Region:Global

Author(s):Dev

Product Code:KRAB0514

Pages:94

Published On:August 2025

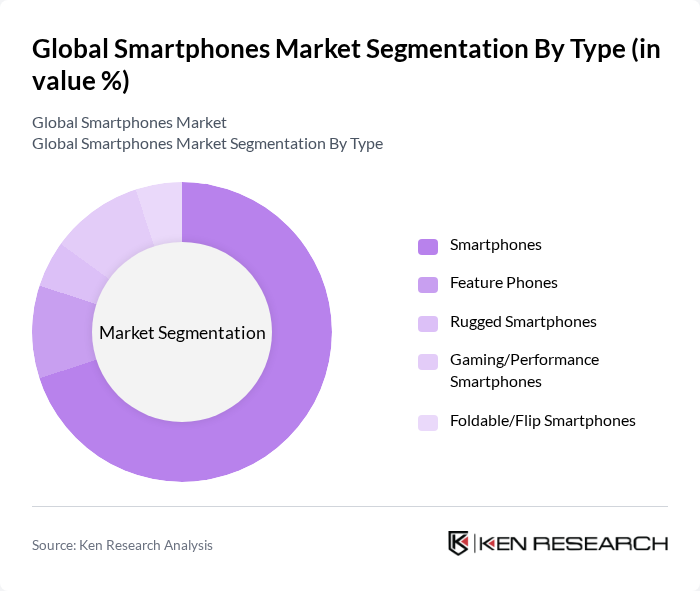

By Type:The market is segmented into various types, including smartphones, feature phones, rugged smartphones, gaming/performance smartphones, and foldable/flip smartphones. Among these, smartphones dominate the market due to their multifunctionality, integration of advanced technologies, and widespread consumer preference for devices that offer internet connectivity, social media access, and various applications. The trend towards high-performance and gaming smartphones is also gaining traction, driven by the increasing popularity of mobile gaming. Additionally, foldables are expanding from a niche into a fast-growing premium subsegment as OEMs broaden portfolios and carriers expand financing and trade-in programs, supporting ASP growth .

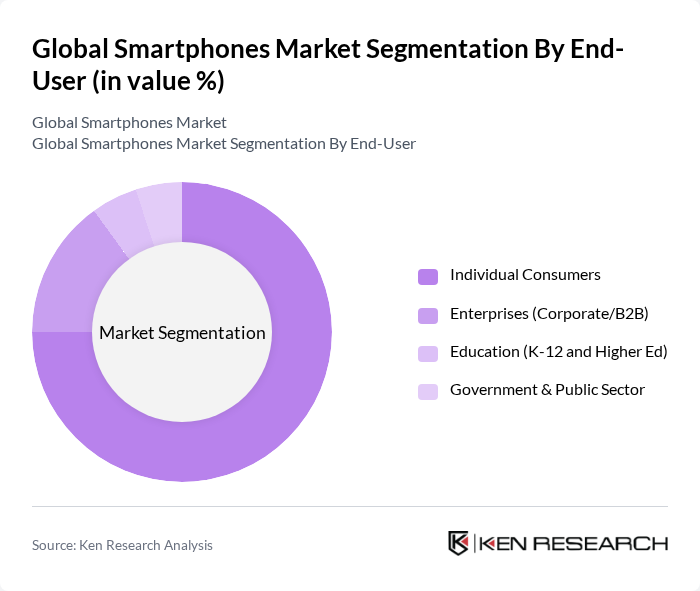

By End-User:The end-user segmentation includes individual consumers, enterprises (Corporate/B2B), education (K-12 and higher education), and government & public sector. Individual consumers represent the largest segment, driven by the increasing reliance on smartphones for daily activities, communication, and entertainment. The rise of remote work and online education has also boosted demand from enterprises and educational institutions, highlighting the versatility of smartphones in various sectors. Enterprise demand is also supported by device financing programs, trade-in initiatives, and security/management features embedded in modern OS and silicon, which have become priorities in corporate deployments .

The Global Smartphones Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apple Inc., Samsung Electronics Co., Ltd., Xiaomi Corporation, vivo Mobile Communication Co., Ltd., OPPO Mobile Telecommunications Corp., Ltd., OnePlus Technology (Shenzhen) Co., Ltd., Transsion Holdings (TECNO, Infinix, itel), Motorola Mobility LLC (a Lenovo Company), Lenovo Group Limited, Huawei Technologies Co., Ltd., HONOR Device Co., Ltd., HMD Global Oy (Nokia-branded phones), Sony Corporation (Xperia), TCL Technology (TCL Communication/Alcatel), ZTE Corporation, ASUS (ASUSTeK Computer Inc.), Google LLC (Pixel), Nothing Technology Limited, Realme Mobile Telecommunications (India) Pvt. Ltd., Panasonic Holdings Corporation (Toughbook/Toughbook Smart Device lines) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the smartphone market appears promising, driven by technological advancements and evolving consumer preferences. As 5G technology becomes more widespread, it will enhance mobile connectivity and enable new applications, particularly in gaming and augmented reality. Additionally, the trend towards sustainable products is likely to shape manufacturing practices, with companies increasingly focusing on eco-friendly materials and recycling initiatives. This shift will not only meet consumer demand but also align with global sustainability goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Smartphones Feature Phones Rugged Smartphones Gaming/Performance Smartphones Foldable/Flip Smartphones |

| By End-User | Individual Consumers Enterprises (Corporate/B2B) Education (K-12 and Higher Ed) Government & Public Sector |

| By Distribution Channel | Online (Direct-to-Consumer and E-commerce Marketplaces) Offline Retail (Brand Stores, Multi-brand Retailers) Carrier/Telco Channels Enterprise/Value-Added Resellers |

| By Price Range | Entry/Budget (<$200) Mid-Range ($200–$599) Premium ($600–$999) Ultra-Premium (?$1,000) |

| By Operating System | Android iOS HarmonyOS Others |

| By Brand | Apple (iPhone) Samsung (Galaxy) Xiaomi (Redmi, POCO) Transsion (TECNO, Infinix, itel) vivo OPPO (including OnePlus) |

| By Connectivity | G LTE G (Sub-6, mmWave) Wi?Fi Only/Cellular-disabled Devices Satellite-enabled/NTN-capable |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Smartphone Preferences | 150 | Smartphone Users, Tech Enthusiasts |

| Retail Sales Insights | 100 | Retail Managers, Sales Associates |

| Market Trends Analysis | 80 | Market Analysts, Industry Experts |

| Brand Loyalty Studies | 120 | Brand Managers, Marketing Executives |

| Emerging Technology Adoption | 90 | Product Developers, R&D Managers |

The global smartphones market is valued at approximately USD 565 billion, reflecting a significant growth trend driven by increasing demand for advanced mobile technology and the proliferation of internet connectivity across various demographics.