Region:Global

Author(s):Dev

Product Code:KRAB0452

Pages:85

Published On:August 2025

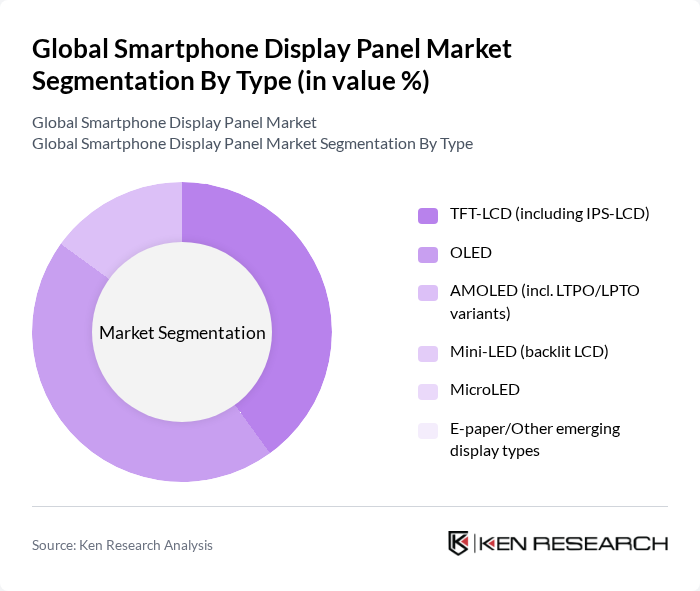

By Type:The smartphone display panel market is segmented into various types, including TFT-LCD, OLED, AMOLED, Mini-LED, MicroLED, and E-paper/Other emerging display types. Among these, OLED technology has gained significant traction due to its superior display quality and energy efficiency. AMOLED displays, particularly in premium smartphones, are leading the market due to their vibrant colors and deep blacks, which enhance user experience. The demand for Mini-LED and MicroLED technologies is also on the rise, driven by their potential for higher brightness and better energy efficiency.

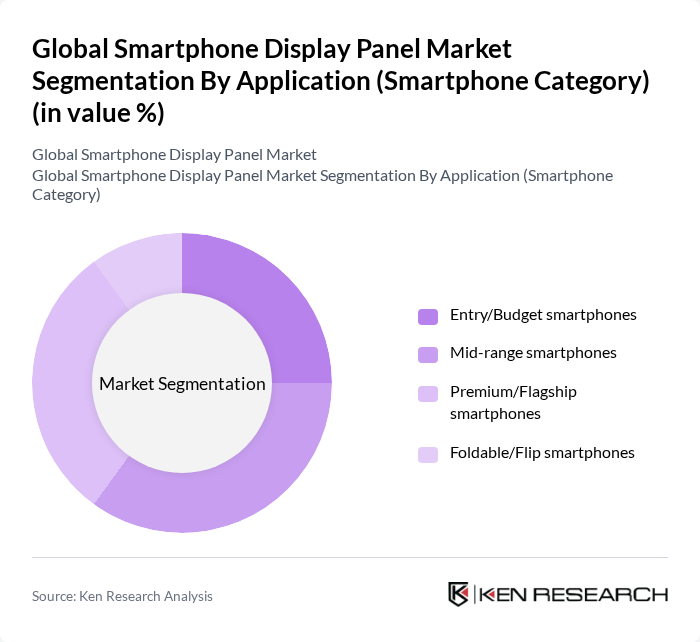

By Application (Smartphone Category):This segmentation includes Entry/Budget smartphones, Mid-range smartphones, Premium/Flagship smartphones, and Foldable/Flip smartphones. The Premium/Flagship segment is currently leading the market, driven by consumer demand for high-end features and superior display technologies. Mid-range smartphones are also gaining traction as manufacturers increasingly offer high-quality displays at competitive prices. The growing interest in foldable smartphones is expected to further diversify the market, with innovative display technologies being developed to meet unique form factors.

The Global Smartphone Display Panel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Display Co., Ltd., LG Display Co., Ltd., BOE Technology Group Co., Ltd., Japan Display Inc. (JDI), Sharp Corporation, Tianma Microelectronics Co., Ltd. (TIANMA), AU Optronics Corp. (AUO), Innolux Corporation, Visionox Technology Inc., TCL China Star Optoelectronics Technology Co., Ltd. (TCL CSOT), Truly International Holdings Limited, HKC Corporation Limited, EverDisplay Optronics (EDO), BOE Varitronix Limited, Holitech Technology Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smartphone display panel market appears promising, driven by technological advancements and evolving consumer preferences. As 5G technology expands, it will enhance mobile experiences, leading to increased demand for high-quality displays. Additionally, the trend towards foldable smartphones is expected to create new opportunities for innovative display technologies. Manufacturers will likely focus on integrating sustainable practices, responding to consumer demand for eco-friendly products, and investing in research and development to stay competitive in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | TFT-LCD (including IPS-LCD) OLED AMOLED (incl. LTPO/LPTO variants) Mini-LED (backlit LCD) MicroLED E-paper/Other emerging display types |

| By Application (Smartphone Category) | Entry/Budget smartphones Mid-range smartphones Premium/Flagship smartphones Foldable/Flip smartphones |

| By Display Size (Diagonal, Inches) | Below 5.5 inches to 6.1 inches to 6.7 inches Above 6.7 inches |

| By Resolution | HD/HD+ Full HD/FHD+ Quad HD/QHD+/2K K and above |

| By Refresh Rate | ?60Hz Hz Hz ?144Hz |

| By Panel Form Factor | Rigid Flexible/Curved Foldable/Rollable |

| By Sales Channel | Direct to OEM (Tier-1 smartphone brands) ODM/EMS procurement Aftermarket/Replacement |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smartphone Manufacturers | 120 | Product Managers, R&D Directors |

| Display Panel Suppliers | 100 | Sales Managers, Technical Engineers |

| Market Analysts | 80 | Industry Analysts, Market Researchers |

| Retailers of Smartphones | 70 | Store Managers, Category Buyers |

| Consumer Electronics Experts | 60 | Technology Consultants, Product Reviewers |

The Global Smartphone Display Panel Market is valued at approximately USD 5662 billion, driven by the increasing demand for high-resolution displays and the rapid adoption of OLED technology, particularly flexible and LTPO variants.