Region:Global

Author(s):Dev

Product Code:KRAA1541

Pages:88

Published On:August 2025

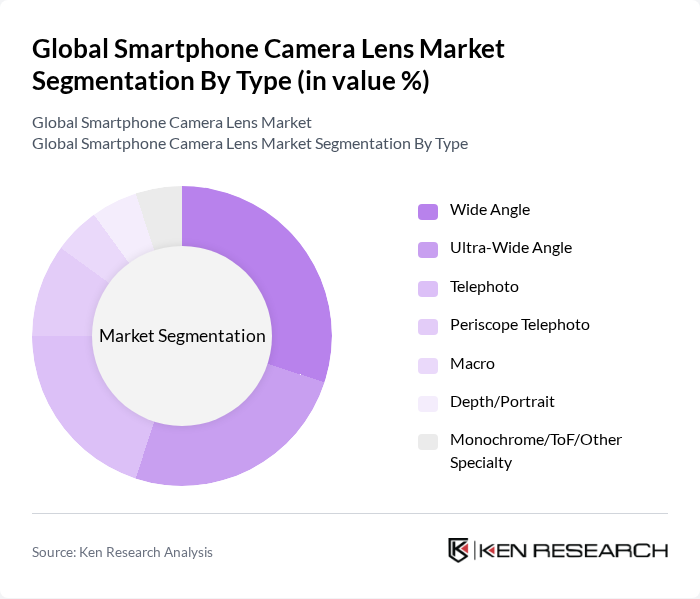

By Type:The smartphone camera lens market is segmented into various types, including Wide Angle, Ultra-Wide Angle, Telephoto, Periscope Telephoto, Macro, Depth/Portrait, and Monochrome/ToF/Other Specialty lenses. Each type serves distinct consumer needs, with wide-angle and ultra-wide-angle lenses gaining popularity for their ability to capture expansive scenes, while telephoto and periscope lenses are favored for their zoom capabilities .

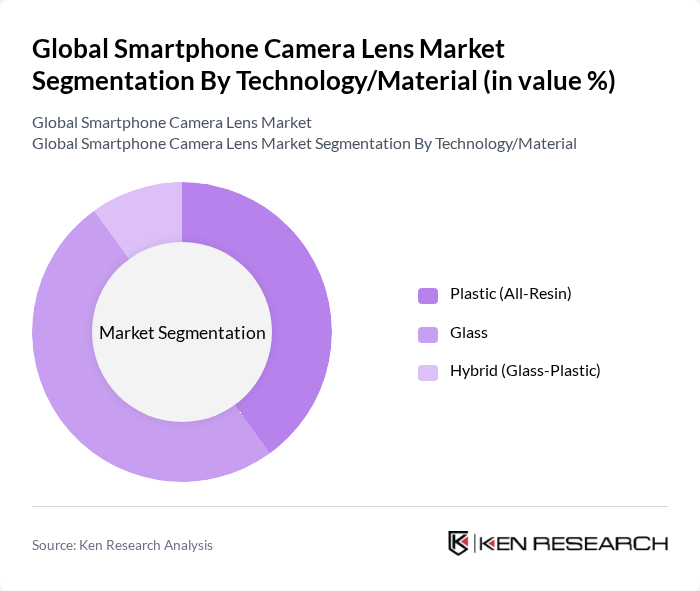

By Technology/Material:The market is also segmented by technology and material, which includes Plastic (All-Resin), Glass, and Hybrid (Glass-Plastic) lenses. The choice of material significantly impacts the lens quality, durability, and cost. Glass lenses are often preferred for their superior optical properties, while plastic lenses are lighter and more cost-effective, making them suitable for budget smartphones. Hybrid constructions have increased adoption to balance optical performance and weight/cost trade-offs in multi-camera modules .

The Global Smartphone Camera Lens Market is characterized by a dynamic mix of regional and international players. Leading participants such as Largan Precision Co., Ltd., Sunny Optical Technology (Group) Co., Ltd., Genius Electronic Optical Co., Ltd. (GSEO), Asia Optical Co., Inc., Kantatsu Co., Ltd., Sekonix Co., Ltd., OFILM Group Co., Ltd., ALPS ALPINE CO., LTD., Chicony Electronics Co., Ltd., Corning Incorporated, Hoya Corporation, AAC Technologies Holdings Inc., Taiwan Semiconductor Co., Ltd. (Lens Unit Subsidiary), Tamron Co., Ltd., Newmax Technology Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the smartphone camera lens market appears promising, driven by technological advancements and evolving consumer preferences. As smartphone users increasingly seek enhanced photography experiences, manufacturers are likely to focus on integrating AI capabilities into camera functionalities. Additionally, the trend towards sustainability will encourage companies to adopt eco-friendly practices in lens production, aligning with consumer values. This dual focus on innovation and sustainability is expected to shape the market landscape significantly in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Wide Angle Ultra-Wide Angle Telephoto Periscope Telephoto Macro Depth/Portrait Monochrome/ToF/Other Specialty |

| By Technology/Material | Plastic (All-Resin) Glass Hybrid (Glass-Plastic) |

| By Resolution (Megapixel Class) | Up to 8 MP MP –64 MP MP and Above |

| By Camera Placement | Rear Camera Lenses Front/Selfie Camera Lenses |

| By Distribution Channel | OEM (Direct to Smartphone Manufacturers) Aftermarket/Replacement Online Offline |

| By Compatibility | Android iPhone Multi-device/Universal |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smartphone Manufacturers | 100 | Product Managers, R&D Engineers |

| Camera Lens Suppliers | 80 | Supply Chain Managers, Optical Engineers |

| Retail Electronics Outlets | 70 | Store Managers, Sales Representatives |

| Consumer Electronics Analysts | 60 | Market Analysts, Industry Consultants |

| End-User Consumers | 120 | Smartphone Users, Photography Enthusiasts |

The Global Smartphone Camera Lens Market is valued at approximately USD 5.56.7 billion, driven by the increasing demand for high-quality photography and videography capabilities in smartphones, as consumers seek professional-grade imaging solutions.