional (Healthcare, Education) |

| By Application | Building Facades & Curtain Walls Skylights & Roof Glazing Automotive Sunroofs & Side Windows Interior Partitions & Privacy Glass Sunshades/Retrofit Smart Films |

| By Distribution Channel | Direct (OEM/Project Sales) System Integrators & EPCs Distributors/Value-Added Resellers Online/Indirect Retail |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Entry-Level (Film/Retrofit) Mid-Range (PDLC/Basic EC) Premium (Automotive EC/SPD/Advanced EC IGUs) |

| By Technology Integration | Smart Home Platforms (Alexa, Google, HomeKit) Building Management Systems (BMS/BAS) Energy & Daylight Management (Sensors/AI Controls) Mobility OEM Integration (Automotive/Aerospace) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Smart Window Adoption | 150 | Homeowners, Interior Designers |

| Commercial Building Implementations | 100 | Facility Managers, Architects |

| Automotive Smart Glass Integration | 80 | Automotive Engineers, Product Development Managers |

| Energy Efficiency Initiatives | 70 | Energy Auditors, Sustainability Consultants |

| Smart Window Technology Suppliers | 90 | Sales Managers, Product Strategists |

The Global Smart Window Market is valued at approximately USD 6.7 billion, driven by the increasing demand for energy-efficient solutions in buildings and vehicles, along with advancements in smart window technologies.